| Followers | 559 |

| Posts | 23793 |

| Boards Moderated | 0 |

| Alias Born | 03/06/2009 |

Monday, March 05, 2012 8:17:21 AM

Stocks set to open lower today...

U.S. stocks were set to open lower Monday, following the path of world markets, after China lowered its annual growth target.

Investors also are bracing for a week full of news on Greece's rescue package and the domestic labor market.

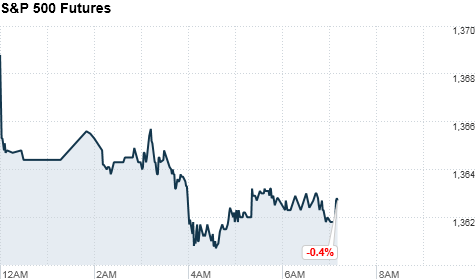

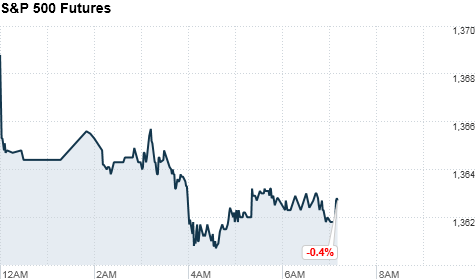

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all about 0.4% lower. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

World markets were in the red Monday, after Chinese Premier Wen Jiabao set a lower target for China's economic growth, underscoring the need to make the country's breakneck development more sustainable.

The government is aiming for economic growth of 7.5% in 2012, Wen said -- lower than the 2011 goal of about 8%. The Chinese economy often exceeds the official objective: last year it grew 9.2%.

On the domestic front, investors will head into the week looking for more evidence of a U.S. recovery under way, while keeping tabs on developments on Europe's debt crisis.

"The Chinese downgrading their economic target is sending a little bit of a jitter through European markets," said David Jones, chief market strategist at IG Index.

"But in general, we've seen fairly quiet markets over the last few weeks, and that might continue until we get the payroll data out of the way on Friday," he said.

European leaders inked a pact on Friday aimed at ensuring fiscal discipline across the continent. However, they have yet to make a decision on the size of the "financial firewall" that many believe is necessary if countries such as France and Spain face further distress.

Stocks closed modestly lower Friday, with the Dow snapping a three-week winning streak.

World markets: European stocks retreated in midday trading. Britain's FTSE 100 (UKX) lost 0.5%, the DAX (DAX) in Germany dropped 1.2% and France's CAC 40 (CAC40) shed 0.8%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) closed down 0.6%, while the Hang Seng (HSI) in Hong Kong lost 1.4% and Japan's Nikkei (N225) dropped 0.8%.

Gas prices hit $3.77 a gallon

Economy: Reports are due Monday morning on the services sector and factory orders.

Last week, the ISM manufacturing index for February slipped to 52.4, from 54.1 in January, indicating a slowdown in the sector's expansion. The February edition of the ISM services index is expected to come in at 56, down from 56.8 in the month prior, which would also signal a slower expansion.

January factory orders are expected to have decreased by 1.9%, according to a survey of analysts by Briefing.com, after ticking up by 1.1% in December.

Coming later in the week are data on consumer credit and the monthly jobs report.

Companies: Online reviews site Yelp (YELP) will look to continue its momentum Monday, after shares spiked 64% to top $24 a share in their debut on the New York Stock Exchange Friday.

BP shares were slightly higher ahead of the open. BP (BP) and plaintiffs involved in the legal battle over the Gulf of Mexico oil spill said Friday they have reached an agreement. BP estimated that it would have to pay about $7.8 billion in the Deepwater Horizon disaster settlement.

Apple (AAPL, Fortune 500) said in a post on its website that the tech company has "created or supported" some 514,000 jobs in the United States, either through direct employment, the "App economy" or other means.

Currencies and commodities: The dollar strengthened against the British pound and the euro, but fell versus the Japanese yen.

Oil for April delivery slipped 56 cents to $106.14 a barrel.

Gold futures for April delivery fell $12.10 to $1,698 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury held steady, with the yield flat at 1.98%.

U.S. stocks were set to open lower Monday, following the path of world markets, after China lowered its annual growth target.

Investors also are bracing for a week full of news on Greece's rescue package and the domestic labor market.

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all about 0.4% lower. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

World markets were in the red Monday, after Chinese Premier Wen Jiabao set a lower target for China's economic growth, underscoring the need to make the country's breakneck development more sustainable.

The government is aiming for economic growth of 7.5% in 2012, Wen said -- lower than the 2011 goal of about 8%. The Chinese economy often exceeds the official objective: last year it grew 9.2%.

On the domestic front, investors will head into the week looking for more evidence of a U.S. recovery under way, while keeping tabs on developments on Europe's debt crisis.

"The Chinese downgrading their economic target is sending a little bit of a jitter through European markets," said David Jones, chief market strategist at IG Index.

"But in general, we've seen fairly quiet markets over the last few weeks, and that might continue until we get the payroll data out of the way on Friday," he said.

European leaders inked a pact on Friday aimed at ensuring fiscal discipline across the continent. However, they have yet to make a decision on the size of the "financial firewall" that many believe is necessary if countries such as France and Spain face further distress.

Stocks closed modestly lower Friday, with the Dow snapping a three-week winning streak.

World markets: European stocks retreated in midday trading. Britain's FTSE 100 (UKX) lost 0.5%, the DAX (DAX) in Germany dropped 1.2% and France's CAC 40 (CAC40) shed 0.8%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) closed down 0.6%, while the Hang Seng (HSI) in Hong Kong lost 1.4% and Japan's Nikkei (N225) dropped 0.8%.

Gas prices hit $3.77 a gallon

Economy: Reports are due Monday morning on the services sector and factory orders.

Last week, the ISM manufacturing index for February slipped to 52.4, from 54.1 in January, indicating a slowdown in the sector's expansion. The February edition of the ISM services index is expected to come in at 56, down from 56.8 in the month prior, which would also signal a slower expansion.

January factory orders are expected to have decreased by 1.9%, according to a survey of analysts by Briefing.com, after ticking up by 1.1% in December.

Coming later in the week are data on consumer credit and the monthly jobs report.

Companies: Online reviews site Yelp (YELP) will look to continue its momentum Monday, after shares spiked 64% to top $24 a share in their debut on the New York Stock Exchange Friday.

BP shares were slightly higher ahead of the open. BP (BP) and plaintiffs involved in the legal battle over the Gulf of Mexico oil spill said Friday they have reached an agreement. BP estimated that it would have to pay about $7.8 billion in the Deepwater Horizon disaster settlement.

Apple (AAPL, Fortune 500) said in a post on its website that the tech company has "created or supported" some 514,000 jobs in the United States, either through direct employment, the "App economy" or other means.

Currencies and commodities: The dollar strengthened against the British pound and the euro, but fell versus the Japanese yen.

Oil for April delivery slipped 56 cents to $106.14 a barrel.

Gold futures for April delivery fell $12.10 to $1,698 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury held steady, with the yield flat at 1.98%.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.