| Followers | 1693 |

| Posts | 205386 |

| Boards Moderated | 11 |

| Alias Born | 01/02/2008 |

Saturday, December 03, 2011 9:18:52 AM

TAT – Research / DD & Charts - Portfolio 2012 -- Presented By AugustaFriends

About TAT –

TransAtlantic Petroleum Ltd.

Akmerkez B Blok Kat 5-6

Nispetiye Caddesi 34330 Etiler

Istanbul,

Turkey - Map

Phone: 90 212 317 25 00

Website: http://www.transatlanticpetroleum.com

Investor RelationsTransAtlantic Petroleum Ltd.

5910 N. Central Expwy | Suite 1755

Dallas, TX 75206

1-214-265-4794

Fax: 1-214-265-4711

investorrelations@tapcor.com

Share Related

Market Cap (Total, All Common Classes) (Mil) 501.05

Shares Outstanding (Total, All Classes) (Mil) 365.73

Shares Outstanding, Average (FY) (Mil) 312.49

Float (Mil) 211.47

Annotated chart by ‘I am Legend’ - Annotate chart cup and handle formation

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69562770

Business Summary

Transatlantic Petroleum Ltd., an integrated international oil and gas company, engages in the acquisition, exploration, development, and production of oil and natural gas. It holds interests in developed and undeveloped oil and gas properties in the United States, Turkey, Bulgaria, and Romania; and provides oilfield and drilling services to third parties in Turkey and Iraq. The company held interests in 56 onshore exploration licenses and 3 onshore production leases covering a total of approximately 6.4 million gross acres in Turkey; and owned interests in 2 onshore exploration permits in Bulgaria, and 1 onshore production license in Romania. Transatlantic Petroleum Ltd. also acquired interests in 3 projects in the San Joaquin Valley in central California; leased 2 properties in Dewey McClain Counties in Oklahoma; and owned a 20% non-operated working interest in a well on the Dewey County. As of June 30, 2011, it owned 11 drilling rigs and 5 workover and completion rigs in Turkey; and managed 1 drilling rig each in Iraq and Turkey. The company was founded in 1985 and is based in Istanbul, Turkey

Southwest IDEAS Investor Conference Presentation

http://media.corporate-ir.net/media_files/irol/15/153906/TATSWIDEASConference.pdf

History

TransAtlantic Petroleum Corp. was incorporated in 1985 under the laws of British Columbia and changed domicile to Alberta in 1997.

In 1992, The Company acquired a 30% interest in OML 109, a 215,000-acre concession located offshore Nigeria. TransAtlantic successfully drilled a discovery well in 1994 and an appraisal well in 1995 in the Ejulebe field on OML 109, and contracted with a service provider to develop the field. Production began in September 1998, and the Ejulebe field produced approximately 11 million barrels of crude oil as of December 2005. Following its participation in OML 109, TransAtlantic drilled several exploration wells offshore from Benin and onshore in Tunisia. Additionally, TransAtlantic attempted to exploit two onshore Egyptian oil and gas exploration blocks.

During 2005, 2006 and 2007, the Company focused on acquiring high-impact international properties, evaluating and acquiring lower-risk cash flow opportunities in the United States and disposing of its Nigerian property, which was sold in 2005. During 2005 and 2006, TransAtlantic acquired an exploration permit and a reconnaissance license in Morocco, three production blocks in Romania, three exploration licenses in Turkey, and two promote round licenses covering six blocks in the UK North Sea. During this same period, the Company acquired properties in Texas. TransAtlantic also participated as a non-operator in four other properties in Texas, Oklahoma, and Louisiana.

In 2007, the Company determined to exit its U.S. operations and focus on the development of its international properties. To that end, TransAtlantic acquired three additional exploration licenses in Turkey, converted a portion of its Moroccan reconnaissance license into two exploration permits, sold the Texas properties it operated, and offered its remaining non-operated U.S. properties for sale.

Management Malone Mitchell - Chairman and Chief Executive Officer

From 1985-2006, Malone built Riata Energy into one of the largest privately held energy companies in the United States. In 2006, he sold controlling stake in Riata Energy. Later, Riata Energy was renamed SandRidge Energy (NYSE:SD). Near the time of sale, SandRidge Energy had 1 Tcf in proved reserves, 300 miles of gas-gathering pipeline, greater than 34,000 horsepower of gas compression, and owned or operated 43 drilling rigs.

Shortly after stepping down from SandRidge, Malone founded Mitchell Group. Mitchell Group includes Riata Management and Private Energy, Oilfield Service, Investment, and Consumer Business in North America, South America, and Asia.

Malone is CEO of TransAtlantic and spends a considerable portion of his time in country (Turkey, Morocco, Bulgaria and Romania).

Malone graduated from Oklahoma State University in 1983 with a Bachelor of Science degree.

Who is TransAtlantic's largest investor?

Mr. Malone Mitchell 3rd, the Company's Chairman, and various affiliates (collectively "Mitchell Group"). Mitchell Group owns over 50% of TransAtlantic Petroleum Ltd.

With more than 25 years in the business, Malone Mitchell, chairman of TransAtlantic Petroleum Corp., has not only endured but also prospered through seven downturns, turning assets he bought in the 1998 down cycle into billions. His secret? A dynamic business plan. In an industry that provides constant, if changing opportunities, a business plan that adapts along with the market—every three to five years—makes for a great business, according to Malone. In this exclusive interview with The Energy Report, he discusses the business service modifications that enabled TransAtlantic to corner some select foreign markets, likens operating in Morocco and Turkey to operating in Texas, defines what he calls a ‘friendly hostile bid’ and explains why he’s been waiting 23 years for this situation.

http://www.forbes.com/pictures/ekge45ll/malone-mitchell

Business

TransAtlantic purchased Longe Energy Limited ("Longe") in December 2008. Longe was the owner-operator of four drilling rigs and an oilfield services business. After the acquisition, Longe was renamed Viking International Limited

Viking Drilling, LLC http://www.viking-drilling.com/

The acquisition of drilling rigs and service equipment expanded TransAtlantic's opportunity to increase acreage in Turkey and Morocco. Because the availability of drilling rigs and service equipment is limited in Turkey and Morocco,the company believes third parties may seek out TransAtlantic to participate in their licenses on terms favorable to the Company. TransAtlantic believes many of these opportunities would not exist if it did not own its own drilling rigs and service equipment. With the acquisition of Incremental Petroleum in March 2009, TransAtlantic expanded its rig fleet from four to seven.

TransAtlantic's modern fleet of drilling rigs serve as a catalyst for the company's growth. By controlling a drilling fleet, the company can develop its existing reserves and explore for new reserves. This provides TransAtlantic with a competitive advantage, especially when the supply of rigs is scarce in Turkey and Morocco.

Welcome to Riata Management Mission: Riata Management, LLC seeks to operate via traditional private equity investments in companies whose management i) has strong experience in their industry, ii) are personally invested in their company, and iii) demonstrate an ability to create and deliver above-market returns to our investors.

He founded Riata Energy (now SandRidge Energy) in 1985. He served as Operations Manager at Riata Energy until 1989 when he assumed the role of Chief Executive Officer and Chairman, which he held until June 2006. During this period, Riata grew from $500 to become one of the largest privately held energy companies and the largest privately held land driller in the US and had significant midstream and tertiary oil production operations.

LATEST NEWS:

TransAtlantic Petroleum Ltd. Provides Update on Operations at Selmo Field

HAMILTON, BERMUDA, Nov 28, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) today provides a comment from N. Malone Mitchell, 3rd, the Company's chairman and chief executive officer, regarding the Company's operations at Selmo field in southeastern Turkey.

Mr. Mitchell said:

Despite the tragic events that transpired last week, TransAtlantic expects to proceed with its existing strategy at Selmo field. We appreciate the tremendous grief experienced by the friends and families of the victims and are working with the authorities to finish their investigations. We trust them to take the actions necessary to bring those responsible to justice. Senior government ministers have assured us they will act and we take them at their word.

To say that "ordinary operations have resumed" is disrespectful both to the families of those who died and to those that continue to operate in the field. However, our brave and hardworking operations team resumed production operations on Thursday and have returned the field to recent production levels. TransAtlantic is increasing and changing its security strategy for our field operations to continue to provide our employees and contractors with the protection that they deserve while realizing that it is always hard to anticipate and defend premeditated intent to do violence.

TransAtlantic Petroleum Ltd. Reports Incident at Selmo Field HAMILTON, BERMUDA, Nov 23, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) reports that today at approximately 10:30 pm (local time) one or more armed individual(s) attacked workers at the Company's Selmo field operations in southeastern Turkey. TransAtlantic is sorry to report that three workers were killed in the incident, which at this time appears to be an isolated event. The Company is working with local authorities to investigate the incident and provide additional security for our operations in the vicinity.

TransAtlantic mourns the loss of our fellow employee and contractors. We express our deepest sympathies to their family members and friends.

TransAtlantic Petroleum Ltd. Announces Third Quarter 2011 Earnings and Operations Update

HAMILTON, BERMUDA, Nov 09, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) is pleased to announce results for the quarter ended September 30, 2011 and provide an operations update.

Selected 3Q11 Highlights

-- Daily average sales in the third quarter of 2011 increased 74% over the same period in 2010 and 25% over the second quarter of 2011;

-- Third quarter 2011 adjusted EBITDAX from continuing operations totaled $20.3 million (EBITDAX is a non-GAAP measure and is defined and reconciled later in this press release);

-- Year-end 2011 production target reiterated at 7,000-7,500 boe per day;

-- Executed a farm out agreement with LNG Energy covering a portion of TransAtlantic's leasehold in Bulgaria and commenced drilling our first test of the Etropole shale;

-- TransAtlantic announced its intent to sell its oilfield services business, the engagement of PPHB as its financial advisor, and the extension of the maturity date of the Dalea credit agreement.

TransAtlantic Petroleum Ltd. Announces Agreement With LNG Energy and Commencement of Etropole Test Well in Bulgaria

HAMILTON, BERMUDA, Sep 22, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) is pleased to announce that it has entered into an agreement with LNG Energy Ltd. ("LNG") (TSX-V: LNG) pursuant to which LNG will invest $7.5 million USD to immediately commence drilling a 10,500 foot (approximately 3,200 meter) exploration well on the A-Lovech exploration license in Bulgaria. The objective of the well will be to core and test the unconventional Etropole formation. The agreement, between LNG and the Company's wholly owned subsidiary, TransAtlantic Worldwide, Ltd. ("Worldwide"), provides that LNG will invest $7.5 million USD which will be used by Worldwide's subsidiary and operator of the well, Direct Petroleum Bulgaria EOOD ("Direct Bulgaria"), to commence drilling the Peshtene R-11 well this week.

"With its participation in a number of licenses in the shale play in Poland, LNG brings hands-on experience to the exploration of the Etropole formation for natural gas. The drilling of an Etropole test well will increase our technical understanding of the play and is the first step in our effort to unlock the long-term potential in the Etropole," said Gary Mize, the Company's President.

The A-Lovech exploration license, which is 100% owned and operated by Direct Bulgaria, covers an area of approximately 565,000 acres (2,288 square kilometers) in northwestern Bulgaria, all of which is prospective for the Etropole formation. This agreement with LNG covers the southern portion of the A-Lovech exploration license, an area of approximately 405,000 acres (1,640 square kilometers). Direct Bulgaria will file an application for a production concession over this southern portion of the A-Lovech license (the "Etropole Concession") later this fall; the results of the Peshtene R-11 well will be used in support of the application.

Subject to various conditions, including the issuance of the Etropole Concession by the government of Bulgaria, LNG will fund up to an additional $12.5 million, of which $7.5 million will be used to drill a second well or for other exploration activities on the Etropole Concession. In return, and subject to approval by the government of Bulgaria, LNG will form a Bulgarian subsidiary to acquire a 50% working interest in the Etropole Concession. In the event certain conditions, including the issuance of the Etropole Concession, are not satisfied, then LNG would have no further obligations under the agreement.

N. Malone Mitchell, 3rd, TransAtlantic's Chairman and Chief Executive Officer, stated, "We have been encouraged by natural gas shows in the Etropole formation in a number of wells drilled in the vicinity of the planned Peshtene R-11, including one well that tested gas from the Etropole formation. We are excited to partner with LNG to accelerate our campaign to target and exploit the natural gas potential of the unconventional Etropole formation. Should the Etropole prove productive, this location lies less than 10 km from existing pipeline infrastructure, and production will benefit from regional natural gas prices that are currently around $10/Mcf."

With respect to the balance of the A-Lovech exploration license, Direct Bulgaria has already applied for a production concession over the northern 160,000 acres (648 square kilometers) called the "Koynare Area"; the Koynare Area contains a conventional gas discovery in the Jurassic-aged Orzirovo formation and is also prospective for the Etropole. The discovery well, the Deventci R-1, is currently producing approximately 250 thousand cubic feet per day on a limited test basis, which is processed in a compressed natural gas facility adjacent to the well. The Company plans to appraise this discovery by drilling a second well, the Deventci R-2, in November 2011. The Company is also seeking a partner to participate with it in developing the Koynare Area and has retained FirstEnergy Capital as its exclusive advisor to assist in that search.

LNG Energy Ltd. has entered into an exclusive term sheet with TransAtlantic Worldwide Ltd., a wholly owned subsidiary of TransAtlantic Petroleum Ltd. (TSX: TNP)(NYSE-AMEX:TAT) ("TransAtlantic") to earn a 50% interest in a future gas shale formation production concession in northwest Bulgaria (the "Transaction").

Bag This Bargain Energy Stock Even Cheaper Than The CEO Did

By FORBES

http://www.forbes.com/sites/energystockchannel/2011/11/22/bag-this-bargain-energy-stock-even-cheaper-than-the-ceo-did/

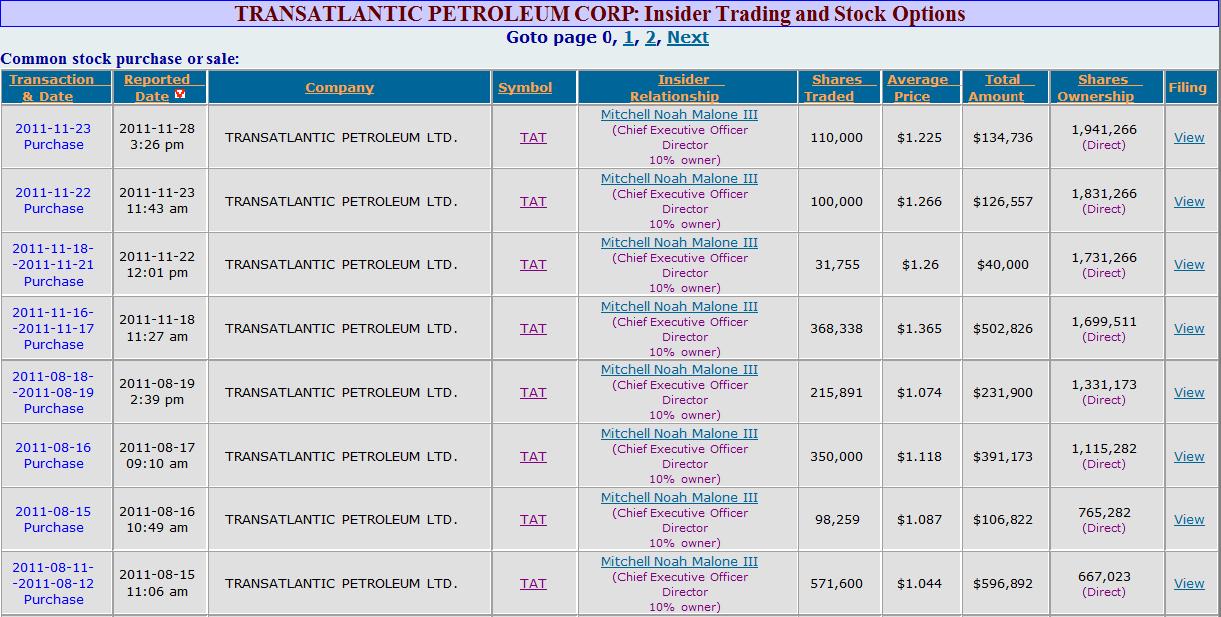

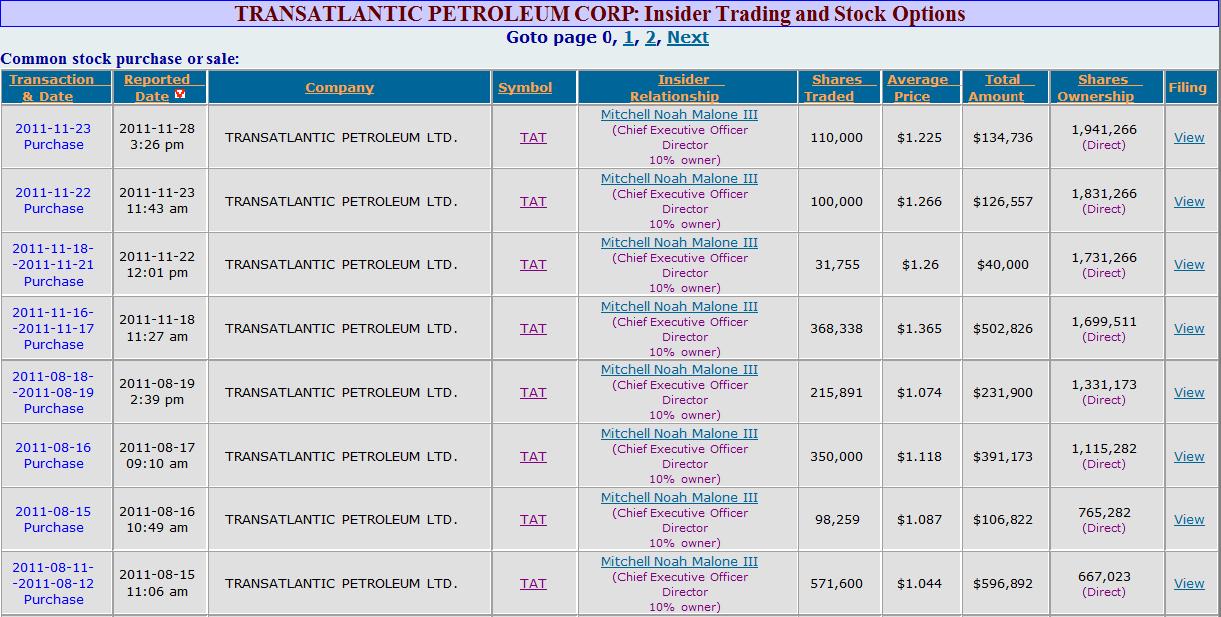

There’s an old saying on Wall Street about insider buying: there are many possible reasons to sell a stock, but only one reason to buy. Back on November 17, TransAtlantic Petroleum Ltd’s Chief Executive Officer, Noah Malone Mitchell III, invested $502,826.02 into 368,338 shares of TAT, for a cost per share of $1.37. Bargain hunters tend to pay particular attention to insider buys like this one, because presumably the only reason an insider would take their hard-earned cash and use it to buy stock of their company in the open market, is that they expect to make money.

About TAT –

TransAtlantic Petroleum Ltd.

Akmerkez B Blok Kat 5-6

Nispetiye Caddesi 34330 Etiler

Istanbul,

Turkey - Map

Phone: 90 212 317 25 00

Website: http://www.transatlanticpetroleum.com

Investor RelationsTransAtlantic Petroleum Ltd.

5910 N. Central Expwy | Suite 1755

Dallas, TX 75206

1-214-265-4794

Fax: 1-214-265-4711

investorrelations@tapcor.com

Share Related

Market Cap (Total, All Common Classes) (Mil) 501.05

Shares Outstanding (Total, All Classes) (Mil) 365.73

Shares Outstanding, Average (FY) (Mil) 312.49

Float (Mil) 211.47

Annotated chart by ‘I am Legend’ - Annotate chart cup and handle formation

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=69562770

Business Summary

Transatlantic Petroleum Ltd., an integrated international oil and gas company, engages in the acquisition, exploration, development, and production of oil and natural gas. It holds interests in developed and undeveloped oil and gas properties in the United States, Turkey, Bulgaria, and Romania; and provides oilfield and drilling services to third parties in Turkey and Iraq. The company held interests in 56 onshore exploration licenses and 3 onshore production leases covering a total of approximately 6.4 million gross acres in Turkey; and owned interests in 2 onshore exploration permits in Bulgaria, and 1 onshore production license in Romania. Transatlantic Petroleum Ltd. also acquired interests in 3 projects in the San Joaquin Valley in central California; leased 2 properties in Dewey McClain Counties in Oklahoma; and owned a 20% non-operated working interest in a well on the Dewey County. As of June 30, 2011, it owned 11 drilling rigs and 5 workover and completion rigs in Turkey; and managed 1 drilling rig each in Iraq and Turkey. The company was founded in 1985 and is based in Istanbul, Turkey

Southwest IDEAS Investor Conference Presentation

http://media.corporate-ir.net/media_files/irol/15/153906/TATSWIDEASConference.pdf

History

TransAtlantic Petroleum Corp. was incorporated in 1985 under the laws of British Columbia and changed domicile to Alberta in 1997.

In 1992, The Company acquired a 30% interest in OML 109, a 215,000-acre concession located offshore Nigeria. TransAtlantic successfully drilled a discovery well in 1994 and an appraisal well in 1995 in the Ejulebe field on OML 109, and contracted with a service provider to develop the field. Production began in September 1998, and the Ejulebe field produced approximately 11 million barrels of crude oil as of December 2005. Following its participation in OML 109, TransAtlantic drilled several exploration wells offshore from Benin and onshore in Tunisia. Additionally, TransAtlantic attempted to exploit two onshore Egyptian oil and gas exploration blocks.

During 2005, 2006 and 2007, the Company focused on acquiring high-impact international properties, evaluating and acquiring lower-risk cash flow opportunities in the United States and disposing of its Nigerian property, which was sold in 2005. During 2005 and 2006, TransAtlantic acquired an exploration permit and a reconnaissance license in Morocco, three production blocks in Romania, three exploration licenses in Turkey, and two promote round licenses covering six blocks in the UK North Sea. During this same period, the Company acquired properties in Texas. TransAtlantic also participated as a non-operator in four other properties in Texas, Oklahoma, and Louisiana.

In 2007, the Company determined to exit its U.S. operations and focus on the development of its international properties. To that end, TransAtlantic acquired three additional exploration licenses in Turkey, converted a portion of its Moroccan reconnaissance license into two exploration permits, sold the Texas properties it operated, and offered its remaining non-operated U.S. properties for sale.

Management Malone Mitchell - Chairman and Chief Executive Officer

From 1985-2006, Malone built Riata Energy into one of the largest privately held energy companies in the United States. In 2006, he sold controlling stake in Riata Energy. Later, Riata Energy was renamed SandRidge Energy (NYSE:SD). Near the time of sale, SandRidge Energy had 1 Tcf in proved reserves, 300 miles of gas-gathering pipeline, greater than 34,000 horsepower of gas compression, and owned or operated 43 drilling rigs.

Shortly after stepping down from SandRidge, Malone founded Mitchell Group. Mitchell Group includes Riata Management and Private Energy, Oilfield Service, Investment, and Consumer Business in North America, South America, and Asia.

Malone is CEO of TransAtlantic and spends a considerable portion of his time in country (Turkey, Morocco, Bulgaria and Romania).

Malone graduated from Oklahoma State University in 1983 with a Bachelor of Science degree.

Who is TransAtlantic's largest investor?

Mr. Malone Mitchell 3rd, the Company's Chairman, and various affiliates (collectively "Mitchell Group"). Mitchell Group owns over 50% of TransAtlantic Petroleum Ltd.

With more than 25 years in the business, Malone Mitchell, chairman of TransAtlantic Petroleum Corp., has not only endured but also prospered through seven downturns, turning assets he bought in the 1998 down cycle into billions. His secret? A dynamic business plan. In an industry that provides constant, if changing opportunities, a business plan that adapts along with the market—every three to five years—makes for a great business, according to Malone. In this exclusive interview with The Energy Report, he discusses the business service modifications that enabled TransAtlantic to corner some select foreign markets, likens operating in Morocco and Turkey to operating in Texas, defines what he calls a ‘friendly hostile bid’ and explains why he’s been waiting 23 years for this situation.

http://www.forbes.com/pictures/ekge45ll/malone-mitchell

Business

TransAtlantic purchased Longe Energy Limited ("Longe") in December 2008. Longe was the owner-operator of four drilling rigs and an oilfield services business. After the acquisition, Longe was renamed Viking International Limited

Viking Drilling, LLC http://www.viking-drilling.com/

The acquisition of drilling rigs and service equipment expanded TransAtlantic's opportunity to increase acreage in Turkey and Morocco. Because the availability of drilling rigs and service equipment is limited in Turkey and Morocco,the company believes third parties may seek out TransAtlantic to participate in their licenses on terms favorable to the Company. TransAtlantic believes many of these opportunities would not exist if it did not own its own drilling rigs and service equipment. With the acquisition of Incremental Petroleum in March 2009, TransAtlantic expanded its rig fleet from four to seven.

TransAtlantic's modern fleet of drilling rigs serve as a catalyst for the company's growth. By controlling a drilling fleet, the company can develop its existing reserves and explore for new reserves. This provides TransAtlantic with a competitive advantage, especially when the supply of rigs is scarce in Turkey and Morocco.

Welcome to Riata Management Mission: Riata Management, LLC seeks to operate via traditional private equity investments in companies whose management i) has strong experience in their industry, ii) are personally invested in their company, and iii) demonstrate an ability to create and deliver above-market returns to our investors.

He founded Riata Energy (now SandRidge Energy) in 1985. He served as Operations Manager at Riata Energy until 1989 when he assumed the role of Chief Executive Officer and Chairman, which he held until June 2006. During this period, Riata grew from $500 to become one of the largest privately held energy companies and the largest privately held land driller in the US and had significant midstream and tertiary oil production operations.

LATEST NEWS:

TransAtlantic Petroleum Ltd. Provides Update on Operations at Selmo Field

HAMILTON, BERMUDA, Nov 28, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) today provides a comment from N. Malone Mitchell, 3rd, the Company's chairman and chief executive officer, regarding the Company's operations at Selmo field in southeastern Turkey.

Mr. Mitchell said:

Despite the tragic events that transpired last week, TransAtlantic expects to proceed with its existing strategy at Selmo field. We appreciate the tremendous grief experienced by the friends and families of the victims and are working with the authorities to finish their investigations. We trust them to take the actions necessary to bring those responsible to justice. Senior government ministers have assured us they will act and we take them at their word.

To say that "ordinary operations have resumed" is disrespectful both to the families of those who died and to those that continue to operate in the field. However, our brave and hardworking operations team resumed production operations on Thursday and have returned the field to recent production levels. TransAtlantic is increasing and changing its security strategy for our field operations to continue to provide our employees and contractors with the protection that they deserve while realizing that it is always hard to anticipate and defend premeditated intent to do violence.

TransAtlantic Petroleum Ltd. Reports Incident at Selmo Field HAMILTON, BERMUDA, Nov 23, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) reports that today at approximately 10:30 pm (local time) one or more armed individual(s) attacked workers at the Company's Selmo field operations in southeastern Turkey. TransAtlantic is sorry to report that three workers were killed in the incident, which at this time appears to be an isolated event. The Company is working with local authorities to investigate the incident and provide additional security for our operations in the vicinity.

TransAtlantic mourns the loss of our fellow employee and contractors. We express our deepest sympathies to their family members and friends.

TransAtlantic Petroleum Ltd. Announces Third Quarter 2011 Earnings and Operations Update

HAMILTON, BERMUDA, Nov 09, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) is pleased to announce results for the quarter ended September 30, 2011 and provide an operations update.

Selected 3Q11 Highlights

-- Daily average sales in the third quarter of 2011 increased 74% over the same period in 2010 and 25% over the second quarter of 2011;

-- Third quarter 2011 adjusted EBITDAX from continuing operations totaled $20.3 million (EBITDAX is a non-GAAP measure and is defined and reconciled later in this press release);

-- Year-end 2011 production target reiterated at 7,000-7,500 boe per day;

-- Executed a farm out agreement with LNG Energy covering a portion of TransAtlantic's leasehold in Bulgaria and commenced drilling our first test of the Etropole shale;

-- TransAtlantic announced its intent to sell its oilfield services business, the engagement of PPHB as its financial advisor, and the extension of the maturity date of the Dalea credit agreement.

TransAtlantic Petroleum Ltd. Announces Agreement With LNG Energy and Commencement of Etropole Test Well in Bulgaria

HAMILTON, BERMUDA, Sep 22, 2011 (MARKETWIRE via COMTEX) --

TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE Amex: TAT) is pleased to announce that it has entered into an agreement with LNG Energy Ltd. ("LNG") (TSX-V: LNG) pursuant to which LNG will invest $7.5 million USD to immediately commence drilling a 10,500 foot (approximately 3,200 meter) exploration well on the A-Lovech exploration license in Bulgaria. The objective of the well will be to core and test the unconventional Etropole formation. The agreement, between LNG and the Company's wholly owned subsidiary, TransAtlantic Worldwide, Ltd. ("Worldwide"), provides that LNG will invest $7.5 million USD which will be used by Worldwide's subsidiary and operator of the well, Direct Petroleum Bulgaria EOOD ("Direct Bulgaria"), to commence drilling the Peshtene R-11 well this week.

"With its participation in a number of licenses in the shale play in Poland, LNG brings hands-on experience to the exploration of the Etropole formation for natural gas. The drilling of an Etropole test well will increase our technical understanding of the play and is the first step in our effort to unlock the long-term potential in the Etropole," said Gary Mize, the Company's President.

The A-Lovech exploration license, which is 100% owned and operated by Direct Bulgaria, covers an area of approximately 565,000 acres (2,288 square kilometers) in northwestern Bulgaria, all of which is prospective for the Etropole formation. This agreement with LNG covers the southern portion of the A-Lovech exploration license, an area of approximately 405,000 acres (1,640 square kilometers). Direct Bulgaria will file an application for a production concession over this southern portion of the A-Lovech license (the "Etropole Concession") later this fall; the results of the Peshtene R-11 well will be used in support of the application.

Subject to various conditions, including the issuance of the Etropole Concession by the government of Bulgaria, LNG will fund up to an additional $12.5 million, of which $7.5 million will be used to drill a second well or for other exploration activities on the Etropole Concession. In return, and subject to approval by the government of Bulgaria, LNG will form a Bulgarian subsidiary to acquire a 50% working interest in the Etropole Concession. In the event certain conditions, including the issuance of the Etropole Concession, are not satisfied, then LNG would have no further obligations under the agreement.

N. Malone Mitchell, 3rd, TransAtlantic's Chairman and Chief Executive Officer, stated, "We have been encouraged by natural gas shows in the Etropole formation in a number of wells drilled in the vicinity of the planned Peshtene R-11, including one well that tested gas from the Etropole formation. We are excited to partner with LNG to accelerate our campaign to target and exploit the natural gas potential of the unconventional Etropole formation. Should the Etropole prove productive, this location lies less than 10 km from existing pipeline infrastructure, and production will benefit from regional natural gas prices that are currently around $10/Mcf."

With respect to the balance of the A-Lovech exploration license, Direct Bulgaria has already applied for a production concession over the northern 160,000 acres (648 square kilometers) called the "Koynare Area"; the Koynare Area contains a conventional gas discovery in the Jurassic-aged Orzirovo formation and is also prospective for the Etropole. The discovery well, the Deventci R-1, is currently producing approximately 250 thousand cubic feet per day on a limited test basis, which is processed in a compressed natural gas facility adjacent to the well. The Company plans to appraise this discovery by drilling a second well, the Deventci R-2, in November 2011. The Company is also seeking a partner to participate with it in developing the Koynare Area and has retained FirstEnergy Capital as its exclusive advisor to assist in that search.

LNG Energy Ltd. has entered into an exclusive term sheet with TransAtlantic Worldwide Ltd., a wholly owned subsidiary of TransAtlantic Petroleum Ltd. (TSX: TNP)(NYSE-AMEX:TAT) ("TransAtlantic") to earn a 50% interest in a future gas shale formation production concession in northwest Bulgaria (the "Transaction").

Bag This Bargain Energy Stock Even Cheaper Than The CEO Did

By FORBES

http://www.forbes.com/sites/energystockchannel/2011/11/22/bag-this-bargain-energy-stock-even-cheaper-than-the-ceo-did/

There’s an old saying on Wall Street about insider buying: there are many possible reasons to sell a stock, but only one reason to buy. Back on November 17, TransAtlantic Petroleum Ltd’s Chief Executive Officer, Noah Malone Mitchell III, invested $502,826.02 into 368,338 shares of TAT, for a cost per share of $1.37. Bargain hunters tend to pay particular attention to insider buys like this one, because presumably the only reason an insider would take their hard-earned cash and use it to buy stock of their company in the open market, is that they expect to make money.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.