AGT's S-3 filing shows about 17 million shares may be sold by some RAB Special Situations Fund that owns about 21 million shares or so. It's actually voted by the probable beneficiary or the fund, specifically William Philip Seymour Richards, a citizen of the United Kingdom.

The thing I find most disconcerting about the content of the S-3 was the "reminder" that there are already a couple of hundred million shares outstanding PLUS options to buy another hundred million or so at an average price of $.31Canadian. In other words, AGT's operations will have to be superbly successful for shareholders to get remarkable returns from here. Of course I haven't tried to do all the math.

Also, the S-3 reminds me that any operational hiccups along the way could be very costly, especially if AGT gets behind in paying its creditors. Schedule for payments to creditors is included in the S-3.

AGT shareholders should read thru the S-3 as part of their DD (well, scan it at least to review the numbers AND risks).

'peeker

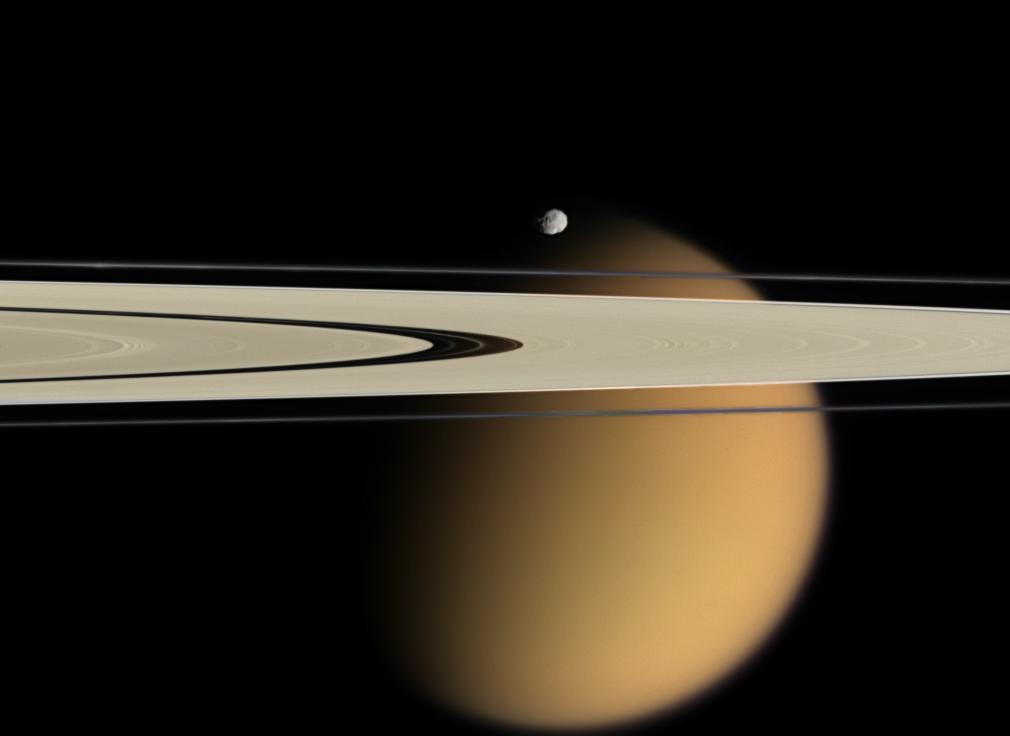

Titan Beyond the Rings of Saturn