Thursday, April 11, 2024 3:43:07 AM

Too bad that $152B was already taken away from the enterprises: $110B SPS overpayment, $19B CRT expenses, net (Charter-unauthorized credit enhancement operation), and the $25B settlement of the PLMBS lawsuit, net of attorney's fees (the cash refund is $2B lower than the sum, in order to comply with the Asset-Liability matching principle when everything is unwound: $244B posting in their Retained Earnings accounts; Treasury Stock, retired. The UST got lucky).

Therefore, it'd only have $26B available for new investments or debt forgiveness across the board.

SUMMARY

$178B profit with a Taking + resale.

+$42B in TCCA fees (10 bps guarantee fee funneled to UST under the TCCA. Now, BBB Act)

+$5B allocated to 2 Affordable Housing funds managed by HUD and UST (4.2 bps on new acquisitions)

+$15B owed to FnF as managers of Obama's Making Home Affordable program (estimation too)

TOTAL = $240B

A pretty decent windfall knowing that the Treasury Department is forbidden to make money using the assets and securities of FnF in the Charter Act, other than the rate on the original UST backup of FnF since the Charter's inception (estimated at a weighted-average 1.8% cumulative dividend on SPS. It's netted out with the interests on the $152B it owes to FnF)

Also taking into consideration that Ginnie Mae kept the special assistance functions when it was spun off from Fannie Mae in 1968.

Pagliara talks about the Warrant gotten at no cost, and he calls it "investment", disregarding the reason why this security was authorized in the first place: to (iii) protect the taxpayer (collateral).

The exercise price of $0.00001 per share is evidence in itself of being considered as collateral of the investment in SPS.

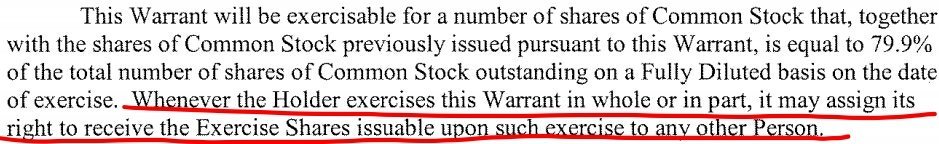

Let alone the "shares assigned to any Person" clause 2.1 of the prospectus, for the assault on the ownership paying nothing, better than paying a Price Earnings Ratio of 10 and 12 times, for FNMA and FMCC, or even greater.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM