Friday, March 15, 2024 2:52:10 AM

+$0 billion in Fannie Mae ($491 million gross. A deductible expense. It has been added up the net amount. That is, turned into Retained Earnings account) and +$0 billion in Freddie Mac (313 million gross).

BV($B)FMCC/FNMA:110/134

— Conservatives against Trump (@CarlosVignote) March 11, 2024

-1.2/19.5 Beginning bce 6/2008

+83/98 Acc.Comprehensive Income,adjusted for 3 Accounting Change charges:

4/2009:5/3

1/2010:-11.7/3.3

1/2020:-0.24/-1.1

+10/9 CRT,net(RE)

+19/7 PLMBS settlement:73%/27% based on AOCI in 6/2008

+0/0 Lamberth rebate.#Fanniegate https://t.co/EmZTYgahAE

The BVPS doesn't change due to rounding, but it's worth pointing it out to highlight the financial concepts everybody should know, more if you write formal documents like court briefs, otherwise you'd be now on the hook for $4.8B in Punitive Damages to the Equity holders, for its coverup.

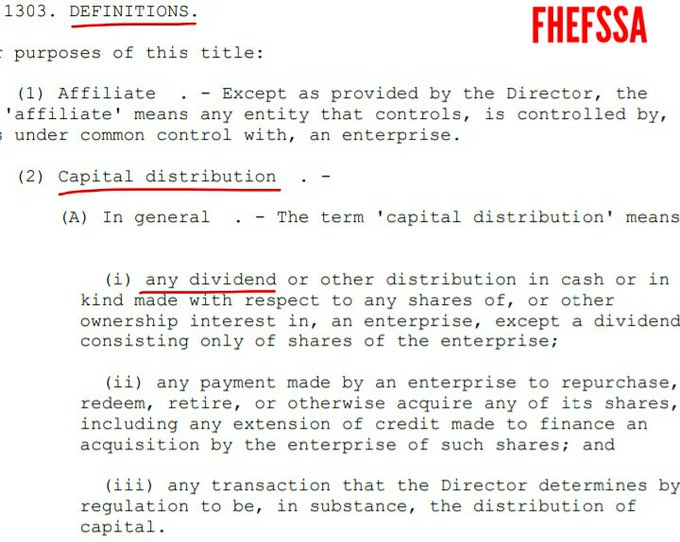

It's another capital distribution (number 3) in the FHEFSSA definition,

thanks to the amendment inserted by the FHFA by regulation (famous Final Rule, July 20, 2011)

