Friday, July 29, 2011 2:52:39 PM

by: Erik Gholtoghian July 29, 2011

http://seekingalpha.com/article/283161-the-dryships-oceanfreight-buyout-has-a-few-wrinkles

Just when most people started thinking George Economou wanted totally out of the dry bulk sector, after he had diversified into the drilling and tanker segments and just after he had announced that he had sold four dry bulk ships for $75.5 million a few days ago, now he goes and acquires 11 dry bulk ships and one tanker for $118 million and by acquiring $182 million in liabilities.

Given his prior moves out of drybulk, it was surprising to me that this offer was made, and if examined carefully, the price paid seems slightly out of line with market values, although not dramatically. For example, Economou just sold four ships for approximately $19 million each, and now he is buying 12 nearly identical but newer ships at approximately $25 million each. The ships sold averaged being built in 1997, while the ships acquired in the merger averaged being built in 2006. The other difference is some of the ships picked up in the merger do come with charters at above market prices. But is it worth paying $72 million to get those charters and to update the fleet when there are no signs of a drybulk recovery anytime soon?

This may seem like nitpicking, but Economou has a well deserved reputation for self dealing. In fact, the DryShips annual reports and SEC filings are filled with information which put investors on notice that Mr. Economou makes deals between his personal companies and his publicly traded counterpart (DRYS). An excerpt from page 111 of the 2010 annual report follows:

"B. Related Party Transactions

Agreements with Cardiff, TMS Bulkers and TMS Tankers

Mr. George Economou, our Chairman and Chief Executive Officer, controls the Foundation, a Liechtenstein foundation that owns 70.0% of the issued and outstanding capital stock of Cardiff, TMS Bulkers and TMS Tankers. The other shareholder of Cardiff, TMS Bulkers and TMS Tankers is Prestige Finance S.A., a Liberian corporation, all of the issued and outstanding capital stock of which is

beneficially owned by Mr. Economou’s sister, Ms. Chryssoula Kandylidis, who serves on our board of directors."

Management Agreements – Drybulk Vessels We outsource all of our technical and commercial functions relating to the operation and employment of our drybulk carrier

vessels to TMS Bulkers pursuant to management agreements effective January 1, 2011. Prior to January 1, 2011, Cardiff, a company affiliated with our Chairman and Chief Executive Officer, Mr. George Economou, served as our technical and commercial manager pursuant to separate management agreements with each of our drybulk vessel-owning subsidiaries. Effective January 1, 2011, we entered into new management agreements that replaced our management agreements with Cardiff, on the same terms as our management agreements with Cardiff, with TMS Bulkers, a related party, as a result of an internal restructuring of Cardiff for the purpose of enhancing its efficiency and the quality of its ship-management services.

In sum, this quote shows that the CEO of DryShips owns most of a privately held company called Cardiff which regularly does business with DryShips, and that the other owner is Economou's sister. Additionally, several years ago, DryShips bought options from Cardiff which cost tens of millions of dollars which ended up expiring. Can you imagine buying an option from yourself? More details can easily be found in the annual reports themselves if more evidence is sought. Using all of this background about Economou should make one suspicious of every deal he is involved with from the start. And as it turns out, this latest deal is no different. OceanFreight's (OCNFD) CEO is none other than George Economou's nephew, which is even printed at the OCNFD company website.

So in sum, what we have in this deal is an uncle buying a company headed by his nephew for an approximate 230% above the market price of the shares, which incidentally were recently delisted from the Nasdaq (OCNF) and are now trading with a new ticker symbol (OCNFD).

(EDITED note by Eastunder: Was not delisted so author is incorrect there: OceanFreight Inc. Regains Compliance With NASDAQ Minimum Bid Price Requirement on 4:05 pm ET 07/21/2011 - Marketwire)

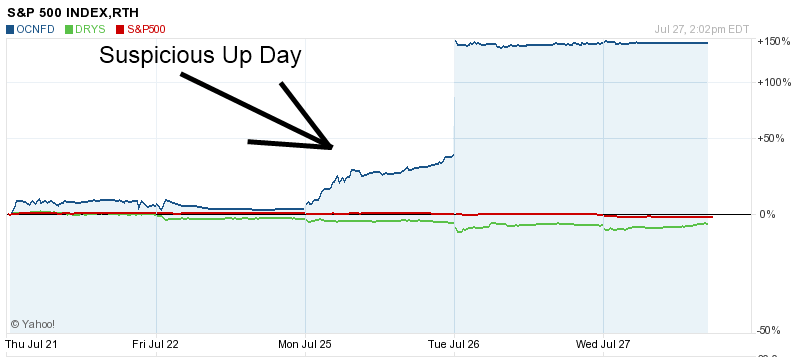

If this were not enough to raise some doubts about the deal, OCNFD exhibited some extremely unusual trading the day before the buyout announcement was made. If you look below, the picture shows that OCNFD was up 40% the day before the announcement, even as the S&P500 and DryShips were both down. The shipping rates index (BDI) was also down that day. It certainly appears that news of the buyout was leaked and insider trading took place. Statistical testing and modeling demonstrates this behavior to be HIGHLY unusual. What other explanation is there?

CONCLUSION:

I think it would be great if the SEC investigated this buyout and stopped the entire deal. This would stop George Economou from self-dealing with family members for once, which I feel is unethical and should be illegal. It would also stop DryShips from overpaying for ships which are nearly identical to those which DryShips already had only a week ago but disposed of. This would also punish any traders that may have traded on inside information the day before the news of the buyout went public.

I must add that the self dealing amongst family members actually appears to be legal, and Economou is not hiding his dealings at all. He just isn't advertising it on the front page of the New York Times.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

"I am extraordinarily patient, provided I get my own way in the end."

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.