Has anyone estimated Free Cash Flow for AGT assuming they stay operational for the remainder of the yr and increase thruput beginning in July as planned?

I assume the following formula could be used

(though some estimates would be difficult as of right now):

When valuing the operations of a firm using a discounted cash flow model, the operating cash flow is needed. This operating cash flow also is called the unlevered free cash flow (UFCF). The term "free cash flow" is used because this cash is free to be paid back to the suppliers of capital.

Calculating Free Cash Flow

For a particular year, the unlevered free cash flow is calculated as follows:

1. Start with the annual sales and subtract cash costs and depreciation to calculate the earnings before interest and taxes (EBIT). The EBIT also is referred to as the operating income and represents the pre-tax earnings without regard to how the business is financed.

2. Calculate the earnings before interest and after tax (EBIAT) by multiplying the EBIT by one minus the tax rate. Note that the EBIAT represents the after-tax earnings of the firm as if it were financed entirely with equity capital.

3. To arrive at the UFCF, add the depreciation expense back to the EBIAT, and subtract capital expenditures (CAPEX) that were not charged against earnings and subtract any investments in net working capital (NWC).

The free cash flow calculation in equation form:

Operating Income (EBIT) = Revenues – Cash Costs – Depreciation Expense

EBIAT = EBIT – Taxes, where Taxes = (tax rate)(EBIT)

UFCF = EBIAT + Depreciation Expense – CAPEX – Increase in NWC

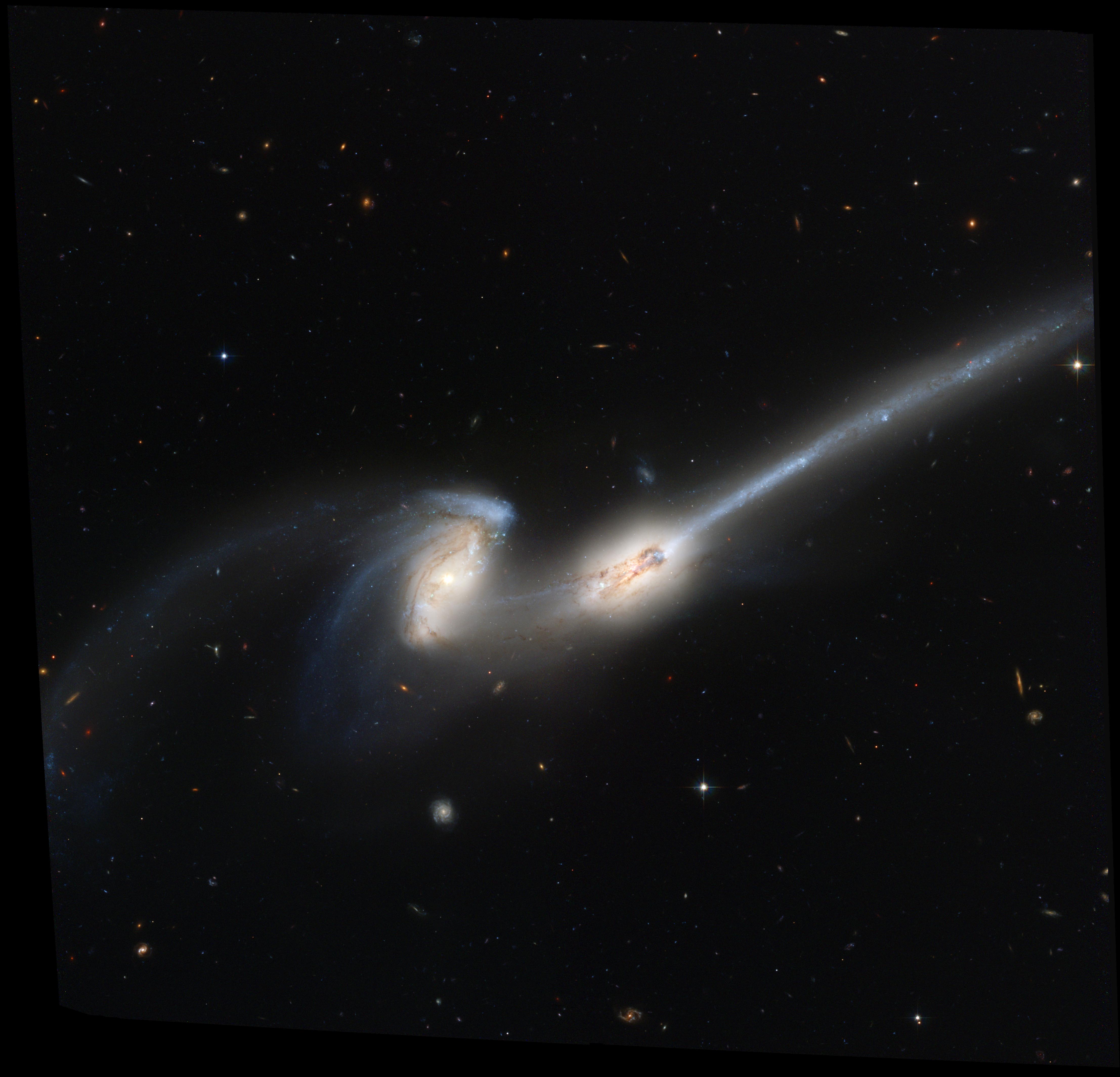

"2 Mice" Galaxies Pulling One Another Apart