Tuesday, April 09, 2024 2:56:22 AM

On day one of Conservatorship.

At the time, it was understandable because it talked about the "critical capital trigger" that triggers a conservatorship, "during the conservatorship period".

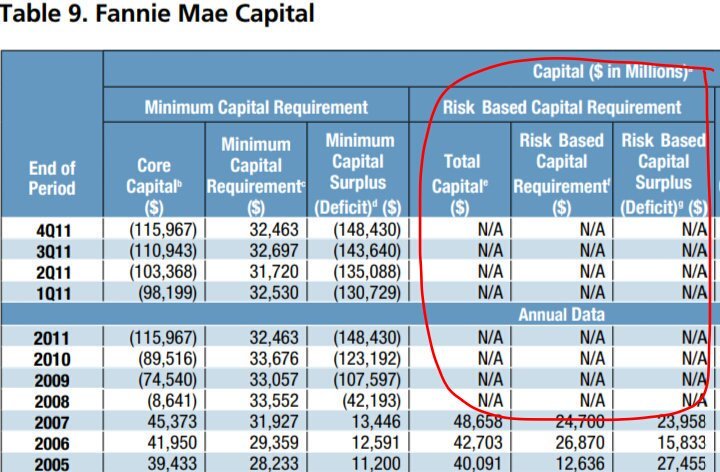

This is why FnF have only published their Minimum (Leverage) Capital level and capital shortfall (deficit) with the Core Capital, every quarter since day one (statutory) in their Earnings reports (10-k form filed with the SEC).

This is Freddie Mac:

HERA struck the FHEFSSA's formulaic of Risk-Based Capital requirement, so N/A until the FHFA comes up with a new one.

FHFA Report to Congress:

At some point, the Critical Capital level must be published. Mainly in the ERCF in light of the Capital Rule that came into effect on February 16th, 2021, as commented before.

But not meeting a capital level called "critical" bothers to the plotters in their slogan of "FnF have been rehabilitated", which is what requires Justice Alito and judge Willett, in their interpretation of the FHFA-C's Incidental Power.

What the judges were doing was explaining the Separate Account plan.

Justice Alito: Rehabilitate FnF in a way, not in the interests of FnF with awful ERCF tables, but in the best interests of the FHFA.

Judge Willett: "Any action within the enumerated powers".

And Justice Alito's add-on: "...and the public it serves", not written in the law, so that the UST can keep the estimated $15B owed to FnF in TARP funds, for being used as managers of Obama's Making Home Affordable program (MHA guidelines). TARP was deemed a success at the time, just because it owed big money to FnF (only $3B disbursed out of $30B obligated). Also, for the sale of NPL and RPL to the hedge funds at bargain prices, sale of REO inventory to minority- and women-owned businesses, LGTB associations, Neighborhood Associations, etc.

At some point, this Separate Account that resembles the statutory wording of the one with the FHLBanks in1989, will have to be unwound to see their financial rehabilitation for real on the Balance Sheets.

This is the reason of their con job: this capital threshold no longer exists. And pointing out HERA, so you will never find it out if it's located in the FHEFSSA.

The FHFA's flag is upside down.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM