hweb, since you asked ... this week has actually been pretty good (thus far, knock on wood).

Well, yes, I bought QID last week during a down day because I thought it may be the start of something onerous, as was remarked repeatedly thruout the day on CNBC. As it turned out, the poor employment data pushed the mkt down hard in the AM, but it recovered steadily thruout the day, so I sold my QID (insurance) for a loss. In retrospect, I decided it was still a good idea to buy QID even if I lost money that day; if the market had continued to fall, it would have been a good moneymaker to offset (hedge) other stocks that were falling.

I remain heavily weighted in PM juniors (GORO, AGT, HWTHF, OCANF, even PAL) with some others that I continue to hold because they've performed pretty well thus far (TBUS, CSGH, CPHI) plus only two energy stocks (IACAF, NEP, due comments on the VMC Energy board). Sold my remaining OFI this morning for 4% gain. Bought a little RODM yesterday looking for a little bounce, but not risking more than 5% loss. In other words, I tend lately to be day/swingtrading most stocks, but buy&hold for jr. miners (my fave sector).

Being psychologically less than stable, I've continued to hold some WEMU, which has proven to be a terrible VMC stock afterall, but I am "hoping" it recovers just a little bit as the overall market froth floats it higher, even while knowing that "hope" is not a viable investment technique. Still offering it at a loss from where I bought it, but I may dump lower if Armageddon does indeed raise its ugly head. Similarly I bought some QLTI and have been kicked around by it for a few days. About ready to take a loss there also. Like others here, I'm also holding BSPM (too long) with expectation that it should recover (pending negative surprise such as disastrous qtrly results).

Missed plenty of great plays in VMCs lately, like your MRM which has done very well and Nelson's radio stocks, plus Bobwins' and cl001's jr miners.

Best Regards,

'peeker

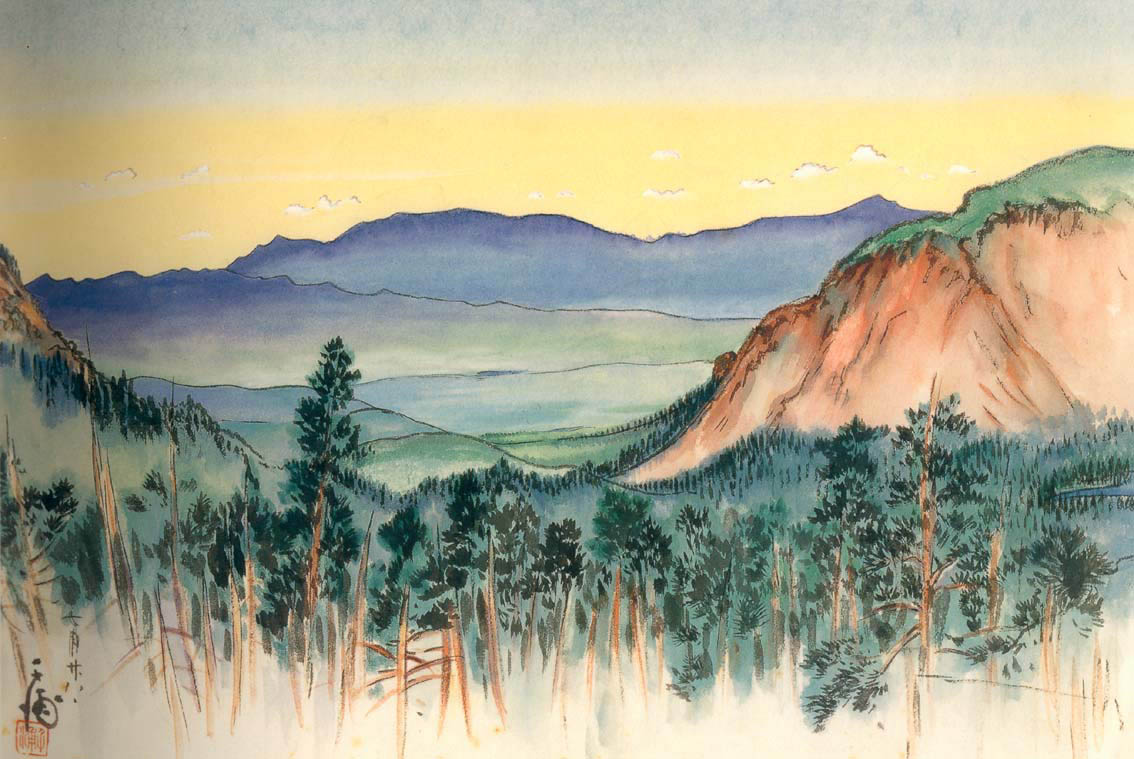

Chiura Obata painting at Yosemite