Saturday, September 18, 2010 12:15:19 PM

DTC Service Guide

Security Eligibility (Page 29)

DTC-Eligible Securities

DTC accepts deposits of all issues of securities eligible to trade and settle at a U. S. depository. If the security you wish to deposit has a CUSIP number, as do all securities or families of securities issued after 1970, it is probably DTC-eligible. If the security is not DTC-eligible, a message to that effect will appear on your PTS screen when you enter the CUSIP number when making a DAM deposit.

You can also check DTC eligibility by reviewing any of the following sources:

• The DTC Reference Directory, a hard-copy listing of eligible securities that is printed quarterly and can be ordered by using the PTS function FORM

• DTC Important Notices, which you can access on our Web site, https://login.dtcc.com/dtcorg

• The PTS function GWIZ.

DTC's Custody service was established to allow participants to deposit securities that were previously ineligible for depository services because of registration requirements and other restrictions. For more information on custody, please refer to the Custody Service Guide.

DTC's Underwriting service reviews eligibility requests from participants and other industry sources for corporate and municipal securities previously distributed outside the depository. For more information, refer to the Older Issue Eligibility section of the Underwriting Service Guide.

Eligible Securities Status

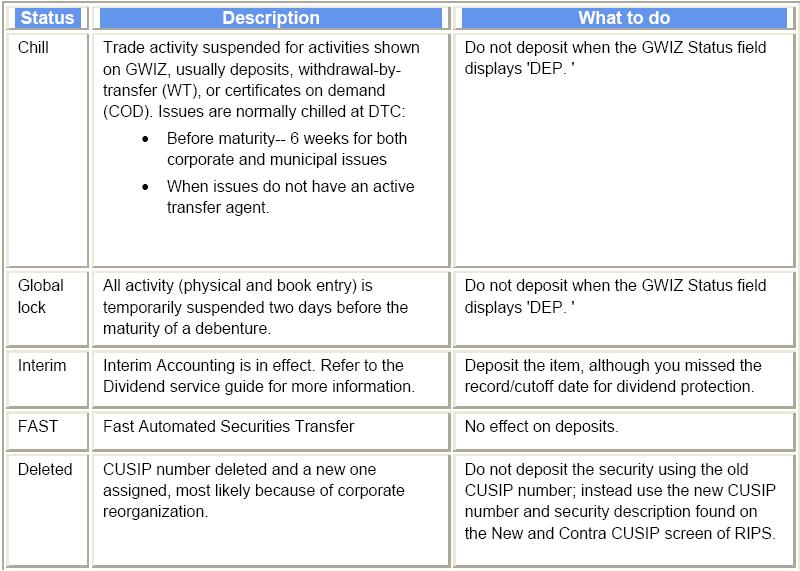

Corporate actions or temporary service problems with a transfer agent may affect deposits of DTC-eligible securities. During these periods, DTC places securities under one of the status categories in the table and descriptions that follow. You can use the PTS functions GWIZ and RIPS to determine the reasons and deadlines for these events.

-----------------

REVISED -- RULE FILING SR-NSCC-2010-02—AGGREGATION OF TRADE-FOR-TRADE TRANSACTIONS

Date: March 4, 2010

From: GENERAL COUNSEL’S OFFICE

On March 4, 2010, National Securities Clearing Corporation (“NSCC”) filed a rule change (SR-NSCC-2010-02) with the Securities and Exchange Commission (the “SEC”) pursuant to Section

19(b)(3)(A) of the Securities Exchange Act of 1934, as amended.

As more fully described below, the rule change provides for the aggregation of receive and deliver orders for transactions that NSCC designates to settle on a trade-for-trade basis.

When transactions in a particular security are designated to settle on a trade-for-trade basis, Members with transactions in that security may be required to individually settle multiple transactions in that security.

In order to simplify this process and mitigate the processing burden on Members, effective Friday, March 5, 2010, NSCC will amend its Rules in order that it may aggregate trade-for-trade obligations, bi-laterally between counterparties, so that the parties would be required to settle just one receive order and one deliver order between them in a given security rather than having to settle multiple transactions.

Buys and sells will not be netted against each other. For example, if Broker A had fifteen buys against Broker B in Security X, these items would be aggregated into one receive obligation for A and one deliver obligation for B for the total amount of shares for the 15 transactions in Security X. Likewise if Broker A had 20 sells with Broker B on that same day for the same security, those items would also be aggregated into one deliver obligation for A and one receive obligation for B. In this example, A and B would each have two settlement obligations with the other for Security X rather than the 35 obligations they would each have without aggregation.

NSCC will issue aggregated receive and deliver orders only for those transactions that it designates to settle on a trade-for-trade basis. Receive and deliver orders for transactions designated by Members as Special Trades will continue to be issued on an individual transaction basis. As is currently the case for trade-for-trade items, NSCC will not guaranty the settlement of transactions aggregated pursuant to this rule change.

The rule change will be implemented for obligations reported on the Consolidated Trade Summary beginning on the night of Friday, March 5, 2010, for transactions settling Monday, March 8 and Tuesday, March 9, 2010.

The full text of this rule change (SR-NSCC-2010-02) may be obtained by visiting DTCC’s website at

www.dtcc.com.

Written comments on the proposed rule filing may be addressed to Lisa T. Siebold, Assistant Secretary, National Securities Clearing Corporation, 55 Water Street, New York, New York 10041, and your comments will be forwarded to the SEC. You may also address your written comments to the Secretary of the Commission, Securities and Exchange Commission, 100 F Street NE, Washington DC 20549-1090. We request that you provide NSCC with a copy of your comments.

Questions regarding this Important Notice should be directed to Vincent Mc Devitt, Director, Product Management, at 212-855-5694, or Peter J. Smith, Product Management, at 212-855-7621. Questions regarding the rule filing should be directed to John Petrofsky, Associate Counsel, at 212-855-7634.

http://www.dtcc.com/downloads/products/learning/Deposits.pdf

=====================

#: Z0025

Date: March 10, 2010

To: ALL DTC & NSCC PARTICIPANTS

Attention: MANAGING PARTNER/OFFICER, OPERATIONS PARTNER/OFFICER, COMPLIANCE OFFICER

From: Relationship Management

Subject: Informational Update on DTC and NSCC Securities Restrictions

DTCC has experienced an increase in the number of customer queries regarding transaction restrictions, generally referred to as “chills” that DTC places on a relatively small number of eligible securities. Occasionally, DTC may need to “chill” certain transactions such as deposits, withdrawals-by-transfers (WTs), deliver orders (DOs) or restrict all these services (commonly referred to as a “global lock”) for operational, risk management or regulatory and compliance reasons. These restrictions may have an impact on Continuous Net Settlement (CNS) eligibility. DTCC recognizes that these actions may create additional operational processing among the member firms and between participants and their customers. The purpose of this notice is to clarify some of the conditions that may cause DTCC to take such action and to communicate DTCC’s intentions to reduce the additional operational processing these necessary actions may cause.

DTC applies certain transaction restrictions in the normal course of processing. For instance, DTC chills physical deposits and WTs for Book-Entry Only (BEO) securities. DTC may need to temporarily chill physical WTs if notified by the transfer agent that it is temporarily out of blank certificates. If DTC learns that the issuer no longer has a designated transfer agent (i.e., the security is non-transferable), DTC will chill WT transactions. At times, non-transferable issues may have certain deposit restrictions as well; only participants subscribing to DTC’s “non-transferable” programs may avail themselves of these services if an issue is designated non-transferable.

During certain reorganizations, redemptions and maturities, DTC will chill the security for book entry activities to ‘close the books’ with the transfer agent in order to stabilize positions while the event is occurring. This may cause NSCC to exit the security from CNS eligibility. In a limited number of cases where a Money Market Instruments (MMI) issuer defaults, all MMI securities associated with the issuer are chilled for all future MMI issuances and maturities.

DTC will place certain restrictions on Limited Eligibility securities, which are not freely transferable or otherwise not eligible for the full range of DTC services. (Participants must subscribe to DTC’s Custody program in order to avail themselves of Custody services.) In addition, Participants can only transact book entry deliveries with certain Canadian securities which are not registered with the SEC, but are part of the DTC Canadian Dollar Settlement Service.

From a legal and regulatory perspective, securities that are subject to sanctions imposed by the Office of Foreign Assets Control (OFAC), for example Cuban Bonds are globally locked.

Restrictions may also be placed on securities in situations where DTC has been informed by the issuer or its agent, regulators or law enforcement, or has other compliance concerns that its Cede & Co certificate inventory has been compromised due to unauthorized, altered, fraudulent or counterfeit share issuance. If DTC reasonably suspects that all or a portion of its street name holdings are not fungible and freely transferable, it may decide to chill one or more of its services as it deems appropriate.

To assist the industry in alleviating additional operational processing, NSCC has implemented an additional service as of March 5, 2010 that will aggregate non-CNS eligible trade-for-trade obligations, bi-laterally between counterparties. Counterparties will now be required to settle just one receive order and one deliver order in a given security rather than having to settle multiple transactions. As is currently the case with all trade-for-trade obligations, these items are not guaranteed by NSCC. For more information regarding this service please refer to NSCC Important Notice #6958.

Please contact your DTCC relationship manager if you have any further questions regarding this notice.

http://www.dtcc.com/downloads/legal/imp_notices/2010/dtcc/z0025.pdf

Security Eligibility (Page 29)

DTC-Eligible Securities

DTC accepts deposits of all issues of securities eligible to trade and settle at a U. S. depository. If the security you wish to deposit has a CUSIP number, as do all securities or families of securities issued after 1970, it is probably DTC-eligible. If the security is not DTC-eligible, a message to that effect will appear on your PTS screen when you enter the CUSIP number when making a DAM deposit.

You can also check DTC eligibility by reviewing any of the following sources:

• The DTC Reference Directory, a hard-copy listing of eligible securities that is printed quarterly and can be ordered by using the PTS function FORM

• DTC Important Notices, which you can access on our Web site, https://login.dtcc.com/dtcorg

• The PTS function GWIZ.

DTC's Custody service was established to allow participants to deposit securities that were previously ineligible for depository services because of registration requirements and other restrictions. For more information on custody, please refer to the Custody Service Guide.

DTC's Underwriting service reviews eligibility requests from participants and other industry sources for corporate and municipal securities previously distributed outside the depository. For more information, refer to the Older Issue Eligibility section of the Underwriting Service Guide.

Eligible Securities Status

Corporate actions or temporary service problems with a transfer agent may affect deposits of DTC-eligible securities. During these periods, DTC places securities under one of the status categories in the table and descriptions that follow. You can use the PTS functions GWIZ and RIPS to determine the reasons and deadlines for these events.

-----------------

REVISED -- RULE FILING SR-NSCC-2010-02—AGGREGATION OF TRADE-FOR-TRADE TRANSACTIONS

Date: March 4, 2010

From: GENERAL COUNSEL’S OFFICE

On March 4, 2010, National Securities Clearing Corporation (“NSCC”) filed a rule change (SR-NSCC-2010-02) with the Securities and Exchange Commission (the “SEC”) pursuant to Section

19(b)(3)(A) of the Securities Exchange Act of 1934, as amended.

As more fully described below, the rule change provides for the aggregation of receive and deliver orders for transactions that NSCC designates to settle on a trade-for-trade basis.

When transactions in a particular security are designated to settle on a trade-for-trade basis, Members with transactions in that security may be required to individually settle multiple transactions in that security.

In order to simplify this process and mitigate the processing burden on Members, effective Friday, March 5, 2010, NSCC will amend its Rules in order that it may aggregate trade-for-trade obligations, bi-laterally between counterparties, so that the parties would be required to settle just one receive order and one deliver order between them in a given security rather than having to settle multiple transactions.

Buys and sells will not be netted against each other. For example, if Broker A had fifteen buys against Broker B in Security X, these items would be aggregated into one receive obligation for A and one deliver obligation for B for the total amount of shares for the 15 transactions in Security X. Likewise if Broker A had 20 sells with Broker B on that same day for the same security, those items would also be aggregated into one deliver obligation for A and one receive obligation for B. In this example, A and B would each have two settlement obligations with the other for Security X rather than the 35 obligations they would each have without aggregation.

NSCC will issue aggregated receive and deliver orders only for those transactions that it designates to settle on a trade-for-trade basis. Receive and deliver orders for transactions designated by Members as Special Trades will continue to be issued on an individual transaction basis. As is currently the case for trade-for-trade items, NSCC will not guaranty the settlement of transactions aggregated pursuant to this rule change.

The rule change will be implemented for obligations reported on the Consolidated Trade Summary beginning on the night of Friday, March 5, 2010, for transactions settling Monday, March 8 and Tuesday, March 9, 2010.

The full text of this rule change (SR-NSCC-2010-02) may be obtained by visiting DTCC’s website at

www.dtcc.com.

Written comments on the proposed rule filing may be addressed to Lisa T. Siebold, Assistant Secretary, National Securities Clearing Corporation, 55 Water Street, New York, New York 10041, and your comments will be forwarded to the SEC. You may also address your written comments to the Secretary of the Commission, Securities and Exchange Commission, 100 F Street NE, Washington DC 20549-1090. We request that you provide NSCC with a copy of your comments.

Questions regarding this Important Notice should be directed to Vincent Mc Devitt, Director, Product Management, at 212-855-5694, or Peter J. Smith, Product Management, at 212-855-7621. Questions regarding the rule filing should be directed to John Petrofsky, Associate Counsel, at 212-855-7634.

http://www.dtcc.com/downloads/products/learning/Deposits.pdf

=====================

#: Z0025

Date: March 10, 2010

To: ALL DTC & NSCC PARTICIPANTS

Attention: MANAGING PARTNER/OFFICER, OPERATIONS PARTNER/OFFICER, COMPLIANCE OFFICER

From: Relationship Management

Subject: Informational Update on DTC and NSCC Securities Restrictions

DTCC has experienced an increase in the number of customer queries regarding transaction restrictions, generally referred to as “chills” that DTC places on a relatively small number of eligible securities. Occasionally, DTC may need to “chill” certain transactions such as deposits, withdrawals-by-transfers (WTs), deliver orders (DOs) or restrict all these services (commonly referred to as a “global lock”) for operational, risk management or regulatory and compliance reasons. These restrictions may have an impact on Continuous Net Settlement (CNS) eligibility. DTCC recognizes that these actions may create additional operational processing among the member firms and between participants and their customers. The purpose of this notice is to clarify some of the conditions that may cause DTCC to take such action and to communicate DTCC’s intentions to reduce the additional operational processing these necessary actions may cause.

DTC applies certain transaction restrictions in the normal course of processing. For instance, DTC chills physical deposits and WTs for Book-Entry Only (BEO) securities. DTC may need to temporarily chill physical WTs if notified by the transfer agent that it is temporarily out of blank certificates. If DTC learns that the issuer no longer has a designated transfer agent (i.e., the security is non-transferable), DTC will chill WT transactions. At times, non-transferable issues may have certain deposit restrictions as well; only participants subscribing to DTC’s “non-transferable” programs may avail themselves of these services if an issue is designated non-transferable.

During certain reorganizations, redemptions and maturities, DTC will chill the security for book entry activities to ‘close the books’ with the transfer agent in order to stabilize positions while the event is occurring. This may cause NSCC to exit the security from CNS eligibility. In a limited number of cases where a Money Market Instruments (MMI) issuer defaults, all MMI securities associated with the issuer are chilled for all future MMI issuances and maturities.

DTC will place certain restrictions on Limited Eligibility securities, which are not freely transferable or otherwise not eligible for the full range of DTC services. (Participants must subscribe to DTC’s Custody program in order to avail themselves of Custody services.) In addition, Participants can only transact book entry deliveries with certain Canadian securities which are not registered with the SEC, but are part of the DTC Canadian Dollar Settlement Service.

From a legal and regulatory perspective, securities that are subject to sanctions imposed by the Office of Foreign Assets Control (OFAC), for example Cuban Bonds are globally locked.

Restrictions may also be placed on securities in situations where DTC has been informed by the issuer or its agent, regulators or law enforcement, or has other compliance concerns that its Cede & Co certificate inventory has been compromised due to unauthorized, altered, fraudulent or counterfeit share issuance. If DTC reasonably suspects that all or a portion of its street name holdings are not fungible and freely transferable, it may decide to chill one or more of its services as it deems appropriate.

To assist the industry in alleviating additional operational processing, NSCC has implemented an additional service as of March 5, 2010 that will aggregate non-CNS eligible trade-for-trade obligations, bi-laterally between counterparties. Counterparties will now be required to settle just one receive order and one deliver order in a given security rather than having to settle multiple transactions. As is currently the case with all trade-for-trade obligations, these items are not guaranteed by NSCC. For more information regarding this service please refer to NSCC Important Notice #6958.

Please contact your DTCC relationship manager if you have any further questions regarding this notice.

http://www.dtcc.com/downloads/legal/imp_notices/2010/dtcc/z0025.pdf

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.