| Followers | 679 |

| Posts | 141062 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Saturday, April 20, 2024 10:17:55 AM

By: Hedgopia | April 20, 2024

• Following futures positions of non-commercials are as of April 16, 2024.

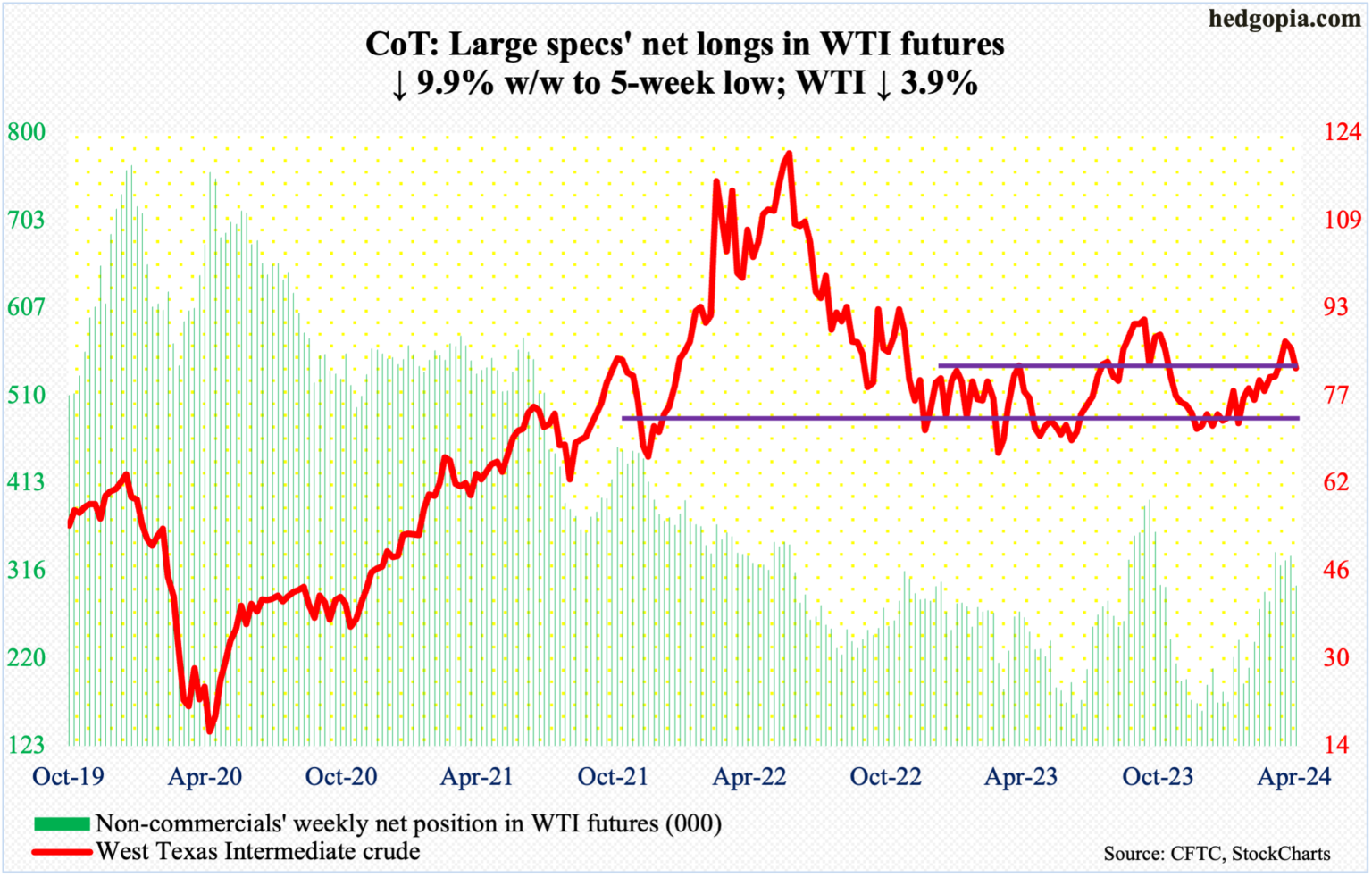

WTI Crude Oil: Currently net long 300.1k, down 32.9k.

West Texas Intermediate crude had its back-to-back down week. On Friday last week, it ticked $87.67 intraday. This week, it rose as high as $86.18 on Tuesday, before ending the week down 3.8 percent to $82.22. Friday’s session was volatile with a high of $85.64 and a low of $81.13; in the end, traders decided the Israel-Iran conflict is not likely to spiral out of control – not yet anyway.

The crude has come a long way from last December’s bottom at $67.71. Traders will be particularly tempted to lock in profit if breakout retest at $81-$82 fails. WTI went back and forth between $71-$72 and $81-$82 for a year and a half before pushing through the upper end three weeks ago. The breakout is currently being tested.

In the meantime, US crude production in the week to April 12th was unchanged for six consecutive weeks at 13.1 million barrels per day; eight weeks ago, output was at a record 13.3 mb/d. Crude imports increased 27,000 b/d to 6.5 mb/d. As did crude inventory, which rose 2.7 million barrels to 460 million barrels. Stocks of gasoline and distillates, however, dropped 1.2 million barrels and 2.8 million barrels respectively to 227.4 million barrels and 115 million barrels. Refinery utilization dropped two-tenths of a percentage point to 88.1 percent.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM