Tuesday, May 07, 2024 8:21:58 AM

The revelation of the attorneys’ fees and nontaxable costs and expenses, better known as "the fat bonus" for their con job, is being postponed to the maximum by the allies: FHFA, the litigants and judge Lamberth.

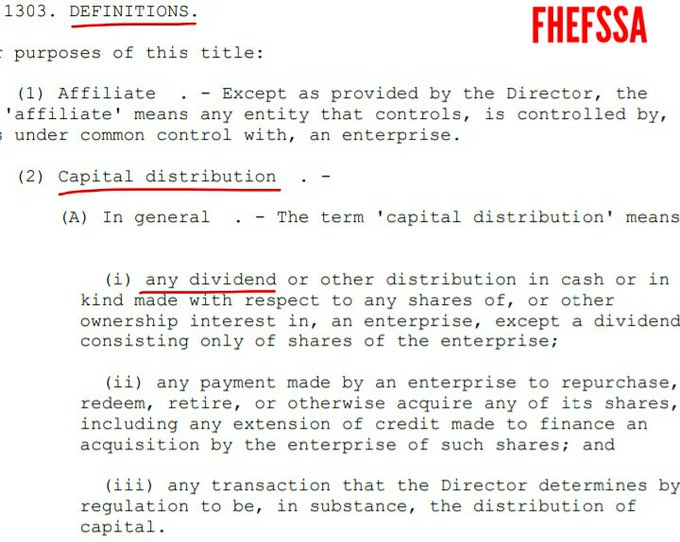

The felony already happened with the jury award. This "Lamberth rebate" was included in the definition of capital distribution with the famous Final Rule of July 20, 2011 (CFR 1229.13 shown in the tweet below), thanks to an express grant of authority by statute in the number 3:

The FHFA doesn't have authority to override the law that states that capital distributions are restricted.

That's not what "in the best interests of the Agency" is about (FHFA-C's Incidental Power), because it isn't meant to turn a Federal Agency into an outlaw. Secondly, it isn't "authorized by this section" (FHFA-C's Rehab Power).

The key: it would expose the other capital distributions during Conservatorship:

-Dividends.

-SPS increased for free in the absence of dividends.

Both, number 1 in the definition of capital distribution.

Which makes us come to the conclusion that they've been assessments in the form of capital distributions, applied towards the exceptions in the law (pay down the SPS - statute- and recapitalization in a separate account - CFR1237.12-) in order to legalize those payments that went through despite the restriction.

An attempt to mimic the assessments sent into a Separate Account plan invested in zero coupon Treasuries, to reduce the principal of the RefCorp obligation, besides interest payments ($300mll annuity), in the 1989 FHLBs' bailout by Congress @ a rate with a 0.299% spread over Treasuries (GAO report).

With FnF, dividends are restricted, so the entire assessment was applied towards the reduction of the SPS.

THE ALLIES FHFA-LITIGANTS-LAMBERTH AFRAID OF UNVEILING THE FAT BONUS TO THE UNSOPHISTICATED ATTYS

— Conservatives against Trump (@CarlosVignote) May 7, 2024

30% cut?

14days Rule,swapped for

45days:May23

Or

30days after a motion. Hence the surreal JMOL pending.

The felony was the award: a capital distribution #3,restricted.

#1?#Fanniegate pic.twitter.com/EmetX7YLUe

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM