| Followers | 690 |

| Posts | 144171 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, April 19, 2024 5:18:34 PM

By: Bruce Powers | April 19, 2024

• Historical context suggests that 1.52 support is significant, suggesting that a drop below it could lead to further selling, and if it is retained there is the potential for an eventual upside breakout.

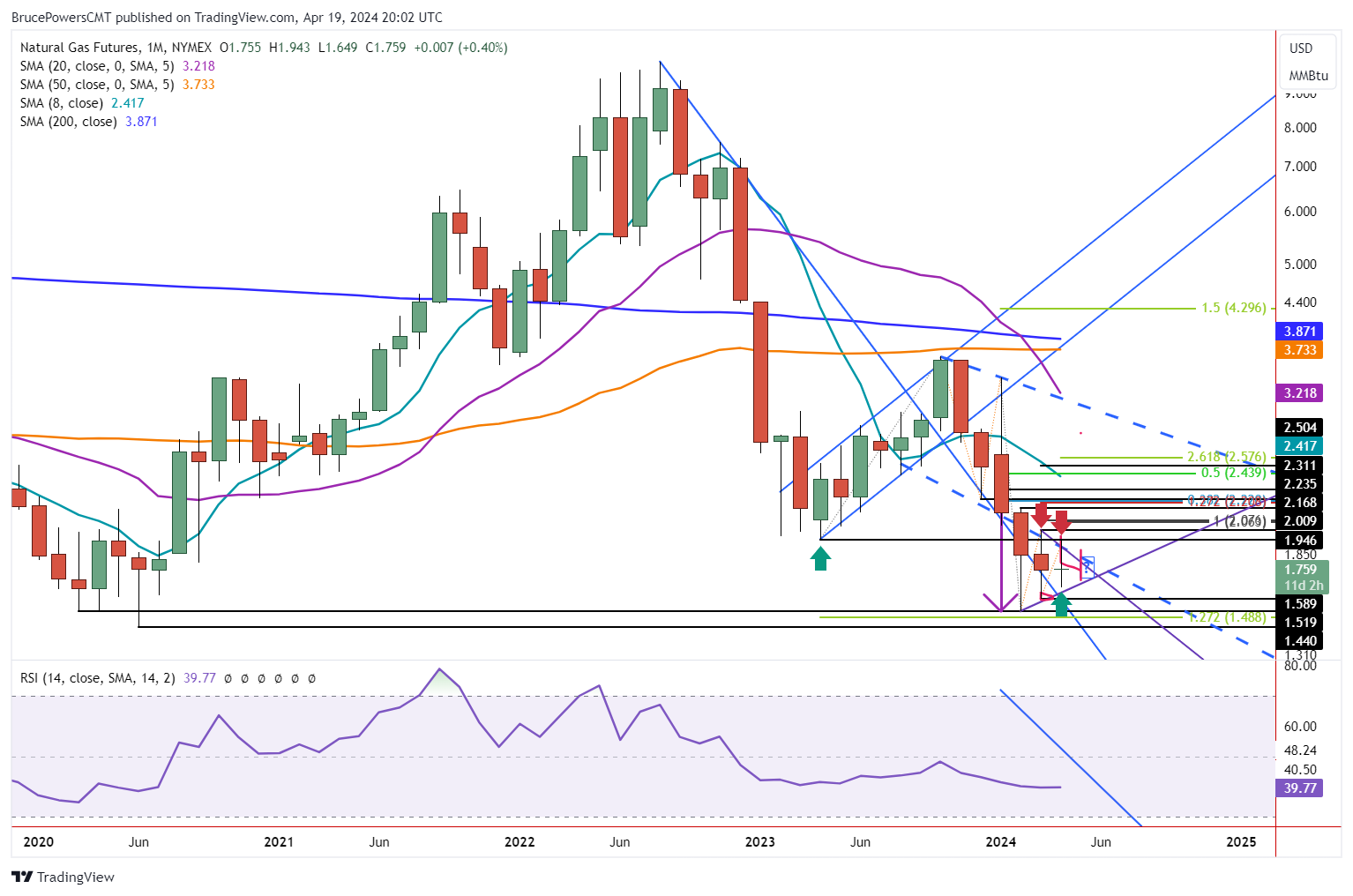

Natural gas shows signs of strength but cannot sustain it. A breakout above the three-day high of 1.80 triggered today before resistance was seen around 1.81. That led to a selloff that took natural gas down to the lower half of the day’s range.

Although the breakout to a four-day high is a sign of strength, the potential close in the lower half of the range is not. Moreover, Thursday also closed in the lower half of the range. Nevertheless, this is the type of uncertainty that can be expected when trading occurs inside a clear consolidation pattern.

Directionless Choppy Outlook Until Breakout

A bear pennant trend continuation consolidation pattern has been forming and the swing low at 1.65 that was reached on Tuesday further confirmed the pattern. That swing low has been followed by a low momentum advance. The logical target is an eventual test of resistance at the top boundary line of the pattern. If resistance is then seen, a possible drop to test the lower line may occur. In other words, until there is a clear breakout of the pennant momentum and volatility will be diminished.

Upside Breakout Would Be Bullish

Although this pennant is considered bearish since it is within a downtrend, a bullish reversal can also occur. On the downside, a decline below this week’s low of 1.65 indicates that a breakdown has started. The first target would then be the trend low at 1.52. However, if the breakdown follows through as it normally might, a decline to new trend lows is likely. Given that, it is important to consider historical context.

Sitting On Strong Support

In June 2020 natural gas reversed from a swing low of 1.44. That low was the lowest traded price in natural gas of the past 28 years. The prior low was 1.52, which is where it found support most recently. Further, the decline below support of 1.52 to the new low of 1.44 occurred in only one day.

A daily close above the 1.52 level occurred the next day and it was followed by a sustained rally. What this seems to indicate is that another drop below 1.52 could be a big deal and lead to further selling and risks seeing natural gas fall below 1.44. Also, there is a good chance that 1.52 is not broken to the downside given its significant, and an upside breakout of the pennant eventually occurs.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

ZenaTech, Inc. (NASDAQ: ZENA) Launchs IQ Nano Drone for Commercial Indoor Use • HALO • Oct 10, 2024 8:09 AM

CBD Life Sciences Inc. (CBDL) Targets Alibaba as the Next Retail Giant for Wholesale Expansion of Top-Selling CBD Products • CBDL • Oct 10, 2024 8:00 AM

Foremost Lithium Announces Option Agreement with Denison on 10 Uranium Projects Spanning over 330,000 Acres in the Athabasca Basin, Saskatchewan • FAT • Oct 10, 2024 5:51 AM

Element79 Gold Corp. Reports Significant Progress in Community Relations and Development Efforts in Chachas, Peru • ELEM • Oct 9, 2024 10:30 AM

Unitronix Corp Launches Share Buyback Initiative • UTRX • Oct 9, 2024 9:10 AM

BASANITE INDUSTRIES, LLC RECEIVES U.S. PATENT FOR ITS BASAFLEX™ BASALT FIBER COMPOSITE REBAR AND METHOD OF MANUFACTURING • BASA • Oct 9, 2024 7:30 AM