Tuesday, April 09, 2024 7:16:28 PM

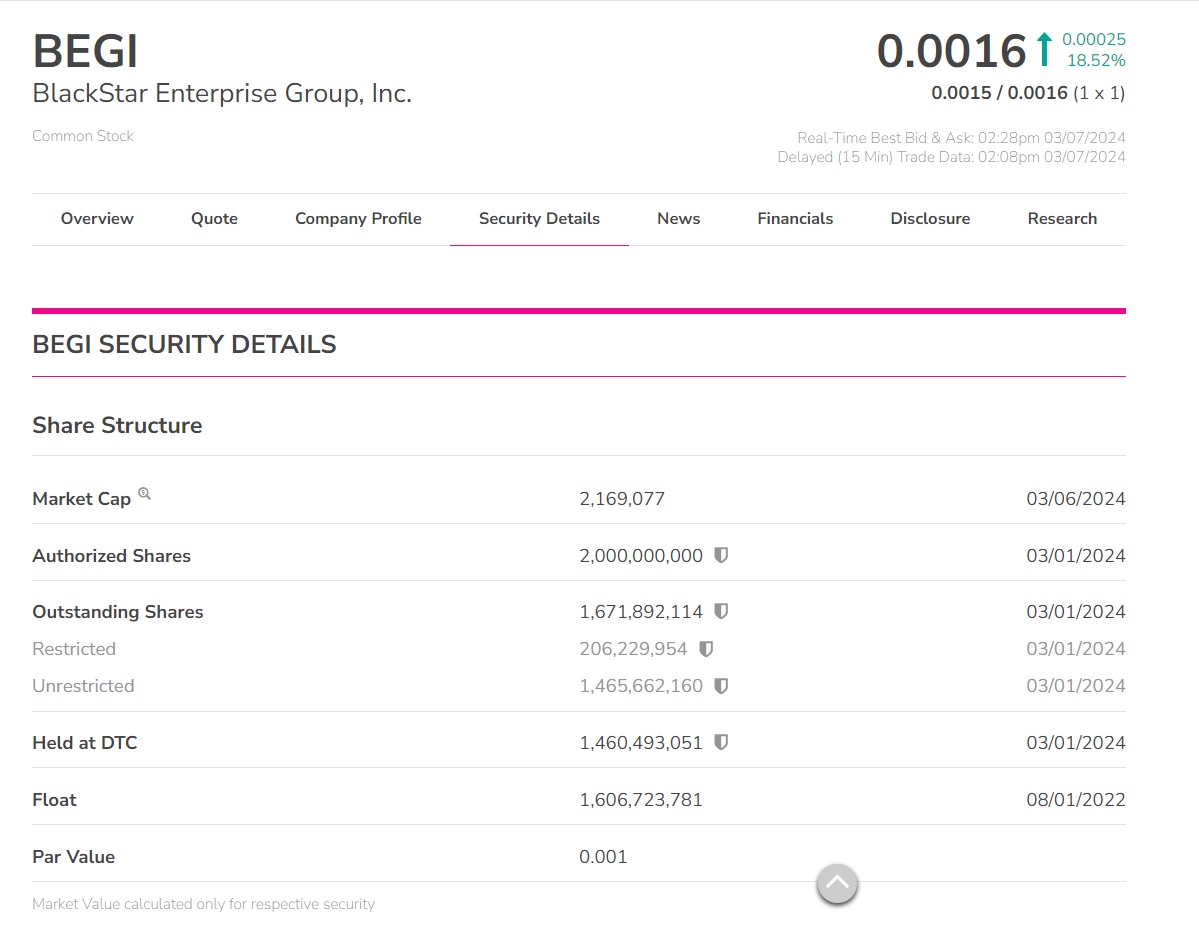

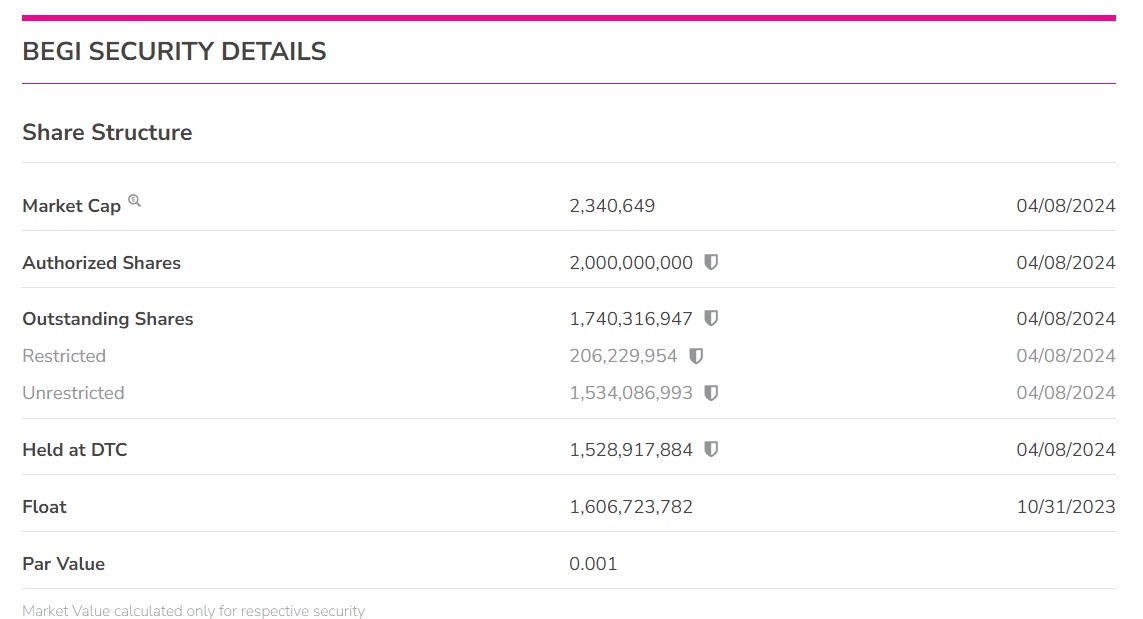

The January 5th update revealed that 300,124,013 shares were issued after the December 22nd update. The January 5th increase included 153,350,000 being restricted with a balance of 146,774,013 shares. Add in the three subsequent increases we have a total of 342,394,512 shares. This appears to be more than the total ordered in the preliminary injunction of 257,701,499 shares.

That is an extra 84,693,013 so we have to question if the restraining order that GS Capital was able to get last November preventing Blackstar from trading any new shares was lifted or are all those shares for the lawsuit. There were a ton of conversions queued up for this promotional period before lawsuit shut it down so stand by for more. Next up for the lawsuit are the question of legal fees, interest, and that note had nasty default terms including daily penalties for not delivering the requested share conversions. Blackstar needs to "make hay while the sun shines" and new money will be needed. These bag holders who have been pumping the he77 out of this for months are looking for the exits in my opinion.

FORM 8K Lawsuit Update

Date of report (Date of earliest event reported): January 11, 2024

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001483646/000106594924000003/blackstar8kjan232024.htm

At the outset of the case, a temporary restraining order was entered preventing the Company from trading any shares. As currently postured, Plaintiff seeks specific performance (a mandatory injunction) requiring the conversion of approximately 257,000,000 shares and possibly additional recovery of legal fees and interest. The lawsuit increases the Company’s financial and administrative burdens and is a risk to the Company’s capital.

Meanwhile, the preliminary injunction ordered the Company to honor the conversion requests of November 2, 2023 (for the conversion of 62,084,333 shares of common stock – completed December 21, 2023) and the three subsequent requests GS Capital claimed it “would have” made (62,023,333 shares, 65,168,333 shares, and 68,425,500 shares). In order to comply with the mandatory injunction, prior to the stay, the Company increased the share reserve for GS Capital Partners LLC and they subsequently completed the first two conversions.

Everything that I post is just my informed opinion and is simply an invitation to debate. Trade on your own due diligence please..

Recent BEGI News

- Form 8-K - Current report • Edgar (US Regulatory) • 06/06/2024 02:22:00 PM

- Blockchain Trading Platform Moving Higher on Patent News • AllPennyStocks.com • 05/20/2024 04:50:00 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 05/14/2024 05:20:04 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/14/2024 05:16:57 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/23/2024 05:23:53 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/20/2023 03:16:52 PM

- Epazz, Inc. (OTC Pink: EPAZ) US Navy Collaboration ZenaDrone 1000 • InvestorsHub NewsWire • 11/09/2023 01:00:34 PM

- Epazz, Inc. (OTC Pink: EPAZ) US Navy Collaboration ZenaDrone 1000 Extreme Weather Demo • InvestorsHub NewsWire • 11/07/2023 12:29:43 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/01/2023 03:37:21 PM

- Shares of Revolutionary Blockchain Trading Platform on a Tear • AllPennyStocks.com • 09/11/2023 03:07:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/14/2023 05:41:27 PM

- Form EFFECT - Notice of Effectiveness • Edgar (US Regulatory) • 07/06/2023 04:15:04 AM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM