Friday, October 17, 2008 3:27:37 PM

US Financial Skeleton: World Illuminati - NWO Big Idea- "911 Terror & Bailout Terror"

Bush Discusses "Serious" Economic Crisis

10/17/2008 3:13 PM ET

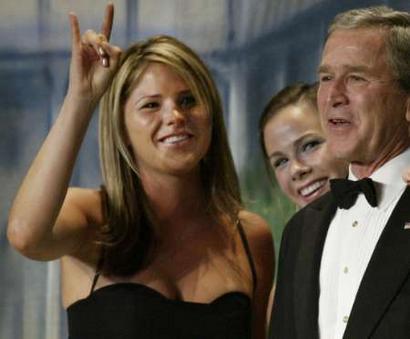

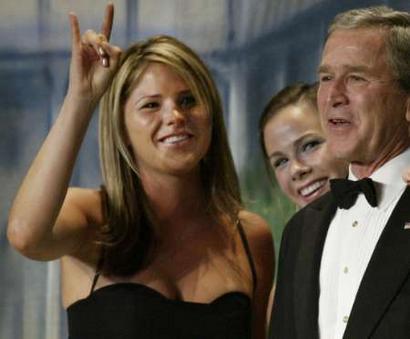

Bush at the center-left.

Bush Discusses "Serious" Economic Crisis

10/17/2008 3:13 PM ET

Seeking to reassure investors and businesspeople, President George W. Bush Friday sought to explain the origins of the financial crisis as well as the steps the government is taking to address it.

The crisis, which Bush called "serious," has sent the stock market reeling in recent days, in spite of a number of proposed federal interventions and the economy is still threatened by a potential freeze in credit markets.

But to understand the present problems, you have to look back more than a decade, Bush said, noting that low interest rates and an influx of capital from overseas had made it easy to borrow.

"This trend was especially apparent in the booming housing market, where many lenders issued mortgages to borrowers who could not otherwise afford homes. Many of those loans were then packaged into complex financial assets, which were sold to banks and investors all across the world," Bush said. "These developments came together to set off a chain reaction when the housing market began to decline."

Just as home values started to drop, many borrowers with adjustable rate mortgages saw interest rates spike, leading to a large number of defaults. That caused a blow to the financial institutions holding securities based on those mortgages.

"This led to high-profile bank failures, restrictions in lending, and widespread anxiety -- all of which contributed to sharp swings in the stock market," Bush said. "These developments were most visible on Wall Street, but their impact has reached far beyond. The drops in the stock market have eroded the value of Americans' retirement accounts and 401Ks. The tightening of credit has made it more expensive for many families to borrow money for cars and homes and college tuition. Many healthy businesses have found it harder to get loans to expand their operations and to create jobs for our workers."

To address these problems, Bush said, the government has responded with "systemic and aggressive" measures, but cautioned that things would not necessarily improve immediately.

"The actions will take more time to have their full impact. It took a while for the credit system to freeze up; it's going to take a while for the credit system to thaw," Bush said. "These are decisive measures aimed at the heart of our financial challenges. And they're big enough and bold enough to work. And the American people can be confident that they will."

The initial emphasis of the federal response was to prevent the collapse of the financial system, which teetered on the brink and could have gone under during a potentially disastrous "disorderly failure" of large, interconnected firms like Bear Stearns, American International Group and the government-sponsored mortgage giants Fannie Mae and Freddie Mac.

"Second, the government has taken unprecedented action to boost liquidity -- the grease that keeps the gears of our financial system turning," Bush said, pointing to the Federal Reserve's decision to inject hundreds of billions of dollars in liquidity into markets and support commercial debt while the FDIC is expanding its coverage of new debt and raising the caps on insured funds in private accounts.

But because the crisis is increasingly global in nature, Bush said, the response also has to come from around the world.

"Last week, the Federal Reserve and other central banks around the world enacted a joint cut in interest rates, which will help ease the pressure on credit markets around the world," Bush said. "Earlier this week, leaders in Europe announced steps to purchase equity in major banks, and provide temporary government guarantees for bank loans. … Our European partners are taking bold steps. They show the world that we're determined to overcome this challenge together. And they have the full support of the United States."

The U.S. Treasury Department will also be taking steps to purchase $250 billion of equity in banks around the country and will be buying up some of the "troubled assets that are weighing down banks' balance sheets and clogging the financial system," Bush said.

Calling the federal response "an extraordinary response to an extraordinary crisis" Bush also sought to assure the assembled businessmen and -women both that it was necessary and that it would only be temporary.

"I know many Americans have reservations about the government's approach, especially about allowing the government to hold shares in private banks. As a strong believer in free markets, I would oppose such measures under ordinary circumstances. But these are not ordinary circumstances," Bush said. "We took this measure as a last resort. Had the government not acted, the hole in our financial system would have grown larger … and ultimately the government would have been forced to respond with even more drastic and costly measures later on."

He added, "This program is designed with strong protections to ensure the government's involvement in individual banks is limited in size, limited in scope, and limited in duration."

The government will only buy "a small percentage" of stake in any given company, Bush said, to be sure that private investors maintain the majority of the company, and the government's shares in banks don't have broad voting rights. Furthermore the program includes provisions to encourage banks to buy out government ownership.

Bush also sought to reassure those concerned by the price of the financial rescue.

"I know many are worried about the price tag of this rescue package. Every dollar spent will be subject to strong oversight by a bipartisan board. We will ensure that failed executives do not receive a windfall from hard-earned taxpayer dollars," he said. "Ultimately, we believe the final cost will be significantly less than the initial investment."

Because some of the assets the government buys may increase in value, the Treasury may be able to make some profit from the purchase of assets that the market now considers toxic, Bush said. And the banks that get a government stake will have to pay quarterly dividends, which will increase sharply after five years, giving the companies an added incentive to buy out government ownership.

Bush also said he was committed to reforming the financial regulatory system, but cautioned against imposing too many new rules.

"As we work to resolve the current crisis, we must also work to ensure that this situation never happens again. Above all, that requires updating the way we regulate America's financial system. Our 21st century global economy continues to be regulated by laws written in the 20th century," Bush said. "Just as importantly, we must guard against unintended consequences. We must ensure that new regulations aimed at Wall Street do not end up hurting responsible business owners, limiting the ability of American firms to raise capital, or putting American workers at a competitive disadvantage."

He added, "Despite corrections in the marketplace and instances of abuse, democratic capitalism remains the greatest system ever devised. It allows individuals to rise as high in their societies as their talents and ambition will take them. It rewards hard work, intelligent risk-taking, and the entrepreneurial spirit."

Bush Discusses "Serious" Economic Crisis

10/17/2008 3:13 PM ET

Bush at the center-left.

Bush Discusses "Serious" Economic Crisis

10/17/2008 3:13 PM ET

Seeking to reassure investors and businesspeople, President George W. Bush Friday sought to explain the origins of the financial crisis as well as the steps the government is taking to address it.

The crisis, which Bush called "serious," has sent the stock market reeling in recent days, in spite of a number of proposed federal interventions and the economy is still threatened by a potential freeze in credit markets.

But to understand the present problems, you have to look back more than a decade, Bush said, noting that low interest rates and an influx of capital from overseas had made it easy to borrow.

"This trend was especially apparent in the booming housing market, where many lenders issued mortgages to borrowers who could not otherwise afford homes. Many of those loans were then packaged into complex financial assets, which were sold to banks and investors all across the world," Bush said. "These developments came together to set off a chain reaction when the housing market began to decline."

Just as home values started to drop, many borrowers with adjustable rate mortgages saw interest rates spike, leading to a large number of defaults. That caused a blow to the financial institutions holding securities based on those mortgages.

"This led to high-profile bank failures, restrictions in lending, and widespread anxiety -- all of which contributed to sharp swings in the stock market," Bush said. "These developments were most visible on Wall Street, but their impact has reached far beyond. The drops in the stock market have eroded the value of Americans' retirement accounts and 401Ks. The tightening of credit has made it more expensive for many families to borrow money for cars and homes and college tuition. Many healthy businesses have found it harder to get loans to expand their operations and to create jobs for our workers."

To address these problems, Bush said, the government has responded with "systemic and aggressive" measures, but cautioned that things would not necessarily improve immediately.

"The actions will take more time to have their full impact. It took a while for the credit system to freeze up; it's going to take a while for the credit system to thaw," Bush said. "These are decisive measures aimed at the heart of our financial challenges. And they're big enough and bold enough to work. And the American people can be confident that they will."

The initial emphasis of the federal response was to prevent the collapse of the financial system, which teetered on the brink and could have gone under during a potentially disastrous "disorderly failure" of large, interconnected firms like Bear Stearns, American International Group and the government-sponsored mortgage giants Fannie Mae and Freddie Mac.

"Second, the government has taken unprecedented action to boost liquidity -- the grease that keeps the gears of our financial system turning," Bush said, pointing to the Federal Reserve's decision to inject hundreds of billions of dollars in liquidity into markets and support commercial debt while the FDIC is expanding its coverage of new debt and raising the caps on insured funds in private accounts.

But because the crisis is increasingly global in nature, Bush said, the response also has to come from around the world.

"Last week, the Federal Reserve and other central banks around the world enacted a joint cut in interest rates, which will help ease the pressure on credit markets around the world," Bush said. "Earlier this week, leaders in Europe announced steps to purchase equity in major banks, and provide temporary government guarantees for bank loans. … Our European partners are taking bold steps. They show the world that we're determined to overcome this challenge together. And they have the full support of the United States."

The U.S. Treasury Department will also be taking steps to purchase $250 billion of equity in banks around the country and will be buying up some of the "troubled assets that are weighing down banks' balance sheets and clogging the financial system," Bush said.

Calling the federal response "an extraordinary response to an extraordinary crisis" Bush also sought to assure the assembled businessmen and -women both that it was necessary and that it would only be temporary.

"I know many Americans have reservations about the government's approach, especially about allowing the government to hold shares in private banks. As a strong believer in free markets, I would oppose such measures under ordinary circumstances. But these are not ordinary circumstances," Bush said. "We took this measure as a last resort. Had the government not acted, the hole in our financial system would have grown larger … and ultimately the government would have been forced to respond with even more drastic and costly measures later on."

He added, "This program is designed with strong protections to ensure the government's involvement in individual banks is limited in size, limited in scope, and limited in duration."

The government will only buy "a small percentage" of stake in any given company, Bush said, to be sure that private investors maintain the majority of the company, and the government's shares in banks don't have broad voting rights. Furthermore the program includes provisions to encourage banks to buy out government ownership.

Bush also sought to reassure those concerned by the price of the financial rescue.

"I know many are worried about the price tag of this rescue package. Every dollar spent will be subject to strong oversight by a bipartisan board. We will ensure that failed executives do not receive a windfall from hard-earned taxpayer dollars," he said. "Ultimately, we believe the final cost will be significantly less than the initial investment."

Because some of the assets the government buys may increase in value, the Treasury may be able to make some profit from the purchase of assets that the market now considers toxic, Bush said. And the banks that get a government stake will have to pay quarterly dividends, which will increase sharply after five years, giving the companies an added incentive to buy out government ownership.

Bush also said he was committed to reforming the financial regulatory system, but cautioned against imposing too many new rules.

"As we work to resolve the current crisis, we must also work to ensure that this situation never happens again. Above all, that requires updating the way we regulate America's financial system. Our 21st century global economy continues to be regulated by laws written in the 20th century," Bush said. "Just as importantly, we must guard against unintended consequences. We must ensure that new regulations aimed at Wall Street do not end up hurting responsible business owners, limiting the ability of American firms to raise capital, or putting American workers at a competitive disadvantage."

He added, "Despite corrections in the marketplace and instances of abuse, democratic capitalism remains the greatest system ever devised. It allows individuals to rise as high in their societies as their talents and ambition will take them. It rewards hard work, intelligent risk-taking, and the entrepreneurial spirit."

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.