Thursday, May 02, 2024 2:59:39 AM

Existing common shareholders do not own the companies at all. They have no economic rights and no voting rights. Nothing.

Economic rights don't exist because there is no "right" to anything, but a legal claim.

For instance, the JPS have a legal claim on a dividend payment as per contract with FnF, but there is no Right, as those can be suspended at the discretion of the Board of Directors (for recapitalization, not for fun) and also, restricted by law when FnF remain undercapitalized (Restriction on Capital Distributions. IN GENERAL).

A Common Stock represents a legal claim on all the future EPS ( Net Income Attributable to common shareholders, after the payment of compensation to the Preferred Stocks, and shares on a fully diluted basis -Warrant-. Hence today's market price discounting a Machiavellian Conservatorship).

You mean Property Rights like the Legal Ownership, which is inherent to a common stock and they've remained deposited in our broker accounts all along, acting as custodians.

You are talking about a Receivership instead.

Other rights, like Voting Rights were transferred to the conservator in order to allow it to fulfill its statutory mission.

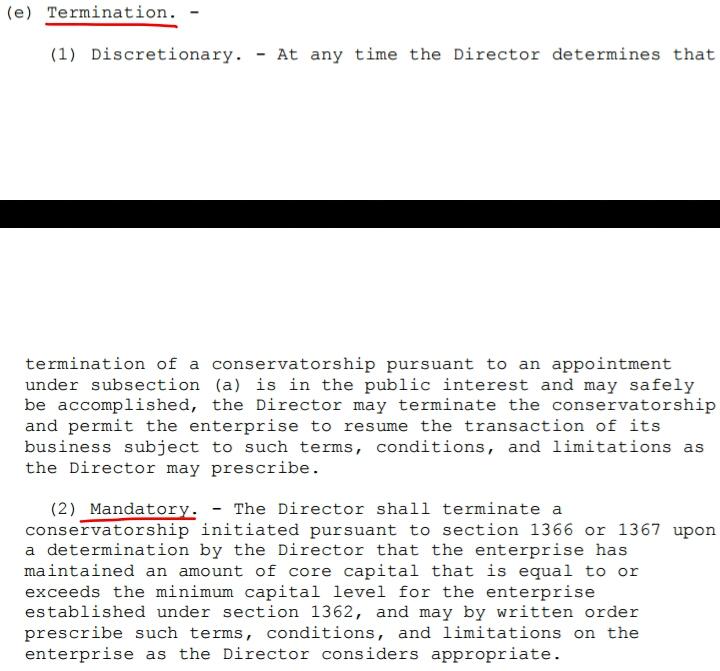

Once FnF have met some minimum thresholds (MANDATORY release Undercapitalized in the FHEFSSA , struck by HERA. Image below), FnF are released from the TEMPORARY Conservatorship, and those rights are returned, unless the conservator uses its Incidental Power "in the best interests of the Agency" ("authorized by this section" means Capital Adequacy-wise), to extend it more years, seeking a "membership cleansing" (FHLB-style in a 2016 Final Rule) with the redemption of the JPS (Core Capital and AT1 Capital), which is what is happening (Conservator Risk).

FEATURED North Bay Resources Acquires Mt. Vernon Gold Mine, Sierra County, California, with Assays up to 4.8 oz. Au per Ton • Jul 18, 2024 9:00 AM

VAYK Expects Revenue from First Airbnb Property Starting from August • VAYK • Jul 18, 2024 9:00 AM

Nightfood Holdings Signs Letter of Intent for All-Stock Acquisition of CarryOutSupplies.com • NGTF • Jul 17, 2024 1:00 PM

Kona Gold Beverages Reaches Out to Largest Debt Holder for Debt Purchase Negotiation • KGKG • Jul 17, 2024 9:00 AM

Avant Technologies Welcomes Back Former CEO with Eye Toward Future Growth and Expansion • AVAI • Jul 17, 2024 8:00 AM

HealthLynked Expands Telemedicine Nationwide • HLYK • Jul 17, 2024 8:00 AM