| Followers | 686 |

| Posts | 142406 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, May 04, 2024 11:34:42 AM

By: Hedgopia | May 4, 2024

• Following futures positions of non-commercials are as of April 30, 2024.

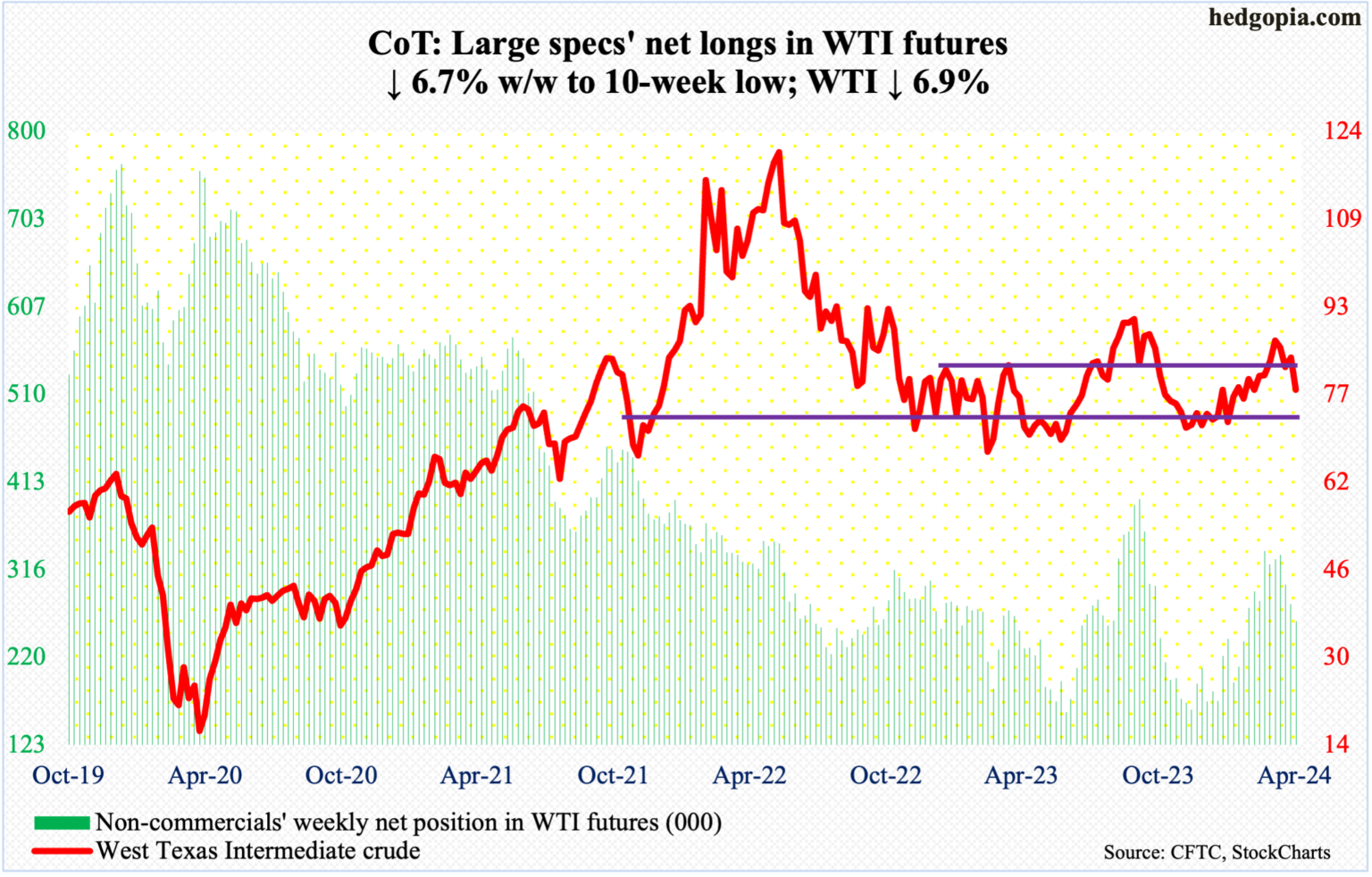

WTI Crude Oil: Currently net long 259.7k, down 18.8k.

West Texas Intermediate crude dropped in all sessions this week, down 6.9 percent for the week to $78.11/barrel. This was the third down week in four. The crude rallied from $67.71 last December to $87.67 on April 12th before coming under pressure.

This week, both the 50- and 200-day were breached. WTI concurrently fell back into a well-established range between $71-$72 and $81-$82 that persisted for 19 months before the upper end gave way five weeks ago. Even more important, it ended the week right on a rising trendline from last December’s low. A likely breach can eventually open the door toward the lower end of the range in question.

In the meantime, US crude production in the week to April 26th was unchanged for eight consecutive weeks at 13.1 million barrels per day; 10 weeks ago, output was at a record 13.3 mb/d. Crude imports increased 275,000 b/d to 6.8 mb/d. As did crude and gasoline inventory, which respectively rose 7.3 million barrels and 344,000 barrels to 460.9 million barrels and 227.1 million barrels. Distillate stocks, however, dropped 732,000 barrels to 115.9 million barrels. Refinery utilization declined one percentage point to 87.5 percent.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

FEATURED Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM