Friday, May 17, 2024 3:56:24 AM

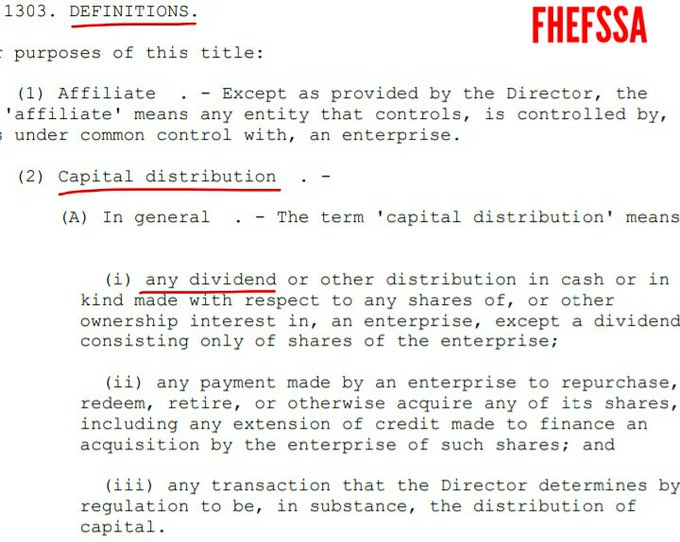

Remember that he is required to pay us Punitive Damages, for going to the Supreme Court as Amicus Curiae, to repeat a dozen times that "the SPS are non-repayable securities", when it's precisely the paydown of the SPS the only capital distribution authorized in this amendment inserted by HERA in the FHEFSSA.

Why doesn't he mention the capital distributions that are really restricted? Dividends, today's SPS LP increased for free and the Lamberth rebate.

I will add a comment not posted ever before, about his assertion: "SPS, non-repayable securities" not written anywhere, because that was a feature of the company Resolution Trust Corporation (RTC), owned by the government, created for the bailout of the FHLBanks in 1989 and their small and regional banks, in what is known as the savings and loans (S&L) crisis.

It was also set up Resolution Funding Corp (RefCorp), fully owned by the FHLBanks (Equity holders) for their bailout and a $30B RefCorp obligation that only paid interests, which doesn't mean that the FHLBanks only had to pay interests stated by the FHFA below.

A 10% interest rate at the time, with a 0.299% spread over Treasuries GAO report-. It was Sandra Thompson who tapped the maximum $30B authorized by law (Who does that?), just when she arrived at the FDIC in 1990 and later, both DeMarco (sole Accountant GAO after the expulsion of PwC. Then, UST) and ST, decided to pay only interests ($300mll annuity), not the principal of the obligation as clearly stated in their Separate Account statutory wording:

.jpeg)

They changed the payment of the principal of Refcop obligation, for "an obligation to pay interests", as we can read in this press release.

The obligation (security) only paid interests. The FHLBanks had to pay interests and principal of the Refcorp obligation. Isn't it clear?

Resolution Funding Corp (RefCorp) invested in RTC, which, in turn, invested in Public-Private Partnerships with Wall Street. What can go wrong?

This is why FSOC requested to Congress last Friday another fund for the resolution of the non-bank mortgage servicers.

Yellen, FSOC Chair, and Sandra Thompson (FSOC member) have become addicted to these "resolution funds" that end up in Public-Private Partnerships with Wall Street and it's when the manufactured crises become very profitable and useful for "loss-mitigation options for borrowers" and the politicians' dream to put a name on (Obama's programs, etc.)

As we can read in the FSOC press release of May 10th (mortgage servicers don't own the mortgages, so they can't carry out loss-mitigation activities without an express authority of the owners of the mortgages):

The fund should be designed to facilitate operational continuity of servicing, including loss-mitigation

The 40-year RefCorp obligation paying a 10% interest rate remains outstanding in full. Thank goodness that ST became FHFA Director to prompt a liquidity crisis in some regional banks, with outsized avances (loans) and the Held-To-Maturity portfolios authorized by the Federal Reserve and the FDIC, and the FDIC could seize $SVB recently, to make up for the $30B in losses with the RefCorp obligation.

The point is, shares in RTC where RefCorp invested in, were non-repayable securities, as stated in the statutory wording of the bailout.

So, Timothy Howard must have known the dynamics of the 1989 bailout of the FHLBanks. This is why he has brought up the feature of non-repayable securities for the SPS as well.

But a few months ago, about a Separate Account plan in FnF too, he said in his blog:

Separate Account? I don't know what that is.

"Separate Account" is expressly written in the statute of the FHLBanks. Evidence that he was playing the fool.

It's time for the plotters to learn what is restricted and what is not. We are running out of diapers.

Capital distributions, restricted.

I am not a regulatory lawyer but a litigator (another attorney for Berkowitz, David Thompson)

FEATURED DaBaby and Stunna 4 Vegas's "NO DRIBBLE" Joins Music Licensing, Inc.'s Portfolio • Jun 7, 2024 10:15 AM

Mushrooms Inc. (OTC: MSRM) Announces Significant Share Buy Back by the Board Director and New Strategic Initiatives. • MSRM • Jun 5, 2024 1:32 PM

Hydromer Announces Launch of HydroThrombX Medical Device Coating Technology • HYDI • Jun 5, 2024 10:24 AM

Dr. Michael Dent Finances $1 Million to Drive HealthLynked's Healthcare Transformation • HLYK • Jun 5, 2024 8:00 AM

Avant Technologies Enters Binding LOI to Purchase Dozens of High-Performance, Immersible, AI-Powered Servers • AVAI • Jun 5, 2024 8:00 AM

IQST - iQSTEL Announces $290 Million 2024 Annual Revenue Forecast • IQST • Jun 4, 2024 1:43 PM