Friday, May 24, 2024 2:09:06 AM

From Timothy Howard concealing that FnF post $0 EPS, to the attorney Hamish Hume that has just opted out of filing the scheduled appeal on May 24th in the Wazee case that, for the first time, had challenged the ongoing NWS 2.0 in a recent 3rd amended complaint: SPS LP increase in the same amount as the Net Worth increase in the quarter, which translates into the Common Equity being substituted for SPS in the Equity or Net Worth of the Balance Sheet, currently concealed when these gifted SPS and its corresponding offset with reduction of Retained Earnings account (CET1) are missing on the Balance Sheet (Financial Statement fraud).

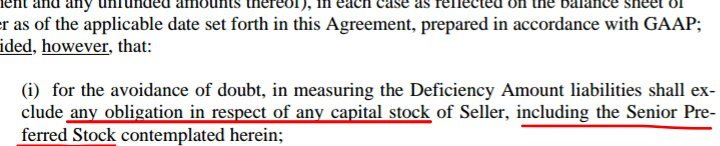

A Common Equity Sweep, equal to the prior Common Equity Sweep with the dividend payments (NWS dividend). This is why now, it's NWS 2.0: this time, the Net Worth grows but with the SPS (an obligation with respect of capital stock: an obligation is a compromise of repayment, that is, a debenture).

In other words, the underlying security in a Preferred Stock is an obligation, a fixed income security, just like a bond.

A made-up hybrid financial instrument.

As stated by the very Treasury Department and the FHFA in the SPSPA:

All the Preferred Stocks are permanent securities, but redeemable at the option of the issuer by definition.

So, Mnuchin's attempt to thwart it with "Optional Paydown of Liquidation Preference upon Termination of the Commitment", written in the January 14th, 2021 PA amendment, if I'm not mistaken, is wrong and futile: the SPS LP corresponding to the draws from UST were long gone: U.S. Code 4614(e) (December of 2013 and 2014)

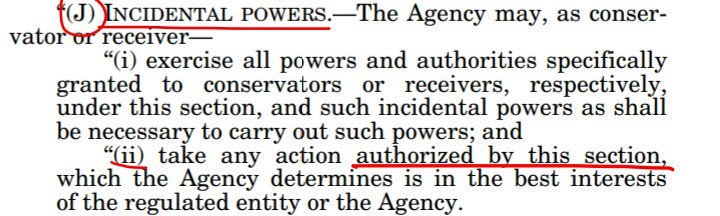

The only way to "rehabilitate FnF" required by Justice Alito, when he interpreted the FHFA-C's Incidental Power that must uphold the Power (as stated by judge Willett in his half-baked ruling that preceded the SCOTUS's opinion) and he read "restore FnF to a sound and solvent condition", is building up Common Equity, for the CET1 and the Core Capital.

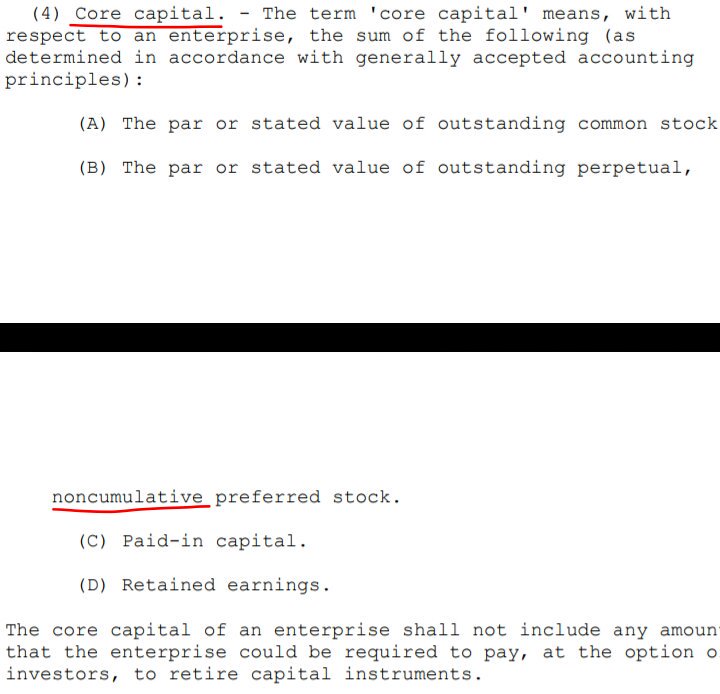

Tier 1 Capital = CET1 + Additional T1 (JPS)

Total Capital = Core Capital + Tier 2 Capital (ALLL account)

You can't rehabilitate FnF increasing the SPS. That's not "authorized by this section", unless it's part of a Separate Account plan, which is what Justice Alito authorized "...in a way beneficial to (in the best interests of) FHFA.". No "monetary benefit" allowed. Nice try though.

But regulatory capital.

All the items included in "regulatory capital" is for a reason: loss-absorbing capacity. Thus, the SPS isn't included due to its cumulative dividend feature.

It's a fact that the Treasury Department relinquished its dividend, primarily because it was aware that there is a special rate in the Charter Act in exchange for their Public Mission, that will be addressed in due time (estimated at a weighted-average 1.8% dividend rate with a 0.5% spread over Treasuries), either because it went through despite being restricted and unavailable for distribution (assessments applied towards the exceptions), and because it formally eliminated it to all effects with the 5th PA amendment, in favor of SPS LP increased for free, when it was called out by judge Willett and attempting to mislead us with "a game changer" (Justice Alito and the DOJ's Perdogar bought it). These gifted SPS are another capital distribution restricted. Oops!

The financial concepts have a definition for a reason. They want to change the definitions and problem solved!

What is it that you want? DENIED!

Peer To Peer Network aka Mobicard™ Launches AI Investor Chatbot Boosting Engagement & Lead Generation on Ihub • PTOP • Jul 15, 2024 8:30 AM

Greenlite Ventures Announces AI Integration into No Limit Platforms • GRNL • Jul 15, 2024 8:00 AM

Cannabix Technologies and Omega Laboratories Inc. Provide Positive Developments on Marijuana Breathalyzer Testing • BLO • Jul 11, 2024 8:21 AM

ECGI Holdings Enhances Board with Artificial Intelligence (AI) Expert Ahead of Allon Apparel Launch • ECGI • Jul 10, 2024 8:30 AM

Avant Technologies to Meet Unmet Needs in AI Industry While Addressing Sustainability Concerns • AVAI • Jul 10, 2024 8:00 AM

Panther Minerals Inc. Launches Investor Connect AI Chatbot for Enhanced Investor Engagement and Lead Generation • PURR • Jul 9, 2024 9:00 AM