Wednesday, March 21, 2012 11:29:12 AM

WHAT DOES?????..........

Warren Buffett,Posco Steel,Pan American,Li3 Energy ALL have in common? LITHIUM!!!!!!!!

WARREN BUFFETT loves LITHIUM. But it seems he is interested in Lithium Battery makers rather than suppliers or mining.

Buffett Wants to Raise Posco Holdings, Company Says (Update3)

By Sungwoo Park - January 19, 2010 05:55 EST

[img]www.bloomberg.com/apps/data?pid=avimage&iid=ilE9tXaYEsH8

[/img]

Warren Buffett, chairman of Berkshire Hathaway Inc. HOLD THE PHONE! Buffett just got back from SA,, hmm what for I wonder!

Posco's steel production facility in South Korea

Pan American Lithium (OTC: PALTF) Provided an Update About Their Deal With POSCO

Pan American Lithium is a lithium mining company with eleven lithium and potash-bearing brine projects in Chile's Atacama Region III that cover more than 20,000 hectares plus the company has an option to purchase an indirect interest in the Cierro Prieto geothermal lithium brine project in Baja California Norte, Mexico. Pan American Lithium’s President and CEO recently discussed their agreement with South Korea’s POSCO (NYSE: PKX), the fourth largest steel producer in the world. The deal will help Pan American Lithium to accelerate their Chile lithium pilot facility project with the goal to develop and construct a pilot facility at one of the company’s eleven Chile lithium locations. In addition, POSCO now has a 19.9% stake in Pan America Lithium. On Wednesday, Pan American Lithium closed at $0.108 (PALTF has a 52 week trading range of $0.11 to $0.20 a share). Investors should note that Pan American Lithium has no revenues; net losses of $2,431k (most recent financial year), $1,314k and $42k for the past three financial years; and $169k (February 28, 2011) in cash and cash equivalents to cover $407k in current liabilities.

Jan. 19 (Bloomberg) -- Warren Buffett wants to increase his stake in Posco, Asia’s most profitable steelmaker, the company said, citing a discussion between Chief Executive Officer Chung Joon Yang and the chairman of Berkshire Hathaway Inc. yesterday.

Berkshire has “3.9 million to 4 million shares of Posco and will increase the holding,” South Korea’s largest steelmaker said today in an e-mailed English statement, citing Buffett. “I should have bought more Posco shares when the stock price dropped during the economic crisis,” Posco cited Buffett as saying.

World steel demand will rise 10 percent this year, Posco said last week when it announced a 77 percent jump in fourth- quarter profit and plans to push ahead with $30 billion of overseas expansion. Buffett, 79, may have a paper profit of more than $1.3 billion in his Posco holding, first disclosed in 2007.

“From the point of view of Buffett, there may be few steel stocks to buy in Asia,” said Chang In Whan, president of KTB Asset Management Co. in Seoul, which manages the equivalent of $8.9 billion in assets. “I’m sure Posco will acquire companies this year, which will help it secure growth in size as well as in efficiency.”

Posco shares rose 1 percent to close at 604,000 won in Seoul. The benchmark Kospi index was little changed.

Omaha, Nebraska-based Berkshire didn’t immediately respond to a message left with Buffett’s assistant Debbie Bosanek after 9:30 p.m. local time late yesterday. Buffett is the largest shareholder of Berkshire, which owns 3.95 million shares in Posco, according to its 2009 annual statement.

According to data compiled by Bloomberg, Berkshire holds a 4.5 percent stake in Posco.

Omaha Meeting

The meeting between Chung and Buffett took place at the headquarters of Berkshire in Omaha, Posco said. Posco released statements of the meeting in Korean first and in English later.

“If we actually get data that Buffett increased Posco holdings, that should provide a short-term boost to the shares,” said Kim Young Chan, a fund manager at Shinhan BNP Paribas Asset Management Co. in Seoul, which manages the equivalent of $28 billion in assets.

Posco’s planned $30 billion overseas investment includes building plants in India, Vietnam and Indonesia, and last week it said it will buy a stake in an Australian iron ore mine.

Buffett “strongly” encourages Posco’s investment plans, the company’s English-language statement said.

Shares Value

Berkshire first disclosed it bought 3.49 million Posco shares for $572 million in 2007. The number of shares held rose to 3.95 million, bought for a total cost of $768 million, Berkshire said last February.

At today’s closing price, 3.95 million Posco shares are worth 2.39 trillion won ($2.1 billion).

“The current management is doing well,” the English- language statement cited Buffett as saying.

Buffett has found Asia a profitable venue in recent years. In September 2008, Berkshire Hathaway unit MidAmerican Energy Holdings Co. agreed to pay HK$1.8 billion ($232 million) for 225 million shares of BYD Co., a Chinese automaker. BYD shares have rallied eight-fold since.

Buffett hopes to visit South Korea again in autumn if there’s an opportunity, Posco said. Buffett made a trip to the country in 2007.

Buffett said last May that some South Korean companies were undervalued, telling reporters at the time he had a book about South Korea’s publicly-traded companies that he studied for possible investments.

The Oracle of Omaha, as he is known, built Berkshire over four decades from a failing maker of men’s suit linings into a $150 billion company through successful stock picks and dozens of takeovers.

Why invest in Lithium?? Warren Buffett is the reason : He said last year that in 20 yrs all cars will be electric. Countdown is now 19 years to go... 1 comment

Nov 29, 2010 8:46 AM | about stocks: LIT, SQM, ROC, FMC, BYDDF.PK, TSLA, TM, HMC, DDAIF.PK, F, GM, NSANY.PK, SLV, GLD, KOL, PKOL, SCCO, CU, PALL, MOO, POT, MOS, AGU, CF, ANR, CLF, WLT, REE, MCP, X, AKS, RS, ATI, RTI, TIE

Sunday, November 29, 2009

Warren Buffett: In 20 years, all cars on the road will be electric

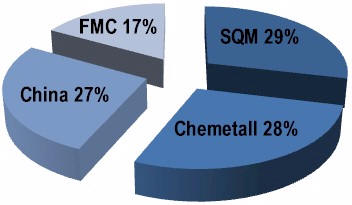

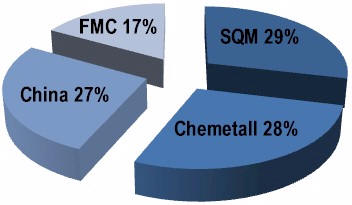

Small Number of Miners and Split of the Pie - Eric Norris, Global Commercial Director for FMC's Lithium Division, offered a synopsis of the split for Li suppliers. In his presentation Norris put market demand of 93K tonnes for lithium carbonate equivalents in 2007 and offered the following split for market supply:

Why invest in Lithium?? Warren Buffett is the reason : He said last year that in 20 yrs all cars will be electric. Countdown is now 19 years to go... 1 comment

Nov 29, 2010 8:46 AM | about stocks: LIT, SQM, ROC, FMC, BYDDF.PK, TSLA, TM, HMC, DDAIF.PK, F, GM, NSANY.PK, SLV, GLD, KOL, PKOL, SCCO, CU, PALL, MOO, POT, MOS, AGU, CF, ANR, CLF, WLT, REE, MCP, X, AKS, RS, ATI, RTI, TIE

Sunday, November 29, 2009

Warren Buffett: In 20 years, all cars on the road will be electric

Small Number of Miners and Split of the Pie - Eric Norris, Global Commercial Director for FMC's Lithium Division, offered a synopsis of the split for Li suppliers. In his presentation Norris put market demand of 93K tonnes for lithium carbonate equivalents in 2007 and offered the following split for market supply:

Figure 4: Source; Notes taken by attendee to Jan./09 talk

Note:Chemetall is a unit of Rockwood Holdings (ROC)

"Something is telling us that we are close to the right Time again, like Warren Buffett was spot on the money last Fall buying into BYD with 250 million and now, one year after and almost an eternity passed in investment world of a slow motion crash video, he is sitting on 1 billion stake in the company and has made BYD founder the China's richest person along the way. This something could be the coming Copenhagen Climate Change conference or Nissan Electric Leaf on North American Tour or even this article about GM Volt anxious to be on time on the road."

BYD: "Build Your Dreams" - founder takes it quite literally and made his fortune already even without selling very many Electric Cars yet. One thing is to get Warren Buffett to advertise your product and another one is for Buffett to proclaim: "In 20 years, all cars on the road will be electric". China, Buffett and Electric Cars - what else do we need to start a new Trend? Bill Gates could help and Google guys are backing Aptera already...Jim Dines is all over it on Supply side with Rare Earth Elements and worries about Lithium oversupply will be blown away with every Electric Car sold. Maestro is giving us the most aggressive timing we ever heard or dreamed about rate of Electric Cars adoption - it is our "Big IF" in action.

"Time is always an essence, we can not afford to live a life of an artist, when she will be admired long time after her time. Money as all particles, which come and go, have a dual nature inhibited in their reality: Money love to test your patience as much as they are impatient themselves. They refuse to grow without a catalyst, even in the most fertile environment. They are always searching for the Trend: they like to come early and enjoy when others will be piling in."

Warren Buffet here is even more aggressive then Nissan in their estimations: Bloomberg Nissan, FedEx Seek Electric-Car Target of 200 Million and now you can put your own figures on Lithium Demand side to that picture.

Lithium Drive: Warren Buffett: BYD Signs Over Another 1500 Vehicles To Shenzen, Making The World's Largest Electric Vehicle Fleet 0 comments

Mar 1, 2012 11:30 AM | about stocks: BYDDY.PK, GM, F, TSLA, AONE, SQM, FMC, ROC, LIT, MCP, REE, VALE, ABX, FCX, NG, BHP, ZIP, IBM

Lithium Drive: Warren Buffett: BYD signs over another 1500 vehicles to Shenzen, making the world's largest electric vehicle fleet ilc.v, tnr.v, czx.v, rm.v, lmr.v, abn.v, asm.v, btt.v, bva.v, bvg.v, epz.v, fst.v, gbn.v, hao.v, jnn.v, ks.v, ktn.v, kxm.v, mgn, mxr.v, rvm.to, svb, ura.v, nup.ax, srz.ax, usa.ax

http://4.bp.blogspot.com/-

While some people would like to make us all think that electric cars are polluting more than ICE ones, China moves fast with its Electric Cars program. If you have noticed from the Envia news about Lithium Wonder Battery - actual cell production facility is based in...China. Chinese companies are claiming larger stake in Lithium Battery production market now and Lithium Materials production is already a home turf for Chinese companies.

Companies like Ganfeng Lithium are staking their claims in Lithium Supply chain for the Green Revolution by investing in companies like International Lithium with world wide base of lithium projects.

[img]2.bp.blogspot.com/--0ACfrj6P0k/T09erzbcceI/AAAAAAAAFfM/yRMKxi7hR8g/s400/China+Beijing+Traffic.jpg

[/img]

BYD had a very bad publicity last year and now company is coming back. Warren Buffett backs the BYD and latest lithium battery breakthrough can make the very fast adoption rate for electric cars in China. There is the question of not only the higher gas prices, but urban survival with pollution from ICE cars, which is already reaching a very dangerous levels in major cities even with still the very low rate of cars per capita in China. Urban mobility in China and India will be impossible in any meaningful numbers without electric cars now.

Lithium Game Changer: GigaOm: A battery breakthrough that could bring electric cars to the masses

"After last week's "Bricking Out" outcry about Tesla Roadster batteries, Electric Cars developers strike back with the new lithium batteries technology breakthrough! Envia Systems claims the new lithium battery technology with Energy Density of 400 Wh/kg and cost of $125 per 1 kWh. Envia Systems joins German DBM Energy, which has been lost in translation recently with its wonder Kolibri Lithium Battery and confirmsElon Musk with his call on cost of Lithium Batteries dropping below $200 per 1 kWh soon. Now, even rumors about all electric Renault Zoe 2014 with 220 miles range could be more credible.

Our Lithium developers are waiting for this technology confirmation to break out from the consolidation stage now.

It looks like Warren Buffet will be right on the money again with his call on Electric Cars!"

Lithium Drive: Warren Buffett: "In not many years, you are going to see a clear change towards Electric Cars"

Lithium Drive: Warren Buffett: BYD Signs Over Another 1500 Vehicles To Shenzen, Making The World's Largest Electric Vehicle Fleet 0 comments

Mar 1, 2012 11:30 AM | about stocks: BYDDY.PK, GM, F, TSLA, AONE, SQM, FMC, ROC, LIT, MCP, REE, VALE, ABX, FCX, NG, BHP, ZIP, IBM

Lithium Drive: Warren Buffett: BYD signs over another 1500 vehicles to Shenzen, making the world's largest electric vehicle fleet ilc.v, tnr.v, czx.v, rm.v, lmr.v, abn.v, asm.v, btt.v, bva.v, bvg.v, epz.v, fst.v, gbn.v, hao.v, jnn.v, ks.v, ktn.v, kxm.v, mgn, mxr.v, rvm.to, svb, ura.v, nup.ax, srz.ax, usa.ax

While some people would like to make us all think that electric cars are polluting more than ICE ones, China moves fast with its Electric Cars program. If you have noticed from the Envia news about Lithium Wonder Battery - actual cell production facility is based in...China. Chinese companies are claiming larger stake in Lithium Battery production market now and Lithium Materials production is already a home turf for Chinese companies.

Companies like Ganfeng Lithium are staking their claims in Lithium Supply chain for the Green Revolution by investing in companies like International Lithium with world wide base of lithium projects.

BYD had a very bad publicity last year and now company is coming back. Warren Buffett backs the BYD and latest lithium battery breakthrough can make the very fast adoption rate for electric cars in China. There is the question of not only the higher gas prices, but urban survival with pollution from ICE cars, which is already reaching a very dangerous levels in major cities even with still the very low rate of cars per capita in China. Urban mobility in China and India will be impossible in any meaningful numbers without electric cars now.

Lithium Game Changer: GigaOm: A battery breakthrough that could bring electric cars to the masses

"After last week's "Bricking Out" outcry about Tesla Roadster batteries, Electric Cars developers strike back with the new lithium batteries technology breakthrough! Envia Systems claims the new lithium battery technology with Energy Density of 400 Wh/kg and cost of $125 per 1 kWh. Envia Systems joins German DBM Energy, which has been lost in translation recently with its wonder Kolibri Lithium Battery and confirmsElon Musk with his call on cost of Lithium Batteries dropping below $200 per 1 kWh soon. Now, even rumors about all electric Renault Zoe 2014 with 220 miles range could be more credible.

Our Lithium developers are waiting for this technology confirmation to break out from the consolidation stage now.

It looks like Warren Buffet will be right on the money again with his call on Electric Cars!"

Lithium Drive: Warren Buffett: "In not many years, you are going to see a clear change towards Electric Cars"

Lithium charge: Beijing to waive license plate lottery for electric vehicles

China Car Times:

BYD signs over another 1500 vehicles to Shenzen, making the world's largest electric vehicle fleet

Where is the world's biggest fleet of electric vehicles? Perhaps it is in a more cosmopolitan western city such as San Francisco, New York, London or Paris? Actually its not so surprising to learn that is in Shenzhen, the home of BYD Auto. BYD in recent years strived to put its electric know how onto the roads, however it has come across road blocks such as low consumer take up but at the same time it has found good customers in fleet users that are eager to take on EV's to lower running costs and again good publicity in the process.

Shenzhen City government has signed a deal with BYD to take on another 1500 EV's from the company which will be a mixture of 1000 K9 electric buses and 500 E6 passenger vehicles. Shenzhen's Development and Reform Comittee (SDRC) have been pushing hard to introduce more EV's into the city to lower running costs and improve the environmental situation in the area, the NDRC's director Mr. Lu Xiangshen commented: "Shenzhen is the first city in China to implement a subsidy for new energy vehicles and the first city to launch consumer sales of the BYD e6." The fleet of E6 taxis around Shenzhen have already given consumers a taste of electric cars and the city was one of the first in China to announce subsidies for EV's

Shenzhen city government are contemplating introducing other incentive policies include allowing pure electric drivers to use the public bus lane during rush hour, discounted insurance privileges, and free annual maintenance checks. China's Southern Power Grid Company has agreed to install free-of-charge, two electric vehicle charging poles for each Shenzhen EV driver - one at the home or apartment of the driver and another near or at the driver's place of business. Shenzhen City continues to offer extremely affordable peak and off-peak electricity prices for new energy vehicle users, reducing nightly charging costs to only 0.3yuan RMB per KWh (~$0.04 USD/KWh equivalent). The SDRC predicts that private alternative energy vehicle use in Shenzhen will increase by over 3000 units in 2012 and plans to install and support over 6,000 new charging pedestals

Lithium is becoming the popular commodity of choice for stock investors — for good reason. Car makers are choosing lithium-ion batteries for their “never could be better timing” hybrid lithium and electronic vehicles. And the $2 billion the U.S. intends to invest in that technology will help ease the way.

Baltimore (TFN (0.30 ?0.00%)): At car shows globally, everybody’s talking lithium…

GM announced it would build a plant to manufacture lithium-ion (Li-ion) batteries for the Chevy Volt scheduled to debut in 2011.

BMW (68.47 ?-0.52%) plans to launch its remodeled Li-ion battery-powered 750i luxury sedan to the Japanese in 2010. This year, the company is producing 500 all-electric MINI Es, also with Li-ion batteries, for leasing in select cities.

Toyota (TM 83.93 ?-0.86%) hopes to launch plug-in hybrid Priuses with Li-ion batteries later this year.

Mercedes (DAI 47.42 ?0.00%)-Benz anticipates launching its S400 Blue HYBRID with a Li-ion battery next year.

The Ford (F 12.61 ?0.52%) Escape plug-in hybrid with the same power technology is slated for 2012.

Then there’s the Tesla Roadster, Chyrsler EcoVoyager, Dodge ZEO, Jeep Renegade and the Saturn Flextreme.

Government money to the tune of $2 billion has been earmarked for hybrid technology. And with the greater demand for all these Li-ion car batteries, miners, processors and battery manufacturers stand to profit.

Just look at the two stocks we recommended to TFN readers in late January (Read that article here):

Chilean-based lithium producer Sociedad Quimica y Minera de Chile (ADR (723.88 ?-0.74%)) (NYSE:SQM (59.15 ?0.36%)) today reported a record year with earnings of $501.4 million for 2008. That’s 179% over 2007.

And their Q4 2008 net income came in at 170% over the same period the year prior.

Our other pick, U.S.-based Polypore International (PPO 34.53 ?0.76%), Inc. (NYSE:PPO), supplies mono- and multilayer membrane separators for lithium batteries – including those used in hybrid electric vehicles (HEVs).

Polypore also reported their 2008 results today: Though restructuring created a loss for Q4, sales were up by 1 million. For all of 2008, sales were up 14% from last year at $610.5 million and adjusted net income was up by 24.1 million.

Johnson Controls, Inc. (NYSE:JCI (32.36 ?-0.06%)), in conjunction with with French outfit Saft, was selected to partner with Ford for it’s lithium battery.

Other companies hoping to ride the lithium profit wave can be found in our The Lithium-Stocks.net Complete Guide to Investing in Lithium Stocks and bringing the best lithium producers, properties, and live charts on the web.

Demand for rechargable Lithium-ion batteries will soar as hybrid cars become more popular . Laura picks two companies that could return triple-digit gains in just a few years.

About the element

Though not uncommon, lithium appears in low concentrations and is typically interwoven (IWOV 16.00 ?0.00%) with other minerals.

The largest commercial deposits currently mined are in Chile and Argentina. China, Russia, Australia and the U.S. are working to pickup production.

And the amount of lithium carbonate required for a car battery is about 100 times that needed for a laptop.

Warren Buffett,Posco Steel,Pan American,Li3 Energy ALL have in common? LITHIUM!!!!!!!!

WARREN BUFFETT loves LITHIUM. But it seems he is interested in Lithium Battery makers rather than suppliers or mining.

Buffett Wants to Raise Posco Holdings, Company Says (Update3)

By Sungwoo Park - January 19, 2010 05:55 EST

[img]www.bloomberg.com/apps/data?pid=avimage&iid=ilE9tXaYEsH8

[/img]

Warren Buffett, chairman of Berkshire Hathaway Inc. HOLD THE PHONE! Buffett just got back from SA,, hmm what for I wonder!

Posco's steel production facility in South Korea

Pan American Lithium (OTC: PALTF) Provided an Update About Their Deal With POSCO

Pan American Lithium is a lithium mining company with eleven lithium and potash-bearing brine projects in Chile's Atacama Region III that cover more than 20,000 hectares plus the company has an option to purchase an indirect interest in the Cierro Prieto geothermal lithium brine project in Baja California Norte, Mexico. Pan American Lithium’s President and CEO recently discussed their agreement with South Korea’s POSCO (NYSE: PKX), the fourth largest steel producer in the world. The deal will help Pan American Lithium to accelerate their Chile lithium pilot facility project with the goal to develop and construct a pilot facility at one of the company’s eleven Chile lithium locations. In addition, POSCO now has a 19.9% stake in Pan America Lithium. On Wednesday, Pan American Lithium closed at $0.108 (PALTF has a 52 week trading range of $0.11 to $0.20 a share). Investors should note that Pan American Lithium has no revenues; net losses of $2,431k (most recent financial year), $1,314k and $42k for the past three financial years; and $169k (February 28, 2011) in cash and cash equivalents to cover $407k in current liabilities.

Jan. 19 (Bloomberg) -- Warren Buffett wants to increase his stake in Posco, Asia’s most profitable steelmaker, the company said, citing a discussion between Chief Executive Officer Chung Joon Yang and the chairman of Berkshire Hathaway Inc. yesterday.

Berkshire has “3.9 million to 4 million shares of Posco and will increase the holding,” South Korea’s largest steelmaker said today in an e-mailed English statement, citing Buffett. “I should have bought more Posco shares when the stock price dropped during the economic crisis,” Posco cited Buffett as saying.

World steel demand will rise 10 percent this year, Posco said last week when it announced a 77 percent jump in fourth- quarter profit and plans to push ahead with $30 billion of overseas expansion. Buffett, 79, may have a paper profit of more than $1.3 billion in his Posco holding, first disclosed in 2007.

“From the point of view of Buffett, there may be few steel stocks to buy in Asia,” said Chang In Whan, president of KTB Asset Management Co. in Seoul, which manages the equivalent of $8.9 billion in assets. “I’m sure Posco will acquire companies this year, which will help it secure growth in size as well as in efficiency.”

Posco shares rose 1 percent to close at 604,000 won in Seoul. The benchmark Kospi index was little changed.

Omaha, Nebraska-based Berkshire didn’t immediately respond to a message left with Buffett’s assistant Debbie Bosanek after 9:30 p.m. local time late yesterday. Buffett is the largest shareholder of Berkshire, which owns 3.95 million shares in Posco, according to its 2009 annual statement.

According to data compiled by Bloomberg, Berkshire holds a 4.5 percent stake in Posco.

Omaha Meeting

The meeting between Chung and Buffett took place at the headquarters of Berkshire in Omaha, Posco said. Posco released statements of the meeting in Korean first and in English later.

“If we actually get data that Buffett increased Posco holdings, that should provide a short-term boost to the shares,” said Kim Young Chan, a fund manager at Shinhan BNP Paribas Asset Management Co. in Seoul, which manages the equivalent of $28 billion in assets.

Posco’s planned $30 billion overseas investment includes building plants in India, Vietnam and Indonesia, and last week it said it will buy a stake in an Australian iron ore mine.

Buffett “strongly” encourages Posco’s investment plans, the company’s English-language statement said.

Shares Value

Berkshire first disclosed it bought 3.49 million Posco shares for $572 million in 2007. The number of shares held rose to 3.95 million, bought for a total cost of $768 million, Berkshire said last February.

At today’s closing price, 3.95 million Posco shares are worth 2.39 trillion won ($2.1 billion).

“The current management is doing well,” the English- language statement cited Buffett as saying.

Buffett has found Asia a profitable venue in recent years. In September 2008, Berkshire Hathaway unit MidAmerican Energy Holdings Co. agreed to pay HK$1.8 billion ($232 million) for 225 million shares of BYD Co., a Chinese automaker. BYD shares have rallied eight-fold since.

Buffett hopes to visit South Korea again in autumn if there’s an opportunity, Posco said. Buffett made a trip to the country in 2007.

Buffett said last May that some South Korean companies were undervalued, telling reporters at the time he had a book about South Korea’s publicly-traded companies that he studied for possible investments.

The Oracle of Omaha, as he is known, built Berkshire over four decades from a failing maker of men’s suit linings into a $150 billion company through successful stock picks and dozens of takeovers.

Why invest in Lithium?? Warren Buffett is the reason : He said last year that in 20 yrs all cars will be electric. Countdown is now 19 years to go... 1 comment

Nov 29, 2010 8:46 AM | about stocks: LIT, SQM, ROC, FMC, BYDDF.PK, TSLA, TM, HMC, DDAIF.PK, F, GM, NSANY.PK, SLV, GLD, KOL, PKOL, SCCO, CU, PALL, MOO, POT, MOS, AGU, CF, ANR, CLF, WLT, REE, MCP, X, AKS, RS, ATI, RTI, TIE

Sunday, November 29, 2009

Warren Buffett: In 20 years, all cars on the road will be electric

Small Number of Miners and Split of the Pie - Eric Norris, Global Commercial Director for FMC's Lithium Division, offered a synopsis of the split for Li suppliers. In his presentation Norris put market demand of 93K tonnes for lithium carbonate equivalents in 2007 and offered the following split for market supply:

Why invest in Lithium?? Warren Buffett is the reason : He said last year that in 20 yrs all cars will be electric. Countdown is now 19 years to go... 1 comment

Nov 29, 2010 8:46 AM | about stocks: LIT, SQM, ROC, FMC, BYDDF.PK, TSLA, TM, HMC, DDAIF.PK, F, GM, NSANY.PK, SLV, GLD, KOL, PKOL, SCCO, CU, PALL, MOO, POT, MOS, AGU, CF, ANR, CLF, WLT, REE, MCP, X, AKS, RS, ATI, RTI, TIE

Sunday, November 29, 2009

Warren Buffett: In 20 years, all cars on the road will be electric

Small Number of Miners and Split of the Pie - Eric Norris, Global Commercial Director for FMC's Lithium Division, offered a synopsis of the split for Li suppliers. In his presentation Norris put market demand of 93K tonnes for lithium carbonate equivalents in 2007 and offered the following split for market supply:

Figure 4: Source; Notes taken by attendee to Jan./09 talk

Note:Chemetall is a unit of Rockwood Holdings (ROC)

"Something is telling us that we are close to the right Time again, like Warren Buffett was spot on the money last Fall buying into BYD with 250 million and now, one year after and almost an eternity passed in investment world of a slow motion crash video, he is sitting on 1 billion stake in the company and has made BYD founder the China's richest person along the way. This something could be the coming Copenhagen Climate Change conference or Nissan Electric Leaf on North American Tour or even this article about GM Volt anxious to be on time on the road."

BYD: "Build Your Dreams" - founder takes it quite literally and made his fortune already even without selling very many Electric Cars yet. One thing is to get Warren Buffett to advertise your product and another one is for Buffett to proclaim: "In 20 years, all cars on the road will be electric". China, Buffett and Electric Cars - what else do we need to start a new Trend? Bill Gates could help and Google guys are backing Aptera already...Jim Dines is all over it on Supply side with Rare Earth Elements and worries about Lithium oversupply will be blown away with every Electric Car sold. Maestro is giving us the most aggressive timing we ever heard or dreamed about rate of Electric Cars adoption - it is our "Big IF" in action.

"Time is always an essence, we can not afford to live a life of an artist, when she will be admired long time after her time. Money as all particles, which come and go, have a dual nature inhibited in their reality: Money love to test your patience as much as they are impatient themselves. They refuse to grow without a catalyst, even in the most fertile environment. They are always searching for the Trend: they like to come early and enjoy when others will be piling in."

Warren Buffet here is even more aggressive then Nissan in their estimations: Bloomberg Nissan, FedEx Seek Electric-Car Target of 200 Million and now you can put your own figures on Lithium Demand side to that picture.

Lithium Drive: Warren Buffett: BYD Signs Over Another 1500 Vehicles To Shenzen, Making The World's Largest Electric Vehicle Fleet 0 comments

Mar 1, 2012 11:30 AM | about stocks: BYDDY.PK, GM, F, TSLA, AONE, SQM, FMC, ROC, LIT, MCP, REE, VALE, ABX, FCX, NG, BHP, ZIP, IBM

Lithium Drive: Warren Buffett: BYD signs over another 1500 vehicles to Shenzen, making the world's largest electric vehicle fleet ilc.v, tnr.v, czx.v, rm.v, lmr.v, abn.v, asm.v, btt.v, bva.v, bvg.v, epz.v, fst.v, gbn.v, hao.v, jnn.v, ks.v, ktn.v, kxm.v, mgn, mxr.v, rvm.to, svb, ura.v, nup.ax, srz.ax, usa.ax

http://4.bp.blogspot.com/-

While some people would like to make us all think that electric cars are polluting more than ICE ones, China moves fast with its Electric Cars program. If you have noticed from the Envia news about Lithium Wonder Battery - actual cell production facility is based in...China. Chinese companies are claiming larger stake in Lithium Battery production market now and Lithium Materials production is already a home turf for Chinese companies.

Companies like Ganfeng Lithium are staking their claims in Lithium Supply chain for the Green Revolution by investing in companies like International Lithium with world wide base of lithium projects.

[img]2.bp.blogspot.com/--0ACfrj6P0k/T09erzbcceI/AAAAAAAAFfM/yRMKxi7hR8g/s400/China+Beijing+Traffic.jpg

[/img]

BYD had a very bad publicity last year and now company is coming back. Warren Buffett backs the BYD and latest lithium battery breakthrough can make the very fast adoption rate for electric cars in China. There is the question of not only the higher gas prices, but urban survival with pollution from ICE cars, which is already reaching a very dangerous levels in major cities even with still the very low rate of cars per capita in China. Urban mobility in China and India will be impossible in any meaningful numbers without electric cars now.

Lithium Game Changer: GigaOm: A battery breakthrough that could bring electric cars to the masses

"After last week's "Bricking Out" outcry about Tesla Roadster batteries, Electric Cars developers strike back with the new lithium batteries technology breakthrough! Envia Systems claims the new lithium battery technology with Energy Density of 400 Wh/kg and cost of $125 per 1 kWh. Envia Systems joins German DBM Energy, which has been lost in translation recently with its wonder Kolibri Lithium Battery and confirmsElon Musk with his call on cost of Lithium Batteries dropping below $200 per 1 kWh soon. Now, even rumors about all electric Renault Zoe 2014 with 220 miles range could be more credible.

Our Lithium developers are waiting for this technology confirmation to break out from the consolidation stage now.

It looks like Warren Buffet will be right on the money again with his call on Electric Cars!"

Lithium Drive: Warren Buffett: "In not many years, you are going to see a clear change towards Electric Cars"

Lithium Drive: Warren Buffett: BYD Signs Over Another 1500 Vehicles To Shenzen, Making The World's Largest Electric Vehicle Fleet 0 comments

Mar 1, 2012 11:30 AM | about stocks: BYDDY.PK, GM, F, TSLA, AONE, SQM, FMC, ROC, LIT, MCP, REE, VALE, ABX, FCX, NG, BHP, ZIP, IBM

Lithium Drive: Warren Buffett: BYD signs over another 1500 vehicles to Shenzen, making the world's largest electric vehicle fleet ilc.v, tnr.v, czx.v, rm.v, lmr.v, abn.v, asm.v, btt.v, bva.v, bvg.v, epz.v, fst.v, gbn.v, hao.v, jnn.v, ks.v, ktn.v, kxm.v, mgn, mxr.v, rvm.to, svb, ura.v, nup.ax, srz.ax, usa.ax

While some people would like to make us all think that electric cars are polluting more than ICE ones, China moves fast with its Electric Cars program. If you have noticed from the Envia news about Lithium Wonder Battery - actual cell production facility is based in...China. Chinese companies are claiming larger stake in Lithium Battery production market now and Lithium Materials production is already a home turf for Chinese companies.

Companies like Ganfeng Lithium are staking their claims in Lithium Supply chain for the Green Revolution by investing in companies like International Lithium with world wide base of lithium projects.

BYD had a very bad publicity last year and now company is coming back. Warren Buffett backs the BYD and latest lithium battery breakthrough can make the very fast adoption rate for electric cars in China. There is the question of not only the higher gas prices, but urban survival with pollution from ICE cars, which is already reaching a very dangerous levels in major cities even with still the very low rate of cars per capita in China. Urban mobility in China and India will be impossible in any meaningful numbers without electric cars now.

Lithium Game Changer: GigaOm: A battery breakthrough that could bring electric cars to the masses

"After last week's "Bricking Out" outcry about Tesla Roadster batteries, Electric Cars developers strike back with the new lithium batteries technology breakthrough! Envia Systems claims the new lithium battery technology with Energy Density of 400 Wh/kg and cost of $125 per 1 kWh. Envia Systems joins German DBM Energy, which has been lost in translation recently with its wonder Kolibri Lithium Battery and confirmsElon Musk with his call on cost of Lithium Batteries dropping below $200 per 1 kWh soon. Now, even rumors about all electric Renault Zoe 2014 with 220 miles range could be more credible.

Our Lithium developers are waiting for this technology confirmation to break out from the consolidation stage now.

It looks like Warren Buffet will be right on the money again with his call on Electric Cars!"

Lithium Drive: Warren Buffett: "In not many years, you are going to see a clear change towards Electric Cars"

Lithium charge: Beijing to waive license plate lottery for electric vehicles

China Car Times:

BYD signs over another 1500 vehicles to Shenzen, making the world's largest electric vehicle fleet

Where is the world's biggest fleet of electric vehicles? Perhaps it is in a more cosmopolitan western city such as San Francisco, New York, London or Paris? Actually its not so surprising to learn that is in Shenzhen, the home of BYD Auto. BYD in recent years strived to put its electric know how onto the roads, however it has come across road blocks such as low consumer take up but at the same time it has found good customers in fleet users that are eager to take on EV's to lower running costs and again good publicity in the process.

Shenzhen City government has signed a deal with BYD to take on another 1500 EV's from the company which will be a mixture of 1000 K9 electric buses and 500 E6 passenger vehicles. Shenzhen's Development and Reform Comittee (SDRC) have been pushing hard to introduce more EV's into the city to lower running costs and improve the environmental situation in the area, the NDRC's director Mr. Lu Xiangshen commented: "Shenzhen is the first city in China to implement a subsidy for new energy vehicles and the first city to launch consumer sales of the BYD e6." The fleet of E6 taxis around Shenzhen have already given consumers a taste of electric cars and the city was one of the first in China to announce subsidies for EV's

Shenzhen city government are contemplating introducing other incentive policies include allowing pure electric drivers to use the public bus lane during rush hour, discounted insurance privileges, and free annual maintenance checks. China's Southern Power Grid Company has agreed to install free-of-charge, two electric vehicle charging poles for each Shenzhen EV driver - one at the home or apartment of the driver and another near or at the driver's place of business. Shenzhen City continues to offer extremely affordable peak and off-peak electricity prices for new energy vehicle users, reducing nightly charging costs to only 0.3yuan RMB per KWh (~$0.04 USD/KWh equivalent). The SDRC predicts that private alternative energy vehicle use in Shenzhen will increase by over 3000 units in 2012 and plans to install and support over 6,000 new charging pedestals

Lithium is becoming the popular commodity of choice for stock investors — for good reason. Car makers are choosing lithium-ion batteries for their “never could be better timing” hybrid lithium and electronic vehicles. And the $2 billion the U.S. intends to invest in that technology will help ease the way.

Baltimore (TFN (0.30 ?0.00%)): At car shows globally, everybody’s talking lithium…

GM announced it would build a plant to manufacture lithium-ion (Li-ion) batteries for the Chevy Volt scheduled to debut in 2011.

BMW (68.47 ?-0.52%) plans to launch its remodeled Li-ion battery-powered 750i luxury sedan to the Japanese in 2010. This year, the company is producing 500 all-electric MINI Es, also with Li-ion batteries, for leasing in select cities.

Toyota (TM 83.93 ?-0.86%) hopes to launch plug-in hybrid Priuses with Li-ion batteries later this year.

Mercedes (DAI 47.42 ?0.00%)-Benz anticipates launching its S400 Blue HYBRID with a Li-ion battery next year.

The Ford (F 12.61 ?0.52%) Escape plug-in hybrid with the same power technology is slated for 2012.

Then there’s the Tesla Roadster, Chyrsler EcoVoyager, Dodge ZEO, Jeep Renegade and the Saturn Flextreme.

Government money to the tune of $2 billion has been earmarked for hybrid technology. And with the greater demand for all these Li-ion car batteries, miners, processors and battery manufacturers stand to profit.

Just look at the two stocks we recommended to TFN readers in late January (Read that article here):

Chilean-based lithium producer Sociedad Quimica y Minera de Chile (ADR (723.88 ?-0.74%)) (NYSE:SQM (59.15 ?0.36%)) today reported a record year with earnings of $501.4 million for 2008. That’s 179% over 2007.

And their Q4 2008 net income came in at 170% over the same period the year prior.

Our other pick, U.S.-based Polypore International (PPO 34.53 ?0.76%), Inc. (NYSE:PPO), supplies mono- and multilayer membrane separators for lithium batteries – including those used in hybrid electric vehicles (HEVs).

Polypore also reported their 2008 results today: Though restructuring created a loss for Q4, sales were up by 1 million. For all of 2008, sales were up 14% from last year at $610.5 million and adjusted net income was up by 24.1 million.

Johnson Controls, Inc. (NYSE:JCI (32.36 ?-0.06%)), in conjunction with with French outfit Saft, was selected to partner with Ford for it’s lithium battery.

Other companies hoping to ride the lithium profit wave can be found in our The Lithium-Stocks.net Complete Guide to Investing in Lithium Stocks and bringing the best lithium producers, properties, and live charts on the web.

Demand for rechargable Lithium-ion batteries will soar as hybrid cars become more popular . Laura picks two companies that could return triple-digit gains in just a few years.

About the element

Though not uncommon, lithium appears in low concentrations and is typically interwoven (IWOV 16.00 ?0.00%) with other minerals.

The largest commercial deposits currently mined are in Chile and Argentina. China, Russia, Australia and the U.S. are working to pickup production.

And the amount of lithium carbonate required for a car battery is about 100 times that needed for a laptop.

(IMO) Sometimes I'm to the point, and sometimes I'm out in left field. JMHO

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.