Dahlman Rose initiates coverage of five fertilizer companies and updated their recent industry assessment.

The firm says in the current fertilizer environment, they are somewhat more positively disposed toward nitrogen, followed by phosphate and then potash. This short-term appraisal runs counter to their longer-term inclination which favors the exact reverse of the order listed above. Overall, their firm's view is less bullish than the current consensus. They say that sentiment is grounded on their cheap food thesis, sense that global fertilizer demand in 2007 and 2008 was overestimated and influenced by inventory building and a hoarding mentality and that any fertilizer demand rebound, especially in potash, and will take effect only slowly as global operating rates stay well below recent highs. Based on their market assessment and each company's relative exposure to the different nutrient classes, they are initiating coverage of Agrium Inc. (AGU) with a Buy, and Hold ratings on The Mosaic Company (MOS) and CF Industries (CF). The firm also initiates Potash Corp (POT) and Intrepid Potash (IPI) with Sells.

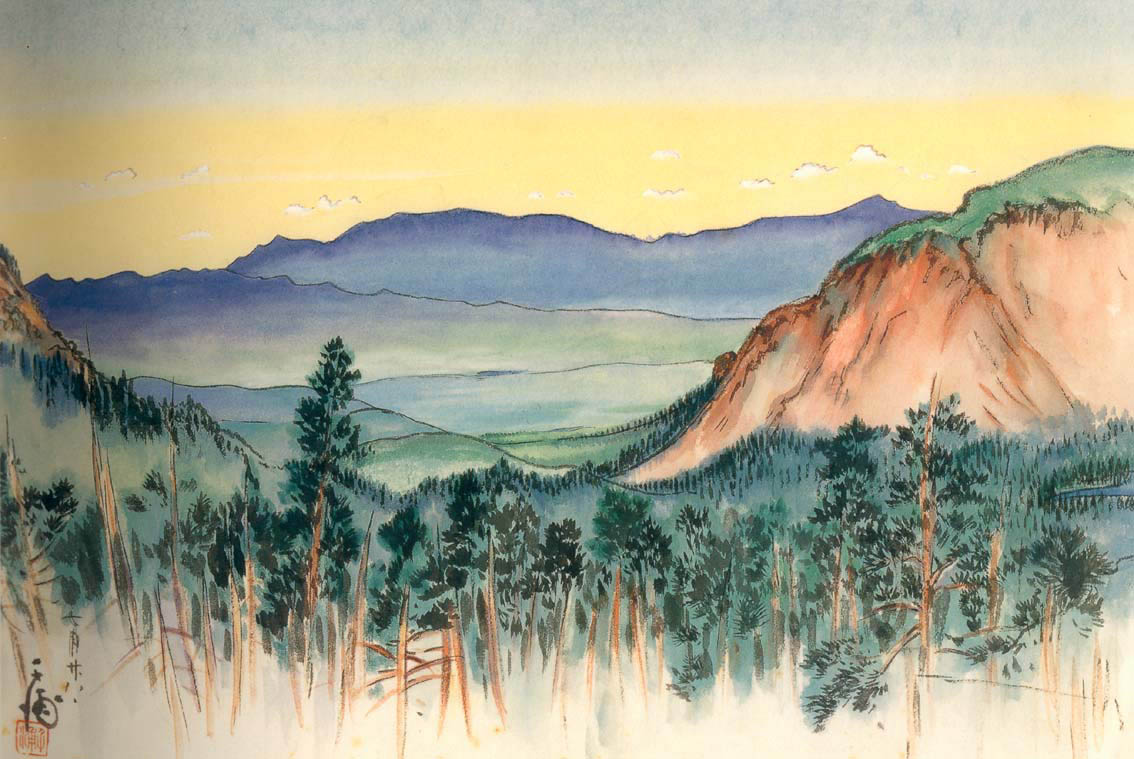

Chiura Obata painting at Yosemite