| Followers | 278 |

| Posts | 16774 |

| Boards Moderated | 1 |

| Alias Born | 07/19/2008 |

Monday, September 07, 2009 11:21:49 PM

Natural Gas: America's Energy Salvation.

by: Joseph Shaefer September 06, 2009 | about: FCG / KOL / UNG / USO

Natural gas will be America’s energy salvation.

If you think solar, biomass, wind, lithium ion-powered, ocean thermal, currents and tides, and even tried-and-true geothermal and hydroelectric will somehow in the aggregate equal natural gas as a share of energy production, read here and here.

It’s time we stopped hiding our heads in the sand about today’s energy problems while spending / wasting tens of billions of dollars on taxpayer-funded grants, incentives and subsidies for tomorrow’s solutions. We need – and have readily available – an American source of relatively clean energy today for today’s needs, if only the politicians would stop spending on pork and get the hell out of the way of private industry that is trying to provide this source: clean-burning natural gas.

We pay much more for the electricity to power and light our homes and offices, the coal, heating oil or gas to heat our homes, and the gasoline to fill our automobiles, than we typically recognize.

We pay once to the utilities or at the pump, and once more when our taxes are withheld from our paychecks. Big government pork for ethanol subsidies, solar subsidies, biomass subsidies, and every other kind of can’t-stand-on-its-own-economics power are costing us, not just in monetary terms but in time value – we are looking so far down the road we don’t even see the 30-foot drop-off right in front of us. Think $4 a gallon for gasoline is high? Add in the subsidies your tax dollars are diverted to for a $0 return and you’re probably paying closer to $6 a gallon.

I say remove the subsidies, credits, and grants from all sources of energy. Big oil gets no special allowances for depletion. That’s the industry you chose, bubbas. You knew it was a wasting asset when you decided to enter the business. Same for natural gas and coal companies. And the same for nuclear, wind, solar, biomass, et al.

Clean renewable energy that is not a wasting asset remains the Holy Grail of energy production. If we shut off the spigot of vote-buying that comes from dispensing grants and subsidies, energy companies will still seek ways to harness the power of the sun and the wind. As long as the sun still shines, those who can turn this diffuse energy into a concentrated form will make money. But I’m tired of effectively paying $6 a gallon for gasoline when alternatives exist that are being ignored. Why are they being ignored? Mostly, so some people can feel morally superior while they freeze in the dark. Me. I’m not into moral superiority. I’d rather have a clean, well-lit place to work and live than to feel smug about my energy “consciousness.”

I’d like to see clean solar and wind as much as the next guy, but I won’t wear rose-colored glasses. I can’t ignore the fact that, after 30 years and $30 billion in subsidies, wind now meets 7/10 of 1% of US energy needs (about the same as when farmers used windmills 150 years ago) and solar is 12/100 of 1%. Let’s round those up to 1%. There are 1,440 minutes in a day. Are you willing to have your lights, air conditioner, computer, stove and every other appliance and convenience on just 14.4 minutes a day? Welcome to Baghdad.

Why Natural Gas

Natural gas is the second-most abundant fossil fuel in America. Coal is first. We are the Saudi Arabia of coal worldwide. China and India together don’t have as much coal as the US, which has 28% of the entire world’s reserves. But coal is dirty. Lots of for-profit firms are doing breakneck research to clean it up, but it’s – currently – dirty.

So is our choice dirty polluting coal or 14.4 minutes of power a day? Of course not. There’s imported oil. However, with the exception of tar-sands oil from Canada, when you add, to the $70 a barrel oil costs when ready for export, the transportation costs, the cost of keeping the Straits of Hormuz open, the costs of foreign wars to assure the continuing supply, the cost of the inevitable oil spills from time to time, and the foreign aid and sweetheart deals our nation makes to keep tyrants, misogynists, and perverts atop otherwise-shaky regimes, the true cost of oil is probably already $200-$300 a barrel.

That leaves natural gas as the only fuel we actually use in abundance and have in abundance right now, today, this minute.

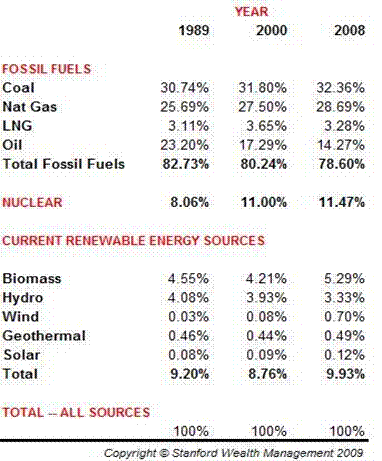

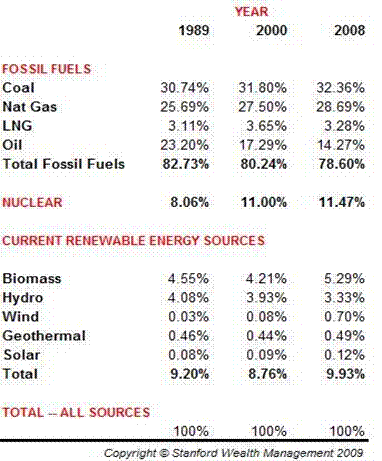

I created the chart below from the raw numbers of quadrillions of BTUs reported by the Department of Energy’s Energy Information Administration of the current mix of fuels used in the United States to produce energy.

Journalists, however, are more enamored of something new! and different! and therefore write reams on renewables and virtually nothing about something old and boring (but tried and true) like fossil fuels, so it’s easy to believe renewables constitute a larger proportion than they really do. Note, for instance, in the previous chart, the less-than-amazing ascent of heavily-subsidized solar from 8/100 of 1% 20 years ago to 12/100 of 1% today. That’s not to denigrate solar or to “wish” that it couldn’t have gone from 8/100 to 8% or 100%. But we must deal in facts if we are to ever wean ourselves from foreign oil and stop walking on eggshells around despots and ideological and religious fanatics.

HERE’s “Why Natural Gas”

1. According to Oil & Gas Weekly and the Energy Information Administration we have upwards of 100 years of natural gas remaining in the US at current rates of usage.

2. The estimate of proven reserves leapt *35%* in just the past year (creating downward pressure on prices in the short term.) No surprise to me. Every year of my 40 years in this business, I’ve been hearing about peak oil in some variation or another. “The world is running out of fossil fuels! We’re all going to freeze to death! We must subsidize unproven technologies to save us from Armageddon!”

What a bunch of hooey. Every year since the first Cassandra screamed this nonsense in my ear, we have increased our estimates of proven reserves. As technology allows us to find and produce gas from previously unknown or inaccessible formation, we’ll find even more.

3. Add Canada’s natural gas to the mix, since Canada is our biggest trading partner and the US is their closest (thus cheapest-to-transport-to) customer, and they have an abundance of nat-gas beyond the needs of their population. And since liquefying natural gas is expensive and potentially dangerous, it’s best to pipeline it from close-by fields rather than ship it liquefied across the world’s oceans.

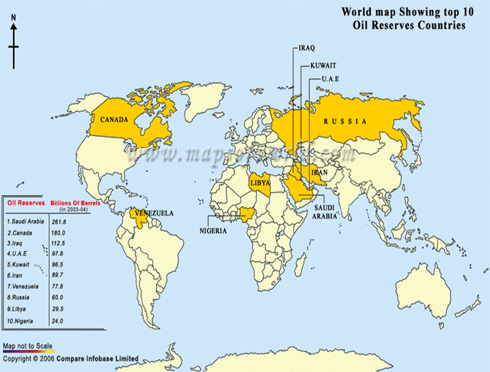

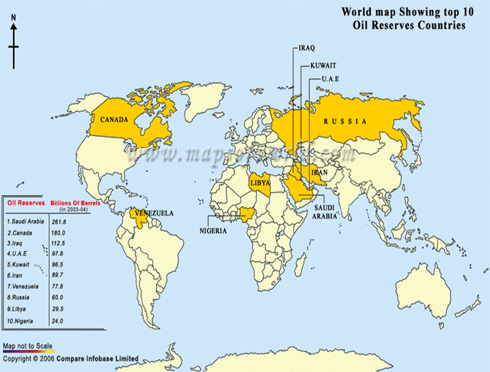

4. If we use more U.S. natural gas, we can tell the likes of Saudi Arabia, Iran, Iraq, Russia, Nigeria and Venezuela “no thanks” to their bribery, corruption and fleecing.

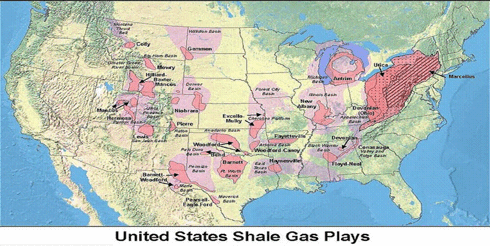

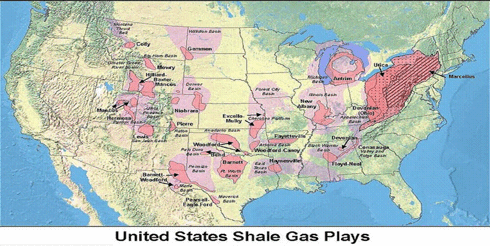

Take a look at the map below (click to enlarge). These are our now-known, proven shale gas reserves. Now note how close most are to population centers...

Okay, But Why NOW?

In previous articles, I began making the case for both nuclear and natural gas. I still believe both offer remarkably good investment opportunities in the months, years and decades ahead -- but I think natural gas will be the first to benefit. Why?

1. People are beginning to realize, in spite of Al Gore’s conflict-of-interest hawking of renewables he’s invested in, that nat-gas is the cleanest burning fossil fuel, is available in quantity right here at home, and is used to heat our homes, cook our food, power the electricity that turns on our lights and fuel the 7 million natural gas vehicles currently in use around the world.

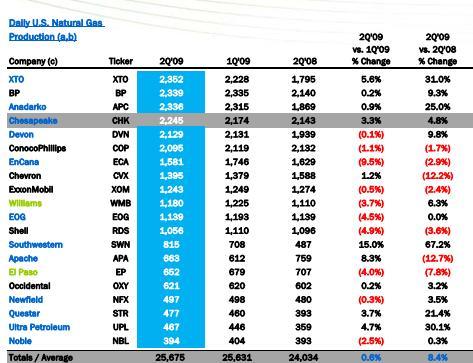

2. The glut in supply of natural gas is both temporary and price-sensitive. The glut was created by new production coming online from shale gas plays. But at today’s prices, those wells are being shuttered. What company could stay in business if they were to sell gas at $2.56 per million BTUs (MMBtu) when it costs them $5.15 per MMBtu to get it out of the ground?

3. The natural gas glut is not only price-sensitive, it is seasonal, as well. As the winter season cranks up over the coming months, utilities will need to produce more natural gas-generated heat. As the days grow longer, we’ll turn our lights on earlier in the day and, if this year is like every other, we’ll settle in, turn up the electric blankets, play more electronic games, and cook more at home – primarily benefiting nat-gas and coal as the two primary generators of electricity in this country. (With nuclear close behind, the three of them accounting for 90% of our electrical generating fuel sources. Add hydroelectric and that leaves just 4% generated by oil, biomass, vegetable oil, solar, wind, etc.)

I believe natural gas is unlikely to remain depressed.

This is a seasonal play that hasn't changed in 50 years, yet the media always project declines or rises -- in any commodity, trend or stock -- as if they were linear. The market, however, is cyclical, not linear...

4. The Farmers' Almanac is predicting a cold winter. The squirrels, chipmunks and birds in my large yard seem to agree. All are scurrying about hiding food from each other earlier than I’ve ever seen. The Almanac predicts numbing cold from the Rocky Mountains to the Appalachians, with milder weather on the coasts. The National Weather Service is calling for a warmer-than-normal winter because of El Nino. In my experience, the animals get it right more often than the humans…

5. Natural gas-fired plants are currently operating at less than 50% capacity. If this administration and this country is really serious about cutting carbon emissions we will turn to natural gas now, not when two guys in their garage find the solar Holy Grail.

Next week, I will write an article on the three E&P (exploration and production) firms I believe will benefit most from an increase in America’s reliance upon “home-grown,” abundant, and cheap natural gas. I’ll also review what I think are the smartest natural gas pipelines for both income and growth.

If you can’t wait until then, here’s an ETF that I believe accurately covers the whole industry: the First Trust ISE-Revere Natural Gas Index Fund (FCG). I know and respect some of the principals at Revere (“Revere Data”) and am quite familiar with their methodology and hierarchy that creates a product- and service-based classification system to map where and how companies interact and compete.

FCG would be a good adjunct to the pipelines mentioned above in that it selects companies on the exploration and production side of the business. It selects only the top 30 stocks based upon an internal ranking system, then rebalances on a quarterly basis. Be aware that this methodology will add a level of “active” management versus the passive nature of many ETFs. That might be good, it might be bad, but I see FCG as a great way to give us broad exposure to the entire industry.

by: Joseph Shaefer September 06, 2009 | about: FCG / KOL / UNG / USO

Natural gas will be America’s energy salvation.

If you think solar, biomass, wind, lithium ion-powered, ocean thermal, currents and tides, and even tried-and-true geothermal and hydroelectric will somehow in the aggregate equal natural gas as a share of energy production, read here and here.

It’s time we stopped hiding our heads in the sand about today’s energy problems while spending / wasting tens of billions of dollars on taxpayer-funded grants, incentives and subsidies for tomorrow’s solutions. We need – and have readily available – an American source of relatively clean energy today for today’s needs, if only the politicians would stop spending on pork and get the hell out of the way of private industry that is trying to provide this source: clean-burning natural gas.

We pay much more for the electricity to power and light our homes and offices, the coal, heating oil or gas to heat our homes, and the gasoline to fill our automobiles, than we typically recognize.

We pay once to the utilities or at the pump, and once more when our taxes are withheld from our paychecks. Big government pork for ethanol subsidies, solar subsidies, biomass subsidies, and every other kind of can’t-stand-on-its-own-economics power are costing us, not just in monetary terms but in time value – we are looking so far down the road we don’t even see the 30-foot drop-off right in front of us. Think $4 a gallon for gasoline is high? Add in the subsidies your tax dollars are diverted to for a $0 return and you’re probably paying closer to $6 a gallon.

I say remove the subsidies, credits, and grants from all sources of energy. Big oil gets no special allowances for depletion. That’s the industry you chose, bubbas. You knew it was a wasting asset when you decided to enter the business. Same for natural gas and coal companies. And the same for nuclear, wind, solar, biomass, et al.

Clean renewable energy that is not a wasting asset remains the Holy Grail of energy production. If we shut off the spigot of vote-buying that comes from dispensing grants and subsidies, energy companies will still seek ways to harness the power of the sun and the wind. As long as the sun still shines, those who can turn this diffuse energy into a concentrated form will make money. But I’m tired of effectively paying $6 a gallon for gasoline when alternatives exist that are being ignored. Why are they being ignored? Mostly, so some people can feel morally superior while they freeze in the dark. Me. I’m not into moral superiority. I’d rather have a clean, well-lit place to work and live than to feel smug about my energy “consciousness.”

I’d like to see clean solar and wind as much as the next guy, but I won’t wear rose-colored glasses. I can’t ignore the fact that, after 30 years and $30 billion in subsidies, wind now meets 7/10 of 1% of US energy needs (about the same as when farmers used windmills 150 years ago) and solar is 12/100 of 1%. Let’s round those up to 1%. There are 1,440 minutes in a day. Are you willing to have your lights, air conditioner, computer, stove and every other appliance and convenience on just 14.4 minutes a day? Welcome to Baghdad.

Why Natural Gas

Natural gas is the second-most abundant fossil fuel in America. Coal is first. We are the Saudi Arabia of coal worldwide. China and India together don’t have as much coal as the US, which has 28% of the entire world’s reserves. But coal is dirty. Lots of for-profit firms are doing breakneck research to clean it up, but it’s – currently – dirty.

So is our choice dirty polluting coal or 14.4 minutes of power a day? Of course not. There’s imported oil. However, with the exception of tar-sands oil from Canada, when you add, to the $70 a barrel oil costs when ready for export, the transportation costs, the cost of keeping the Straits of Hormuz open, the costs of foreign wars to assure the continuing supply, the cost of the inevitable oil spills from time to time, and the foreign aid and sweetheart deals our nation makes to keep tyrants, misogynists, and perverts atop otherwise-shaky regimes, the true cost of oil is probably already $200-$300 a barrel.

That leaves natural gas as the only fuel we actually use in abundance and have in abundance right now, today, this minute.

I created the chart below from the raw numbers of quadrillions of BTUs reported by the Department of Energy’s Energy Information Administration of the current mix of fuels used in the United States to produce energy.

Journalists, however, are more enamored of something new! and different! and therefore write reams on renewables and virtually nothing about something old and boring (but tried and true) like fossil fuels, so it’s easy to believe renewables constitute a larger proportion than they really do. Note, for instance, in the previous chart, the less-than-amazing ascent of heavily-subsidized solar from 8/100 of 1% 20 years ago to 12/100 of 1% today. That’s not to denigrate solar or to “wish” that it couldn’t have gone from 8/100 to 8% or 100%. But we must deal in facts if we are to ever wean ourselves from foreign oil and stop walking on eggshells around despots and ideological and religious fanatics.

HERE’s “Why Natural Gas”

1. According to Oil & Gas Weekly and the Energy Information Administration we have upwards of 100 years of natural gas remaining in the US at current rates of usage.

2. The estimate of proven reserves leapt *35%* in just the past year (creating downward pressure on prices in the short term.) No surprise to me. Every year of my 40 years in this business, I’ve been hearing about peak oil in some variation or another. “The world is running out of fossil fuels! We’re all going to freeze to death! We must subsidize unproven technologies to save us from Armageddon!”

What a bunch of hooey. Every year since the first Cassandra screamed this nonsense in my ear, we have increased our estimates of proven reserves. As technology allows us to find and produce gas from previously unknown or inaccessible formation, we’ll find even more.

3. Add Canada’s natural gas to the mix, since Canada is our biggest trading partner and the US is their closest (thus cheapest-to-transport-to) customer, and they have an abundance of nat-gas beyond the needs of their population. And since liquefying natural gas is expensive and potentially dangerous, it’s best to pipeline it from close-by fields rather than ship it liquefied across the world’s oceans.

4. If we use more U.S. natural gas, we can tell the likes of Saudi Arabia, Iran, Iraq, Russia, Nigeria and Venezuela “no thanks” to their bribery, corruption and fleecing.

Take a look at the map below (click to enlarge). These are our now-known, proven shale gas reserves. Now note how close most are to population centers...

Okay, But Why NOW?

In previous articles, I began making the case for both nuclear and natural gas. I still believe both offer remarkably good investment opportunities in the months, years and decades ahead -- but I think natural gas will be the first to benefit. Why?

1. People are beginning to realize, in spite of Al Gore’s conflict-of-interest hawking of renewables he’s invested in, that nat-gas is the cleanest burning fossil fuel, is available in quantity right here at home, and is used to heat our homes, cook our food, power the electricity that turns on our lights and fuel the 7 million natural gas vehicles currently in use around the world.

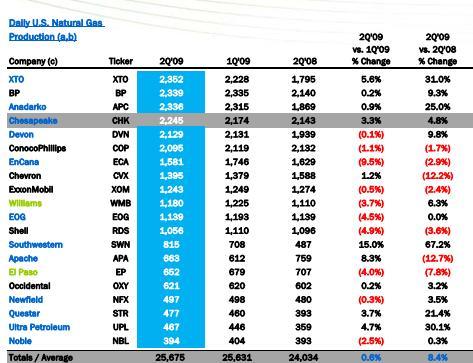

2. The glut in supply of natural gas is both temporary and price-sensitive. The glut was created by new production coming online from shale gas plays. But at today’s prices, those wells are being shuttered. What company could stay in business if they were to sell gas at $2.56 per million BTUs (MMBtu) when it costs them $5.15 per MMBtu to get it out of the ground?

3. The natural gas glut is not only price-sensitive, it is seasonal, as well. As the winter season cranks up over the coming months, utilities will need to produce more natural gas-generated heat. As the days grow longer, we’ll turn our lights on earlier in the day and, if this year is like every other, we’ll settle in, turn up the electric blankets, play more electronic games, and cook more at home – primarily benefiting nat-gas and coal as the two primary generators of electricity in this country. (With nuclear close behind, the three of them accounting for 90% of our electrical generating fuel sources. Add hydroelectric and that leaves just 4% generated by oil, biomass, vegetable oil, solar, wind, etc.)

I believe natural gas is unlikely to remain depressed.

This is a seasonal play that hasn't changed in 50 years, yet the media always project declines or rises -- in any commodity, trend or stock -- as if they were linear. The market, however, is cyclical, not linear...

4. The Farmers' Almanac is predicting a cold winter. The squirrels, chipmunks and birds in my large yard seem to agree. All are scurrying about hiding food from each other earlier than I’ve ever seen. The Almanac predicts numbing cold from the Rocky Mountains to the Appalachians, with milder weather on the coasts. The National Weather Service is calling for a warmer-than-normal winter because of El Nino. In my experience, the animals get it right more often than the humans…

5. Natural gas-fired plants are currently operating at less than 50% capacity. If this administration and this country is really serious about cutting carbon emissions we will turn to natural gas now, not when two guys in their garage find the solar Holy Grail.

Next week, I will write an article on the three E&P (exploration and production) firms I believe will benefit most from an increase in America’s reliance upon “home-grown,” abundant, and cheap natural gas. I’ll also review what I think are the smartest natural gas pipelines for both income and growth.

If you can’t wait until then, here’s an ETF that I believe accurately covers the whole industry: the First Trust ISE-Revere Natural Gas Index Fund (FCG). I know and respect some of the principals at Revere (“Revere Data”) and am quite familiar with their methodology and hierarchy that creates a product- and service-based classification system to map where and how companies interact and compete.

FCG would be a good adjunct to the pipelines mentioned above in that it selects companies on the exploration and production side of the business. It selects only the top 30 stocks based upon an internal ranking system, then rebalances on a quarterly basis. Be aware that this methodology will add a level of “active” management versus the passive nature of many ETFs. That might be good, it might be bad, but I see FCG as a great way to give us broad exposure to the entire industry.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.