May 4, 2011 3:30 PM EDT

Mexico ramps up gold reserves at dollar's expense

Mexico massively ramped up its gold reserves in the first quarter

of this year, buying over $4 billion of bullion as emerging

economies move away from the ailing U.S. dollar,

which has dipped to 2-1/2-year lows.

The third biggest one-off purchase of gold by any country over

the past decade took Mexico's reserves to 100.15 tonnes --

or 3.22 million ounces --

by the end of March from just 6.84 tonnes at the end of January,

according to the International Monetary Fund and

Mexico's central bank.

Gold has gained 11 percent this year, driven by concern over

euro zone debt and the violence in the Arab world, as well as

by the U.S. dollar's 7.6 percent decline against a basket

of currencies.

Sergio Martin, chief economist for HSBC in Mexico, said the

government probably saw gold as a highly liquid asset that

would reduce exposure to the falling greenback.

"They're probably thinking that getting out of dollars

and into gold makes sense because we know that the dollar

has some trend to depreciate in the near future at least,"

said Martin. "I don't think they're going to lose money

with this."

Mexico's foreign currency and asset reserves hit a record $128

billion in April, making the gold purchased mostly in February

and March worth nearly 4 percent of that total.

Mexican central bank data on gold holdings only exists

through March.

The central bank did not respond to a request for comment.

According to the International Monetary Fund, Latin America's

No. 2 economy now owns $4.93 billion worth of gold, which hit

a record $1,575.79 an ounce on Monday.

Other emerging economies such as China, Russia and India have

also beefed up bullion reserves over the past few years.

SILVER LINING?

Credit Suisse precious metals analyst Tom Kendall said it was

worthy of note that Mexico, whose economy is very closely

tied to the United States, had taken this step.

"The size (of the purchase) is certainly pretty chunky to have

been accomplished in that space of time.

So it certainly gives another sizable layer of support to gold's

position in the international reserves system," he added.

George Milling-Stanley, managing director of government affairs

at the World Gold Council industry group, said Mexico was

following a recent trend among central banks to restore a

"prior balance between gold and currency reserves."

"This is further supported by the fact that the May IMF numbers

show continued buying by Russia and Thailand of 18.8 tonnes

and 9.3 tonnes respectively," he added.

Mexico's reserves rank it 33rd among the top official holders

of gold.

The United States is the largest official holder of gold,

with 8,133 tonnes, which account for 73.8 percent of its

total international reserves.

China is the sixth largest holder of gold, with 1,054.1 tonnes,

or just 1.6 percent of total reserves, while eighth-ranked

Russia now has some 811 tonnes of gold, up from 788.78 in

January, according to the IMF data.

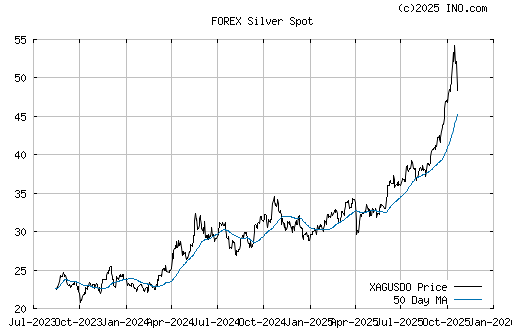

Silver, which hit a record price earlier this year, may also

have been on Mexico's buying list, said Martin at HSBC.

"I think Mexico has moved from second to first place in the list

of global silver producers, so they may have been buying silver

to help the price," he added.

http://m.ibtimes.com/mexico-ramps-up-gold-reserves-at-dollar-s-expense-141334.html

Adam vs The man interviews Gerald Celent

http://geraldcelente-blog.blogspot.com/

The 0-administ. through their contacts on Wall Street have them

calling big commodity houses and telling them to get rid of

their silver positions so that Morgan can cover and that's what

this is all about right now, great opportunity to buy..." says

Bob Chapman of The International Forecaster

http://bobchapman.blogspot.com/2011/05/bob-chapman-great-opportunity-to-buy.html

Of course, we knew that, but Bob's comments implicate the

0-administ. (well-known that we have been taken over by

Wall Street - revolving door).

Silver = Kesef = Money =

well, Silver also means Money in my Hebrew

well, the REAL MONEY since 1000s of years -

= the more manipulation = the higher Ag will FLY =

history of LT bankster Ag=Kesef=Money manipulations =

for banksters to take Kesef from the People -

give nickel/copper to the slave to keep them slaves -

= well, old timers said fiat$1000 in our Ag=Kesef Money =

= well, be Safety LT for our Family

http://maxkeiser.com/

= well, told you since the turn around $2,55 =

= well, the LT Ag-Keseftrain GOING UP =

= well, get OFF the fence =

= well, join GPR / GPL the Jer-USA-lem Ag Kesefride =

= well, the faster the better LT FOS

God Bless

FEATURED ZenaTech, Inc. (NASDAQ: ZENA) First US Trial of IQ Nano Drone for Inventory Management • Oct 15, 2024 8:21 AM

Kona Gold Beverages, Inc. Announces Strategic Progress and Corporate Evolution • KGKG • Oct 15, 2024 9:00 AM

One World Products Secures First Order for Hemp-Based Reusable Containers, Pioneers Renewable Materials for the Automotive Industry • OWPC • Oct 15, 2024 8:35 AM

CBD Life Sciences, Inc. Announces Strategic MOU with U.S. Armed Forces for Groundbreaking Mushroom Supplement • CBDL • Oct 15, 2024 8:00 AM

HealthLynked Files Non-Provisional Patent for AI-Powered Healthcare Assistant, ARi • HLYK • Oct 15, 2024 8:00 AM

ZenaTech, Inc. (NASDAQ: ZENA) Launchs IQ Nano Drone for Commercial Indoor Use • HALO • Oct 10, 2024 8:09 AM