AGT will need to get cracking on their gold production and sales. Their big gold hedge position thru 2013 greatly obscures the profitability over the next 4 years, but it will obviously cause a quarterly charge against profits as long as gold stays above $876. I'm not sure what the breakeven production volume will be when gold sells at $1000, $1100 or even $1500/oz, but from here on, AGT price performance will continue to be negatively impacted by net profit/share.

I wonder if they can undo the hedge after they pay back the $70million to the RMB buggers or if they will be burdened with this ongoing charge against earnings thru 2013, after which time much of the mine life may have passed beyond prime production rates.

Not accusing AGT of doing anything wrong, but just scratching my head about the ongoing negative impact of the hedge on earnings thru 2013. Also I'm not sure about the schedule of hedged ounces per year, that is, whether it if front loaded, back loaded, or evenly spread.

At any rate, the AGT management and production team needs to ensure the mill gets up and stays up to speed over the life of Black Fox and Grey Fox (for which estimated/proven resource details due soon).

'peeker

PS> Yeah, I'm showing a little impatience here (again), and it makes GORO look like geniuses for selling large stakes to Hothschilds vs. the dirty rotten RMB buggers. On the bright side, production will be ramping up quickly for AGT and they named the mines after foxes, not trickster coyotes.

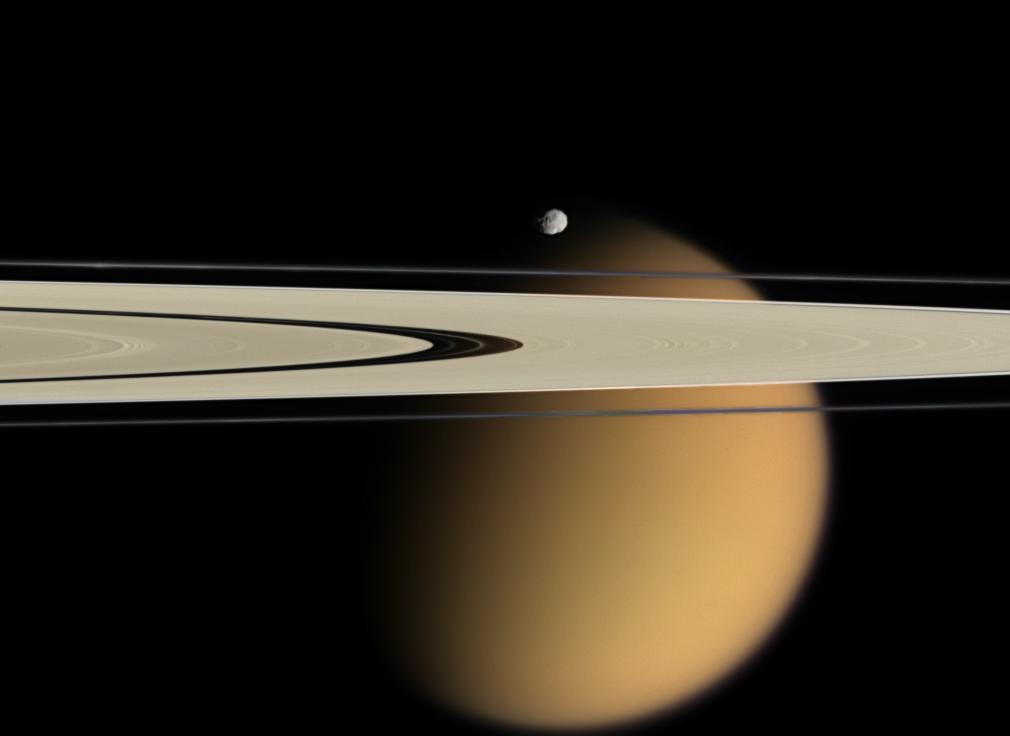

Titan Beyond the Rings of Saturn