More from their financials...

Go to their website for the complete report:

http://micro.newswire.ca/release.cgi?rkey=1803015765&view=66520-0&Start=0&htm=0

Business Highlights in Q2 and Subsequent to Quarter End

- Continued expansion of operations into Shandong, one of China's fastest growing regions.

- Following overwhelming shareholder approval at its annual meeting in Toronto, the Company changed the location of its registered office to Ontario and ratified its stock option plan.

- Signed four new construction project contracts with an aggregate value of $76.6 million. The agreements encompass residential, commercial and hotel construction projects on Hainan Island and Shandong Province, Boyuan's newest market.

Review of Financial Results

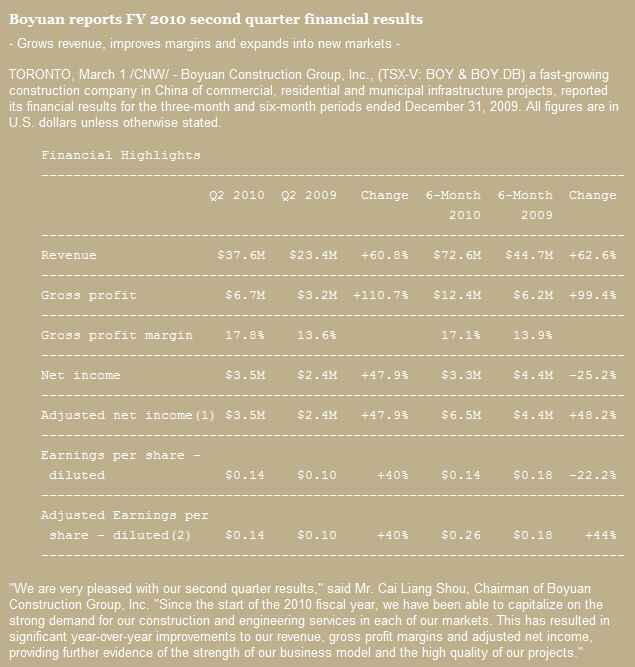

Revenue for the second quarter ended December 31, 2009 was $37.6 million, up 60.8% from $23.4 million for Q2 of FY2009. Revenue for the first six months of FY2010 was $72.6 million, compared to $44.7 million for the same period in FY2009.

Boyuan recognizes revenue on the percentage-of-completion method. The significant year-over-year growth in revenue was primarily attributable to an increase in the number of successful project bids by the Company as well as to an increase in demand for construction and engineering services in the Yangtze River Delta region and Hainan Island, Boyuan's core markets. Subsequent to quarter end, Boyuan has experienced strong demand for its services from Shandong province, a new market for the Company. Higher demand for construction and engineering services is due to ongoing urban migration and an expansion of China's middle class, which drive the need for new housing, commercial and public infrastructure projects.

Cost of construction for the second quarter of FY2010 was $30.9 million compared to $20.2 million for Q2 of FY2009. Cost of construction for the first six months of FY 2010 was $60.2 million, up from $38.4 million for the comparable period in FY2009. The increase was primarily as a result of higher expenses associated with greater project volume and an expanded work force. Cost of sales includes all direct material, labor, subcontract and other related costs, such as equipment repairs.

Gross profit for the second quarter of FY2010 was $6.7 million, or 17.8% of revenue, compared to $3.2 million, or 13.6% of revenue, for the same period of FY2009. Gross profit for the first six months of FY2010 was $12.4 million, or 17.1% of revenue, compared to $6.2 million, or 13.9% of revenue, for the same period of FY2009. The year-over-year improvement in gross profit margins in Q2 by 410 basis points was due to a higher percentage of revenue contributed from higher margin projects, particularly in Hainan Island, where the Company experiences strong demand for its services but faces limited competition, and a lower than average gross margin in Q2 FY2009. Historically, the norm for the Company's gross margins is 15%.

Net income for the second quarter of FY2010 was $3.5 million, or $0.14 per fully diluted share, compared to net income of $2.4 million, or $0.10 per fully diluted share, for Q2 of FY2009.

Net income for the six-month period was $3.3 million, down 25.2% from $4.4 million for the same period of FY2009. The decline is attributable to a non-cash stock-based compensation charge of $3.2 million that the Company incurred in the first quarter of FY2010. As previously reported, the charge related to the fair value transfer of shares under the make good provision of a financing agreement signed in July 2009. The charge is in full compliance with Canadian generally accepted accounting principles.

As specified by the Company's make-good provision of the July financing agreement, Boyuan forecasted an after-tax net income of $8.5 million for the fiscal year ended June 30, 2009. As a condition of the make-good provision, Boyuan's Chairman put 3.2 million shares in escrow and would have transferred 1.6 million shares to investors if the forecast target had not been met. As reported previously, the Company generated $9.6 million in adjusted after tax net income for FY 2009. As a result, 1.6 million shares previously held in escrow were returned to Chairman Shou during the quarter, resulting in a make good charge of $3.2 million.

Excluding the make-good provision charge, adjusted net income for the six month period ended December 31, 2009 was $6.5 million, or $0.26 per share diluted, which compares to $4.4 million, or $0.18 per share diluted, for the same period in FY2009. The Company believes that adjusted net income is more representative of its profitability and performance since the make good charge is a non-cash accounting charge and not related to its business activities.

The Company had cash, cash equivalents and restricted cash totaling $4.9 million and working capital of $35.3 million for the period ended December 31, 2009. This compares to a cash, cash equivalents and restricted cash balance of $5.5 million and working capital of $22.4 million at June 30, 2009.

Outlook

"Recent economic indicators in China remain relatively strong, suggesting continued optimism for the construction industry over the short term," said Mr. Shou. "Our opportunities for growth, in particular, are encouraging given that we operate in tier two level cities where the competitive landscape is fragmented and local economies are less affected by economic trends, such as rising property values, found in major cities, such as Shanghai or Beijing."

Boyuan's consolidated statements for the three and six month periods ended December 31, 2009 and related management's discussion and analysis (MD&A) will be filed with securities regulatory authorities

within applicable timelines and will be available via SEDAR at www.sedar.com.

About Boyuan Construction Group, Inc.

Based in Jiaxing City, China, Boyuan Construction Group, Inc. is in the business of residential and commercial building construction, municipal infrastructure and engineering projects. In its last four fiscal years ending June 30, 2009, Boyuan completed more than 125 projects for a number of private and public sector clients including Cargill and the Dalian Shide Group, a billion dollar conglomerate whose partners include DuPont, Mitsubishi and GE. Boyuan's current backlog includes residential, industrial and mixed-use developments, including a five-star hotel and a project at the Qingshan Nuclear Plant, China's first and largest nuclear facility. From its operating bases in Zhejiang Province and on Hainan Island, Boyuan focuses on construction projects in China's fast-growing regions of the Yangtze River Delta, Hainan Island and Shandong Province. For more information please visit www.boyuangroup.com or follow us at http://boyuangroup.posterous.com

Caution Regarding Forward-Looking Information:

Certain information contained in this press release constitutes forward-looking information, which is information relating to future events or the Company's future performance and which is inherently uncertain. All information other than statements of historical fact may be forward-looking information. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "budget", "plan", "continue", "estimate", "expect", "forecast", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook. Forward-looking information contained in this press release includes, but is not limited to, the Company's outlook on higher demand for construction and engineering services in China, China's ongoing urban migration and expansion of middle class, need for new housing, commercial and public projects in China, strong economic indicators in China, optimism on Chinese construction industry over the short term, and impact of economic trends (such as rising property value) on tier-two Chinese cities. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. The Company believes the expectations reflected in the forward-looking information are reasonable but no assurance can be given that these expectations will prove to be correct and readers are cautioned not to place undue reliance on forward-looking information contained in this press release. Some of the risks and other factors which could cause results to differ materially from those expressed in the forward-looking information contained in this press release include, but are not limited to: risk of macro-economy cycle, risk from competition, risk from insufficient marketing to secure new projects, risk in obtaining additional financing, risk involving permits and licences, reliance on key management member, risk from supply of raw materials, risk of financial leverage, risk of bad debts in accounts receivables, risk involved in real estate development, foreign exchange fluctuations, political and economic conditions in China and other risks included in the Company's AIF for the fiscal year ended June 30, 2009 and in the Company's public disclosure documents filed with certain Canadian securities regulatory authorities and available at www.sedar.com. The forward-looking information contained in this press release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as otherwise required by law.

Go to their website for the complete report:

http://micro.newswire.ca/release.cgi?rkey=1803015765&view=66520-0&Start=0&htm=0

Business Highlights in Q2 and Subsequent to Quarter End

- Continued expansion of operations into Shandong, one of China's fastest growing regions.

- Following overwhelming shareholder approval at its annual meeting in Toronto, the Company changed the location of its registered office to Ontario and ratified its stock option plan.

- Signed four new construction project contracts with an aggregate value of $76.6 million. The agreements encompass residential, commercial and hotel construction projects on Hainan Island and Shandong Province, Boyuan's newest market.

Review of Financial Results

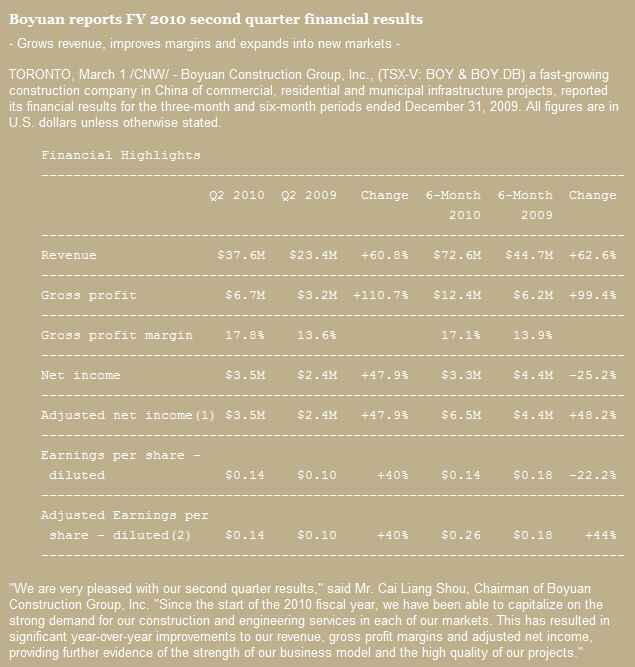

Revenue for the second quarter ended December 31, 2009 was $37.6 million, up 60.8% from $23.4 million for Q2 of FY2009. Revenue for the first six months of FY2010 was $72.6 million, compared to $44.7 million for the same period in FY2009.

Boyuan recognizes revenue on the percentage-of-completion method. The significant year-over-year growth in revenue was primarily attributable to an increase in the number of successful project bids by the Company as well as to an increase in demand for construction and engineering services in the Yangtze River Delta region and Hainan Island, Boyuan's core markets. Subsequent to quarter end, Boyuan has experienced strong demand for its services from Shandong province, a new market for the Company. Higher demand for construction and engineering services is due to ongoing urban migration and an expansion of China's middle class, which drive the need for new housing, commercial and public infrastructure projects.

Cost of construction for the second quarter of FY2010 was $30.9 million compared to $20.2 million for Q2 of FY2009. Cost of construction for the first six months of FY 2010 was $60.2 million, up from $38.4 million for the comparable period in FY2009. The increase was primarily as a result of higher expenses associated with greater project volume and an expanded work force. Cost of sales includes all direct material, labor, subcontract and other related costs, such as equipment repairs.

Gross profit for the second quarter of FY2010 was $6.7 million, or 17.8% of revenue, compared to $3.2 million, or 13.6% of revenue, for the same period of FY2009. Gross profit for the first six months of FY2010 was $12.4 million, or 17.1% of revenue, compared to $6.2 million, or 13.9% of revenue, for the same period of FY2009. The year-over-year improvement in gross profit margins in Q2 by 410 basis points was due to a higher percentage of revenue contributed from higher margin projects, particularly in Hainan Island, where the Company experiences strong demand for its services but faces limited competition, and a lower than average gross margin in Q2 FY2009. Historically, the norm for the Company's gross margins is 15%.

Net income for the second quarter of FY2010 was $3.5 million, or $0.14 per fully diluted share, compared to net income of $2.4 million, or $0.10 per fully diluted share, for Q2 of FY2009.

Net income for the six-month period was $3.3 million, down 25.2% from $4.4 million for the same period of FY2009. The decline is attributable to a non-cash stock-based compensation charge of $3.2 million that the Company incurred in the first quarter of FY2010. As previously reported, the charge related to the fair value transfer of shares under the make good provision of a financing agreement signed in July 2009. The charge is in full compliance with Canadian generally accepted accounting principles.

As specified by the Company's make-good provision of the July financing agreement, Boyuan forecasted an after-tax net income of $8.5 million for the fiscal year ended June 30, 2009. As a condition of the make-good provision, Boyuan's Chairman put 3.2 million shares in escrow and would have transferred 1.6 million shares to investors if the forecast target had not been met. As reported previously, the Company generated $9.6 million in adjusted after tax net income for FY 2009. As a result, 1.6 million shares previously held in escrow were returned to Chairman Shou during the quarter, resulting in a make good charge of $3.2 million.

Excluding the make-good provision charge, adjusted net income for the six month period ended December 31, 2009 was $6.5 million, or $0.26 per share diluted, which compares to $4.4 million, or $0.18 per share diluted, for the same period in FY2009. The Company believes that adjusted net income is more representative of its profitability and performance since the make good charge is a non-cash accounting charge and not related to its business activities.

The Company had cash, cash equivalents and restricted cash totaling $4.9 million and working capital of $35.3 million for the period ended December 31, 2009. This compares to a cash, cash equivalents and restricted cash balance of $5.5 million and working capital of $22.4 million at June 30, 2009.

Outlook

"Recent economic indicators in China remain relatively strong, suggesting continued optimism for the construction industry over the short term," said Mr. Shou. "Our opportunities for growth, in particular, are encouraging given that we operate in tier two level cities where the competitive landscape is fragmented and local economies are less affected by economic trends, such as rising property values, found in major cities, such as Shanghai or Beijing."

Boyuan's consolidated statements for the three and six month periods ended December 31, 2009 and related management's discussion and analysis (MD&A) will be filed with securities regulatory authorities

within applicable timelines and will be available via SEDAR at www.sedar.com.

About Boyuan Construction Group, Inc.

Based in Jiaxing City, China, Boyuan Construction Group, Inc. is in the business of residential and commercial building construction, municipal infrastructure and engineering projects. In its last four fiscal years ending June 30, 2009, Boyuan completed more than 125 projects for a number of private and public sector clients including Cargill and the Dalian Shide Group, a billion dollar conglomerate whose partners include DuPont, Mitsubishi and GE. Boyuan's current backlog includes residential, industrial and mixed-use developments, including a five-star hotel and a project at the Qingshan Nuclear Plant, China's first and largest nuclear facility. From its operating bases in Zhejiang Province and on Hainan Island, Boyuan focuses on construction projects in China's fast-growing regions of the Yangtze River Delta, Hainan Island and Shandong Province. For more information please visit www.boyuangroup.com or follow us at http://boyuangroup.posterous.com

Caution Regarding Forward-Looking Information:

Certain information contained in this press release constitutes forward-looking information, which is information relating to future events or the Company's future performance and which is inherently uncertain. All information other than statements of historical fact may be forward-looking information. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "budget", "plan", "continue", "estimate", "expect", "forecast", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook. Forward-looking information contained in this press release includes, but is not limited to, the Company's outlook on higher demand for construction and engineering services in China, China's ongoing urban migration and expansion of middle class, need for new housing, commercial and public projects in China, strong economic indicators in China, optimism on Chinese construction industry over the short term, and impact of economic trends (such as rising property value) on tier-two Chinese cities. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. The Company believes the expectations reflected in the forward-looking information are reasonable but no assurance can be given that these expectations will prove to be correct and readers are cautioned not to place undue reliance on forward-looking information contained in this press release. Some of the risks and other factors which could cause results to differ materially from those expressed in the forward-looking information contained in this press release include, but are not limited to: risk of macro-economy cycle, risk from competition, risk from insufficient marketing to secure new projects, risk in obtaining additional financing, risk involving permits and licences, reliance on key management member, risk from supply of raw materials, risk of financial leverage, risk of bad debts in accounts receivables, risk involved in real estate development, foreign exchange fluctuations, political and economic conditions in China and other risks included in the Company's AIF for the fiscal year ended June 30, 2009 and in the Company's public disclosure documents filed with certain Canadian securities regulatory authorities and available at www.sedar.com. The forward-looking information contained in this press release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as otherwise required by law.

GLTA... KarinCA ;)

"Be kinder than necessary, for everyone you meet is fighting some kind of battle."

Just my opinion. Your own entry and exit points will determine whether or not you made a good trade

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.