Thursday, March 15, 2012 11:45:40 PM

Amazing what a week will do—apparently, the dollar is much more valuable today. But in reality, this temporary dollar strength can not be predicated on the U.S. advancing in the accumulation of the largest debt in the history of the world. To those with common sense, an unsustainable debt is obviosuly a problem—but for some, an ever-expanding debt isn't a problem—it's a reason to celebrate.

The reason it is not a problem, from the perspective of a select few, is that without an ever increasing debt, we have monetary deflation (The nemesis of those who conjure currency) causing institutional insolvency and bank failures. Stop-gap measures such as suspension of mark-to-market accounting and GAAP standards helps in the short run. But debt expansion and a larger supply of currency is the solution.

This is why you see the "two-party system" both perpetuate large debt expenditures, such as socialized healthcare, the welfare state and war.

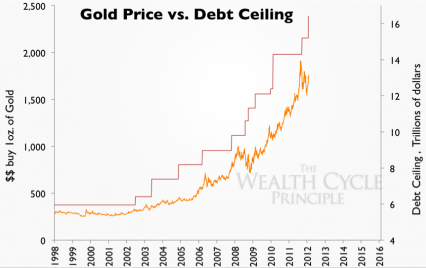

The best way to measure dollar strength is to invert the gold chart (below). Today you can save in ounces of gold, by trading in only 1,650 dollars. Earlier it may have taken 1,700 or 1,900 when the U.S. economy was perceived as weaker. The fundamental value of the dollar is headed lower, as you can see by its long-term decline, which makes sense, in tandem with our rising debt and dilution resulting from printing. Observe the acceleration of the downtrend after the crisis.

The Federal Reserve Note (dollar) Value:

More debt and the debt ceiling hikes (below) translate into an impressive correlation to the weakness in the dollar, a reflection of the health of the nation.

Tyler Durden put into words so succinctly exactly how everyone is feeling:

"In conclusion we wish to say - thank you Chairman for the firesale in physical precious metals. We, and certainly China, thank you from the bottom of our hearts."

Recent SLV News

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 05/08/2024 08:40:23 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/03/2023 06:39:51 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/04/2023 06:19:53 PM

- Will Silver’s 200-Day MA Break? • ValueWalk • 06/30/2023 07:38:03 PM

- Silver Hangs On By A Thread • ValueWalk • 06/16/2023 05:46:04 PM

- Silver Market Deficit Reaches All-time High In 2022 Amidst Investor Indifference • ValueWalk • 06/10/2023 03:23:22 PM

Mushrooms Inc. (OTC: MSRM) Announces Significant Share Buy Back by the Board Director and New Strategic Initiatives. • MSRM • Jun 5, 2024 1:32 PM

Hydromer Announces Launch of HydroThrombX Medical Device Coating Technology • HYDI • Jun 5, 2024 10:24 AM

Dr. Michael Dent Finances $1 Million to Drive HealthLynked's Healthcare Transformation • HLYK • Jun 5, 2024 8:00 AM

Avant Technologies Enters Binding LOI to Purchase Dozens of High-Performance, Immersible, AI-Powered Servers • AVAI • Jun 5, 2024 8:00 AM

IQST - iQSTEL Announces $290 Million 2024 Annual Revenue Forecast • IQST • Jun 4, 2024 1:43 PM

ECGI Holdings Accelerates Strategic Initiatives by Securing First of Two $125,000 Convertible Notes • ECGI • Jun 4, 2024 12:15 PM