Saturday, February 25, 2012 6:02:14 AM

Bill Luby, the self-proclaimed expert on these things, includes a statement: "Disclosure(s): long XIV; short TVIX, UVXY and VXX at time of writing." He is ALWAYS short TVIX. If he were to ever suggest buying it for other than short-term trading, that would be highly significant.*

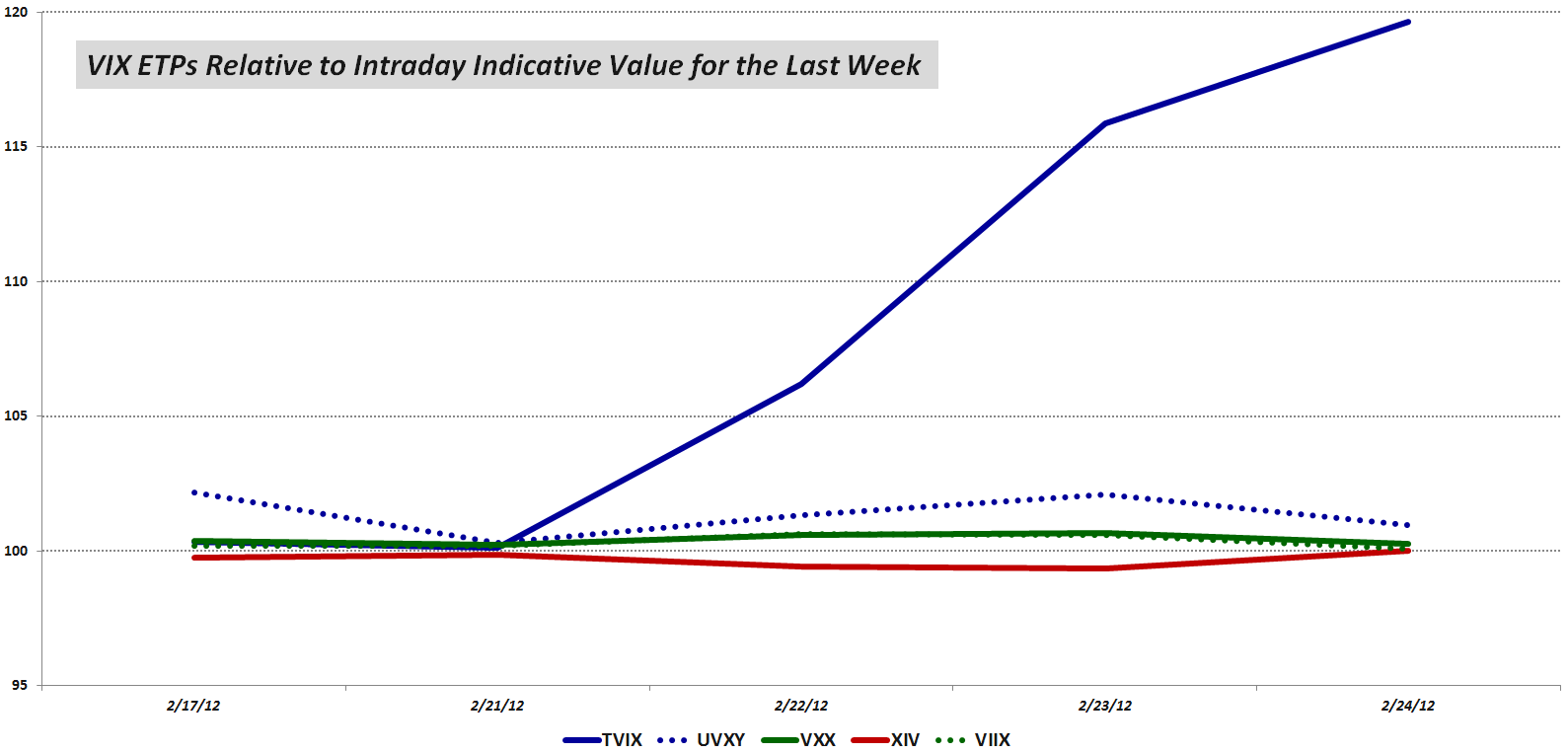

He includes a graph in this article, in which he talks about the "premium" on TVIX, due to "the suspension of new creation units." He says, "Once Credit Suisse closed the door for new creation units, the price of TVIX has drifted steadily higher relative to its indicative value," which would be "a real-time estimate of an ETP’s fair value, based on the most recent prices of its underlying securities."*

Premium? What "premium?" The graph clearly shows TVIX moving higher, although the price seems to be stuck so low that the untrained observer would never have noticed.*

http://etfdailynews.com/2012/02/24/the-story-of-vix-etps-relative-to-their-intraday-indicative-values-tvix-vxx-viix-xiv-uvxy/

http://i104.photobucket.com/albums/m163/bl82/VIXETPsPctIV5d022412.png

--*

The volatility index itself, or VIX, comes from the Chicago Board Options Exchange, and the information about it can be found on their website:

http://www.cboe.com/micro/VIX/vixintro.aspx

Scrolling down the page, they give graphs for several different time periods.*

I often use the Google finance page:

http://www.google.com/finance

Although Google gives graphs for several indexes, they don't give this one. The Google graphs give more detailed information than the CBOE, so this makes it harder to compare.*

The various exchange traded products related to the VIX seem to have totally unrelated values. They move up and down at the same time, but the numbers don't seem to be based on anything. I would assume that a VIX share would be kept at a price close to the actual VIX number. A double VIX should move up and down by twice the amount.*

From what I can see, the TVIX price seems to match pretty closely with the actual VIX. Not double, but the same. Friday's closing price was $16.66, while the VIX was 17.31 - -

Twice in February, the VIX went just barely over 20 dollars, and so did TVIX. If TVIX just barely matches the VIX, then VXX must be a half-rate fund. Whether this is "decay" or "dilution," or something else, is what we hope to find out.*

The prices of TVIX and VXX crossed over on about December 16th, at about 39 dollars. This should not happen. The baseline for both should be zero. VXX should almost exactly match the VIX, and TVIX should be approximately double both of those others.*

The suspension of new share creation should cause the price to rise, gradually. It would have to go up a little bit to match the VIX exactly, but it would have to go up a lot to give double the value.*

In any case, the volatility is good for someone who wants to trade it up and down within the trading range.*

--*

Also note: the (inverse) XIV forum on this website is listed in the wrong category.*

http://investorshub.advfn.com/boards/board.aspx?board_id=22231

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM