Friday, April 12, 2024 1:18:03 AM

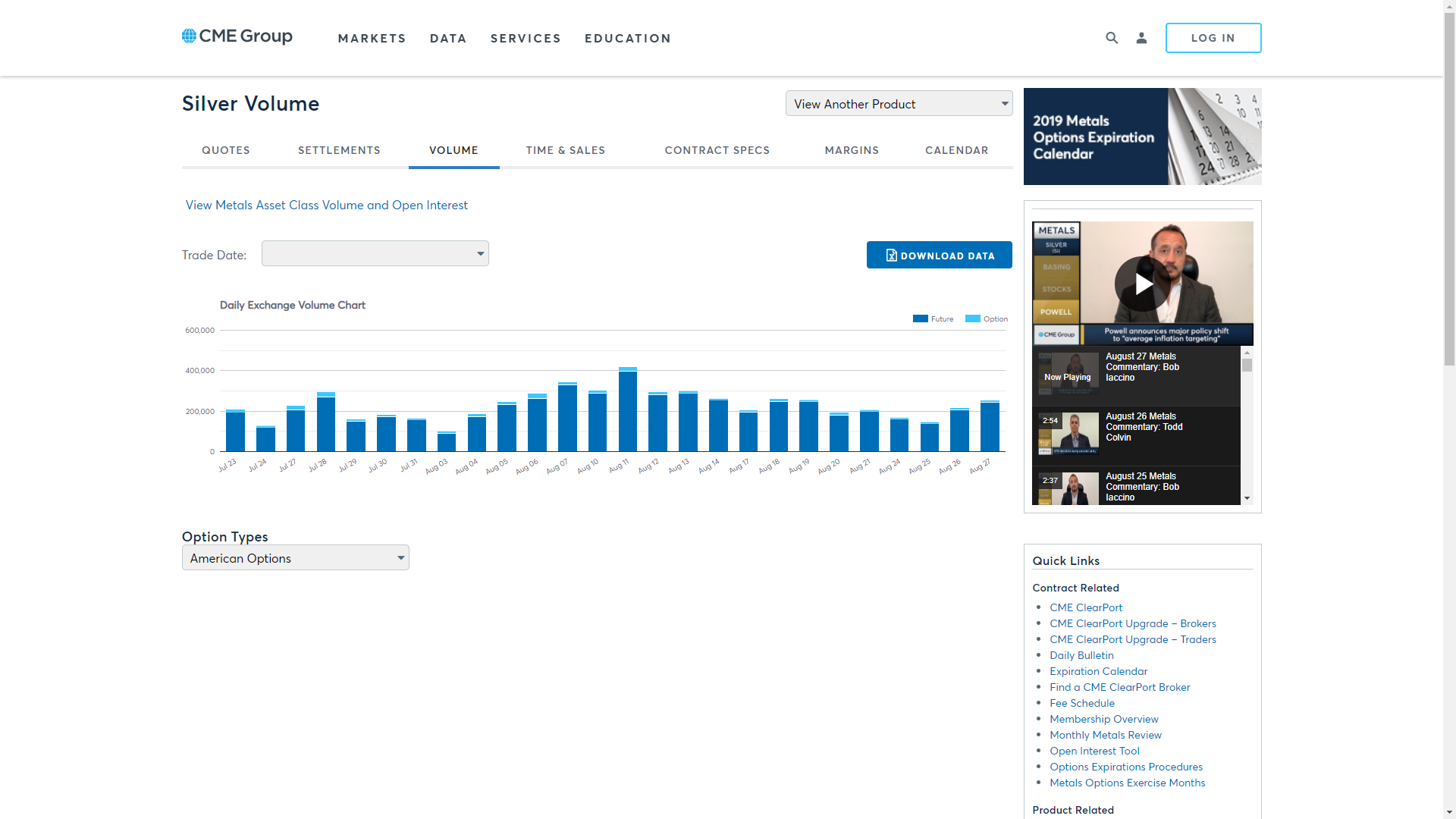

Right now they are using about 180,000 contracts of SLV to control the price of silver:

https://www.cmegroup.com/markets/metals/precious/silver.volume.html

Those bars are rising. They are using more and more to control the price daily. Imagine if they weren't what the price would be.

I want to use a comparison.

Here are the numbers during the last "Silver Squeeze" in 2020:

The daily average was around 200,000 for almost a month and at its peak it was 400,000 contracts in one day.

The have not yet used nearly the power they can.

There are 95,935 contracts due by the end of May:

https://www.cmegroup.com/markets/metals/precious/silver.volume.html

They are moving a lot back to July. However they still have to deal with 95,935. Which is 95,935x5000=479,675,000 ounces of silver to be delivered by the end of May.

The price of silver throughout May of last year was between 23 and 26 dollars. So if the contracts were created last year for delivery in May of this year, they will want to get the price of silver as close to 23 and 26 dollars by the end of may.

https://www.bullionvault.com/silver-price-chart.do

I know it is exciting right now. And I assure you they are far more concerned with the price of silver than gold. They can let gold rise. They aren't using gold in consumer goods.

And it does not look like they are focusing on gold at the moment either:

https://www.cmegroup.com/markets/metals/precious/gold.volume.html

But they will have to deal with the silver price.

The fact is that right now they are creating and settling contracts for Sept of '25 at 30 dollars:

https://www.cmegroup.com/markets/metals/precious/silver.settlements.html

March of '25 at 29.50

When they settle contracts they are legally binding.

They have to fill those orders. So if the settle price last year was between 23 and 26 dollars. And they have to buy that silver to fill the contracts. They don't want to pay more than the contracted price for silver. So I am expecting that throughout the month of May we will see the price of silver between 23 and 26 dollars.

May 2nd 2023 26 dollar silver

May 22nd 2023 23 dollar silver.

https://www.bullionvault.com/silver-price-chart.do

A Democracy is 2 wolves and a lamb arguing what's for dinner. In a Constitutional Republic the lamb is armed. We live in a Constitutional Republic.

Recent SLV News

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/03/2023 06:39:51 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/04/2023 06:19:53 PM

- Will Silver’s 200-Day MA Break? • ValueWalk • 06/30/2023 07:38:03 PM

- Silver Hangs On By A Thread • ValueWalk • 06/16/2023 05:46:04 PM

- Silver Market Deficit Reaches All-time High In 2022 Amidst Investor Indifference • ValueWalk • 06/10/2023 03:23:22 PM

- Silver’s Swoon Should Resume • ValueWalk • 06/05/2023 05:22:07 PM

- Silver’s Slide Was Far From A Surprise • ValueWalk • 05/19/2023 09:51:37 PM

- When Banks Drop, Silver Pops • ValueWalk • 05/05/2023 08:39:19 PM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM

Avant Technologies to Implement AI-Empowered, Zero Trust Architecture in Its Data Centers • AVAI • Apr 29, 2024 8:00 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM