Saturday, April 20, 2024 8:55:48 PM

For the fiscal year ended December 31, 2023

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001483646/000106594924000044/begi-20231231.htm

Holders

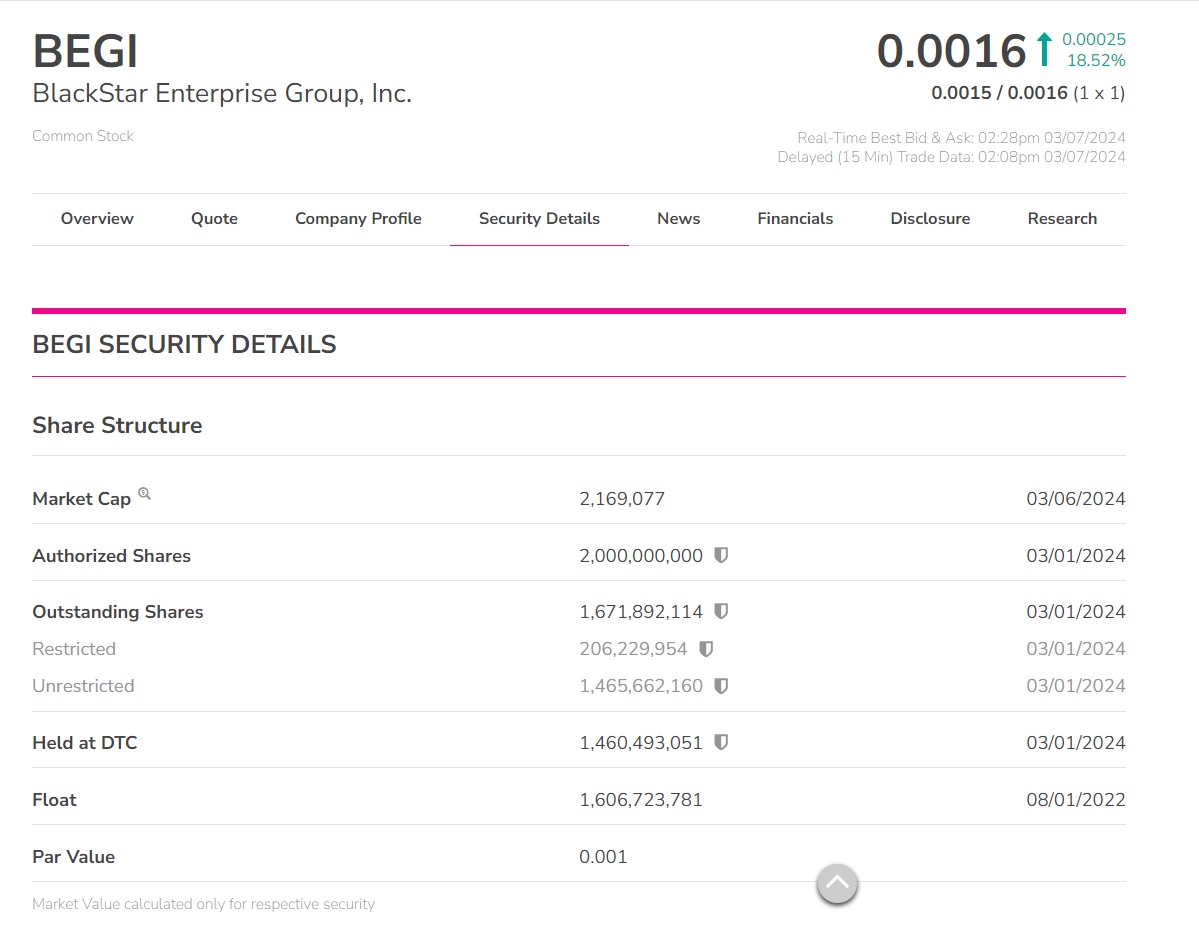

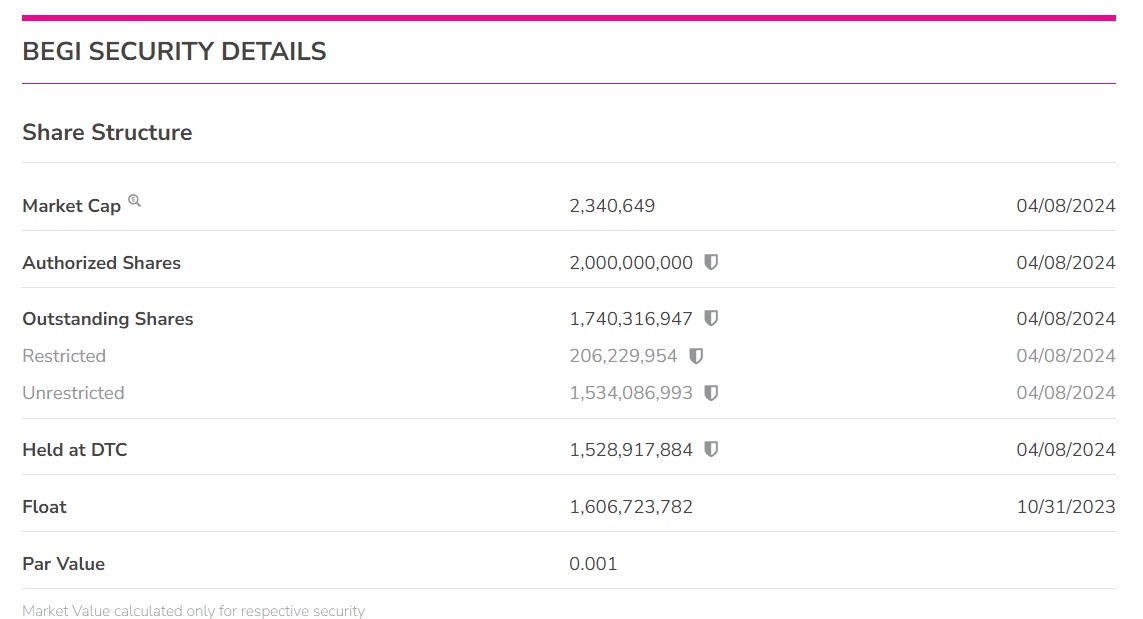

As of December 31, 2023, there were approximately 351 record holders of 1,544,696,448 shares of our common stock. The Company has also reserved out of its authorized Common Stock approximately 259,683,053 shares of Common Stock for conversion pursuant to the convertible promissory notes as of March 29, 2024.

In 2024, GS Capital filed notices of conversion and were issued, in three tranches, 195,620,499 shares of the Company’s common stock at a price of $0.00006 per share on their note of October 11, 2021. (See Notes 7 and 11)

FORM 8-K

Update to November 6, 2023 Nevada Lawsuit

Date of report (Date of earliest event reported): January 11, 2024

Note entered into on October 11, 2021, which had a remaining principal balance of $33,682. At the outset of the case, a temporary restraining order was entered preventing the Company from trading any shares. As currently postured, Plaintiff seeks specific performance (a mandatory injunction) requiring the conversion of approximately 257,000,000 shares and possibly additional recovery of legal fees and interest. The lawsuit increases the Company’s financial and administrative burdens and is a risk to the Company’s capital.

Meanwhile, the preliminary injunction ordered the Company to honor the conversion requests of November 2, 2023 (for the conversion of 62,084,333 shares of common stock – completed December 21, 2023) and the three subsequent requests GS Capital claimed it “would have” made (62,023,333 shares, 65,168,333 shares, and 68,425,500 shares). In order to comply with the mandatory injunction, prior to the stay, the Company increased the share reserve for GS Capital Partners LLC and they subsequently completed the first two conversions.

Everything that I post is just my informed opinion and is simply an invitation to debate. Trade on your own due diligence please..

Recent BEGI News

- Form 8-K - Current report • Edgar (US Regulatory) • 01/23/2024 05:23:53 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/20/2023 03:16:52 PM

- Epazz, Inc. (OTC Pink: EPAZ) US Navy Collaboration ZenaDrone 1000 • InvestorsHub NewsWire • 11/09/2023 01:00:34 PM

- Epazz, Inc. (OTC Pink: EPAZ) US Navy Collaboration ZenaDrone 1000 Extreme Weather Demo • InvestorsHub NewsWire • 11/07/2023 12:29:43 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/01/2023 03:37:21 PM

- Shares of Revolutionary Blockchain Trading Platform on a Tear • AllPennyStocks.com • 09/11/2023 03:07:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/14/2023 05:41:27 PM

- Form EFFECT - Notice of Effectiveness • Edgar (US Regulatory) • 07/06/2023 04:15:04 AM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM