Wednesday, May 15, 2024 3:04:00 AM

The underlying security is an obligation. A fixed-income security with a legal claim on dividend (coupon) payments and the par value. It trades close to the par value all along, depending on the market interest rates in relation to its coupon, just like a bond.

With the dividend suspended as per its contract or prospectus (at the BOD's discretion) and the statutory Restriction on Capital Distributions, it trades at a discount to par value, discounting the time period to resume dividend payments.

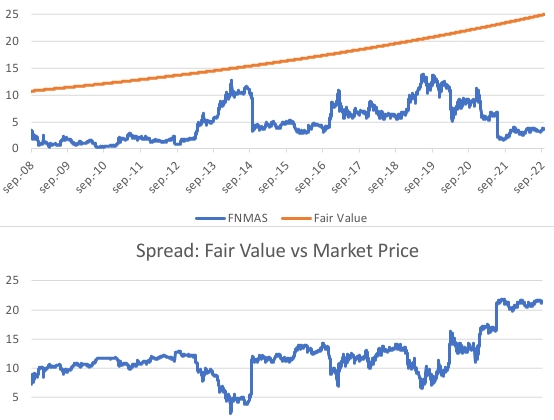

This is the chart with a 6% discount rate, assuming the dividend was resumed under the Table 8: Payout ratio, with the 3Q2022 results.

The JPS holders like Berkowitz are annoyed with this chart (primarily, in comparison with a common stock that trades at x times the EPS) and embarked on a con operation in the U.S. courts when they learned that the UST in 2011 required the Basel-framework for capital requirements for the release from conservatorship, but this is their fair value. JPS have this risk and this is why they get a higher dividend rate than the interest rate on similar obligations by the same issuer. He thought that he was outsmarting them, with no strings attached.

It has ended up with Mnuchin requiring, as compensation to UST, SPS LP increases (another capital distribution restricted) 1:1 Net Worth increase in FnF, so that later he requires that the same haircut for these gifted SPS, be applied to the JPS of his buddy, Berkowitz (Calabria told us in his book).

This is Regulatory Risk (Leverage ratio or Minimum Captial Level: Core Capital > 2.5% of ATA, versus 0.25% before, for the off-balance sheet obligations -MBS Trusts-.). Even an additional 25% of the Prescribed Capital Buffer is necessary (Table 8 of the Capital Rule: Payout ratio) to recover the par value.

Then, Conservator Risk. FHFA-C, in the best interests of FHFA-R, is maintaining the dividend suspension seeking "Membership cleansing", that is, fetch CET1 > 2.5% of ATA, so that the JPS (AT1 Capital) can be redeemed before the Privatized Housing Finance System is unveiled (Tier 1 Capital > 2.5% of ATA), FnF were bound for, since it was chosen for the release by the UST in 2011.

A replica of the FHFA final rule of 2016, about the expulsion of the unwanted members of the FHLBanks.

Cannabix Technologies and Omega Laboratories Inc. Provide Positive Developments on Marijuana Breathalyzer Testing • BLO • Jul 11, 2024 8:21 AM

ECGI Holdings Enhances Board with Artificial Intelligence (AI) Expert Ahead of Allon Apparel Launch • ECGI • Jul 10, 2024 8:30 AM

Avant Technologies to Meet Unmet Needs in AI Industry While Addressing Sustainability Concerns • AVAI • Jul 10, 2024 8:00 AM

Panther Minerals Inc. Launches Investor Connect AI Chatbot for Enhanced Investor Engagement and Lead Generation • PURR • Jul 9, 2024 9:00 AM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM