Thursday, January 05, 2012 12:11:27 PM

1. Why didn't the SEC settle this?

After all the company took immediate steps to bow to the SEC:

Shortly after obtaining the approximately $8.4 million in financing the company

issued a public statement indicating its financial statements could no longer be relied upon due,

in part, to the erroneous valuation of certain assets on the balance sheet (i.e., the media credits,

among other things)

What are 'other things'...Is that a legal term? Why wasn't that defined if it actually represented something.

2. What are media credits?

They are prepaid credits which can be redeemed for advertising in radio, print, etc.

It's a matter of opinion as to their value. Obviously the company thought they had value:

They could have been used to advertise/promote Pak-It Products

Could be used to promote P2O

How does the SEC know they had little/no value?:

'completely worthless and needing to be written off entirely. the media credits had little to no real value. '

and

'no probable economic benefit to JBI from the media credits as the ads had limited distribution and would be unlikely to

increase sales and profits, '

3.. Who exactly was harmed/defrauded?

The PIPE investors came in because of Plastic2Oil....not because of a media credit asset.

Any investors of JBII stand to make significant gains when P2O becomes commercially profitable.

4. And they want them to disgorge their 'ill gotten gains'.

These 'gains' were used to develop Plastic2Oil, not for any personal use.

5. Why do they want to prevent Bordynuik and Baldwin from being officers the company?

Does the SEC really believe that they are career violators?:

'unless enjoined will continue to violate,'

6. There are 14 claims. Why restate the exact same thing in all 14 claims of the document.

They really padded that claim to make it look stronger, cause it's actually a pretty weak claim.

7. Personality conflict between whoever instigated this at the SEC and the company?

Another issue/reason?

8. The timing.

Why file this with 30 minutes left for trading.

Doesn't the SEC themselves have a rule that significant news should be released during non-market hours?

9. The use of the term purportedly.

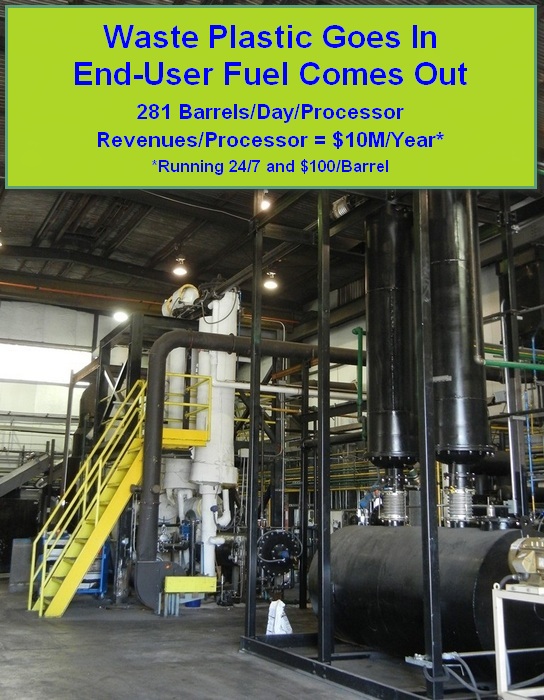

There's nothing 'purportedly' about JBII's Plastic2Oil Development

There's ample evidence that Plastic2Oil has been developed and is currently in commercial production.

'purportedly involved in the research and development of a process designed to convert plastic waste into oil, known as “Plastic2Oil” or “P2O”.'

10. Why go after JBII?

This difference of opinion as to the value of the credits doesn't seem like a very high priority issue.

Somebody made a lot of money on shorting

Seems the SEC was egged on by somebody who wanted to hurt the company

Did those people profit?

Seems certain people had advance knowledge of this. 'Friends' of the SEC?

JBII poses a threat to energy burners...Plastic has a high BTU count. Take that away and they lose money.

Big Oil? While JBII poses no direct competition (yet), the fact that lower priced fuel is available could affect market prices for oil.

11. And why no action against DOMK/Domark from whom they were bought....who had these on the books at $10M??

Bottom Line: There seems to be a lot behind the scenes here that isn't exactly kosher.

If anybody has any other thoughts on this, pls respond to this post.

z

FEATURED POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM

ECGI Holdings Targets $9.7 Billion Equestrian Apparel Market with Allon Brand Launch • ECGI • Jun 25, 2024 8:36 AM

Avant Technologies Addresses Progress on AI Supercomputer-Driven Data Centers • AVAI • Jun 25, 2024 8:00 AM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM