Briefing.com Commentary on Jobs, Economy:

Page One: Market Sees What It Wants to See

And away we go... Alcoa's (AA) earnings report last night ceremoniously kicked off the third quarter reporting period. At the same time, it kicked more than a few short sellers in the mouth as the aluminum maker said mostly all the right things.

Alcoa topped earnings estimates, said it is seeing signs of stabilization in key markets, indicated aluminum consumption should be up 11% in the second half of the year, and added that its cash on hand was $1.1 billion versus $762 million at the end of 2008.

The one item that didn't show up in its headlines was that revenues were down 33.8% year-over-year. We did get a sense, though, of how companies are likely to craft their press releases this season. It will be about burying the lead.

Don't call attention to the fact that demand is still nowhere what it used to be. Instead, emphasize that there is growth now from a very depressed base. Alcoa did just that, highlighting the relatively encouraging point that revenues were up 9% on a sequential basis.

It is a clever strategy, particularly since most companies should be able to highlight actual year-over-year growth in the fourth quarter and first quarter given the easy comparisons.

Focusing on sequential comparisons this reporting period, then, will buy companies more time to keep investors interested in their turnaround stories.

It is a necessary strategy if the early returns are any indication. Briefing.com's earnings calendar shows 19 companies have reported earnings results this week. Out of that total, only four have reported year-over-year revenue growth.

Moving on, a number of retailers are reporting better-than-expected same-store sales for September. That's not to say they are strong results. It simply means analysts' expectations were too low.

The majority of reports thus far still have a minus sign in front of the monthly same-store sales number. Nonetheless, positive surprises in any form are typically viewed as a bullish catalyst by traders.

On that note, the futures market got an added boost on the report that initial claims for the week ended Oct. 3 were "only" 521,000. That was down from 554,000 in the prior week and better than the consensus estimate of 540,000.

Continuing claims, in turn, also surprised on the upside. They were 6.04 million for the week ended Sept. 26 versus 6.112 million in the prior week and the consensus estimate of 6.105 million.

Initial claims are considered to be a leading indicator. While the report has produced some seemingly encouraging headlines for traders, the real indication embedded in the inflated initial claims total is that consumer spending is going to remain sluggish, with an emphasis on spending to need as opposed to want.

Separately, both the ECB and Bank of England left their key lending rates unchanged. If we work off the logic earlier in the week that the rate hike in Australia was cause for celebration, then one would think the ECB and Bank of England holding steady would be cause for concern.

That doesn't appear to be the case at all. Like we said after Australia's rate hike, the market sees what it wants to see from one day to the next.

Alcoa, same-store sales, and initial claims -- they all have big room for real improvement, yet the market saw positive surprises in each relative to expectations. That, apparently, is good enough to keep this week's rally going for a bit longer.

As of this posting, the S&P 500 is expected to start the session with a gain of about 0.8%.

--Patrick J. O'Hare, Briefing.com

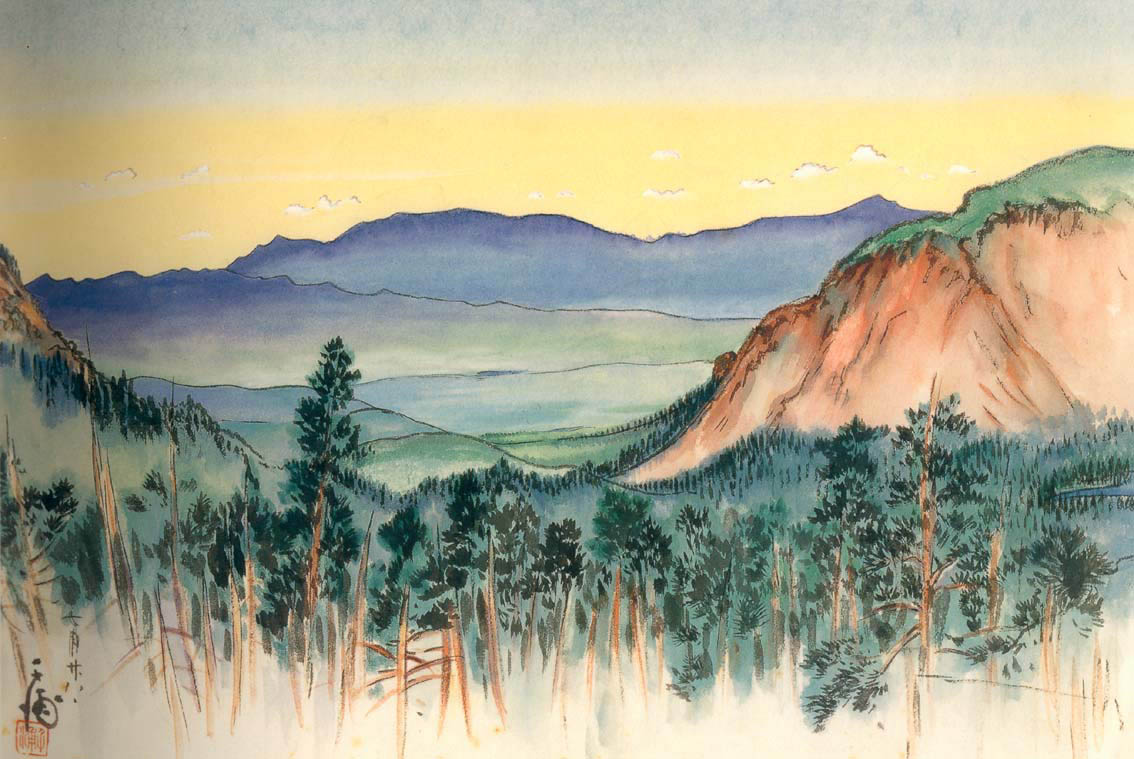

Chiura Obata painting at Yosemite