AGT hedging: Somebody probably understands exactly how the mark-to-market adjustments will need to be applied quarterly to AGT earnings. If so please explain.

Accountingwise, I'm trying to understand whether we should expect quarterly adjustments to earnings based on the ENTIRE REMAINING amount of the hedged position vs. price of gold at end of each qtr? In other words if the gold price on June 30 is less than it was on March 31st, do we potentially get a credit to earnings (vs. price of gold at end of prior qtr) instead of a penalty?

Cash flow is a wonderful thing, but I'd like to also track how earnings will be impacted each future quarter as Black Fox production and future Grey Fox production are putting cash in the bank.

It's hard to even ask the question clearly, so if anyone can explain how quarterly earnings adjustments due to hedging thru 2013 will be calculated, please clarify.

'peeker

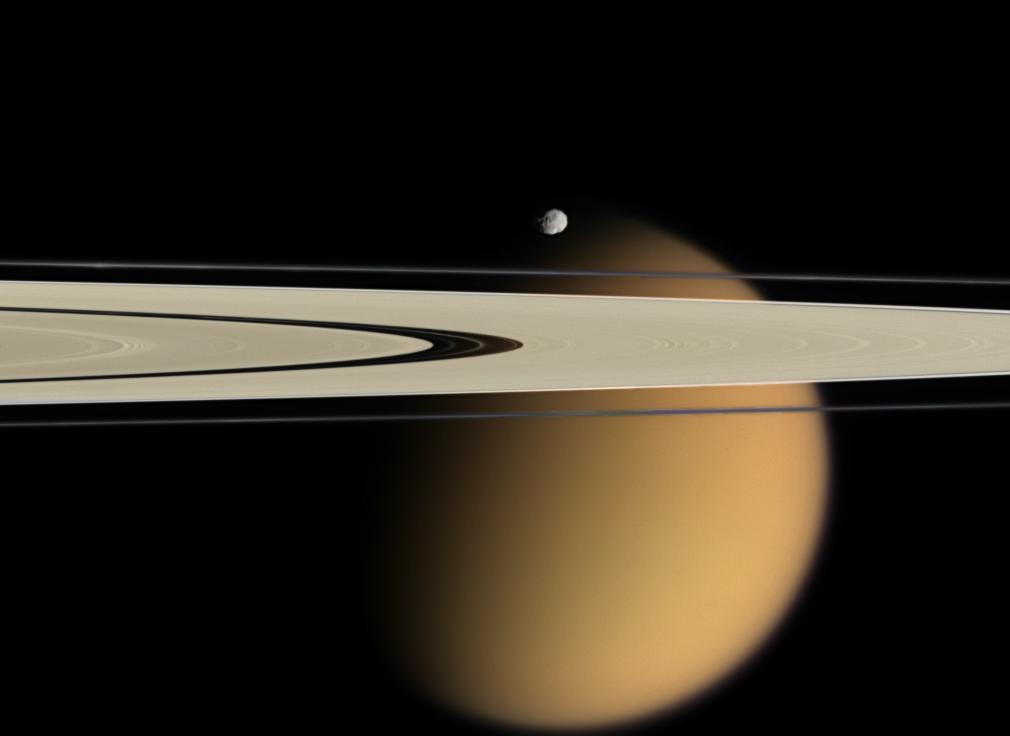

Titan Beyond the Rings of Saturn