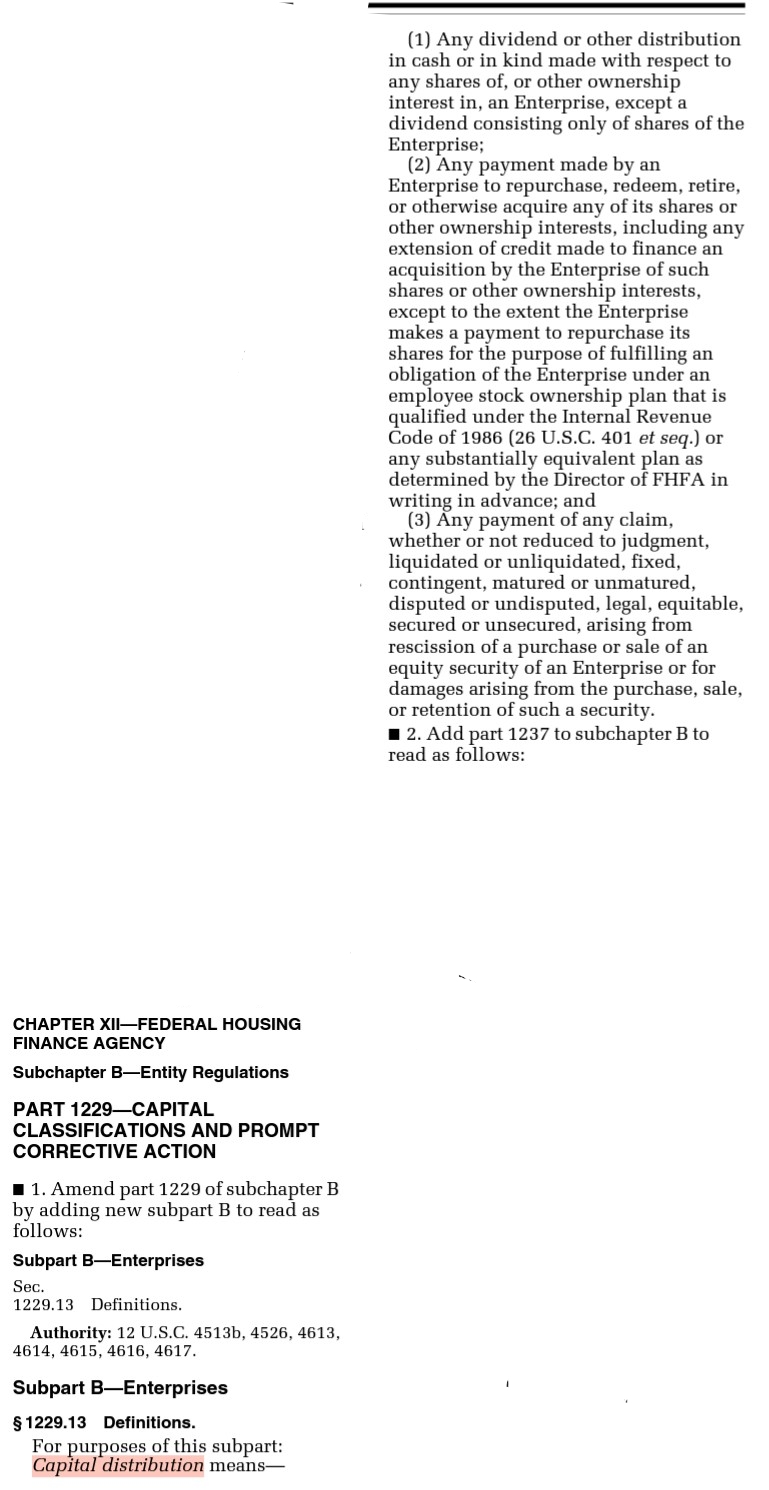

Barred regardless, as stressed by the FHFA in a comment posted in the preface of this rule, indicating that this case of securities litigation claim is a result of "the retention of a security" and, thus, against the issuers, FnF (Hence, against the conservator).

This explanation serves as a masterpiece to explain the conservatorship dynamics as a whole, both the restriction on capital distribution and, specially, the word being abused nowadays of rehabilitation.

But then, by regulation, the FHFA inserted a funny joke, CFR 1237.13:

except to the extent the director determines is in the interests of the conservatorship.

No where is authorized the conservator to break the law (not "authorized by this section" -Rehabilitation- and a restricted payment to this same end). This is why the Fanniegate scammers peddle the idea that FHFA can do whatever the hell it wants and that it has absolute discretion.

BOTTOM LINE

Although the Lamberth rebate hasn't been disbursed yet, it can't be set aside (held in escrow) in a Separate Account either.

A capital distribution is restricted to build capital, and capital means regulatory capital for Capital Adequacy matters (soundness), not just cash for Liquidity matters. 2 different issues and the financial rehabilitation is related to regulatory capital (Capital ratios -ERCF-).

Don't be a boat "Rum" tommater on Ihub with "Cash Equity" that doesn't exist.

You'd be fooling yourself with the mental exercise that holding this payment in escrow is just fine, because you aren't building regulatory capital if it isn't posted on the Balance Sheet.

It's just another scheme to hold the Common Equity in escrow, like with:

- The 10% and NWS dividends,

- The SPS LP increased for free (SPS absent from the balance sheet to evade watching this effect),

- The Settlement of the PLMBS lawsuits,

- The Charter-barred CRT expenses, and

- The Lamberth rebate.

The Common Equity or Book Value is the amount that is required in a Takings today. This is why all of it has been held in escrow. They didn't know that everything would be adjusted. Oops!

This is the chart with all the Common Equity generated by Freddie Mac that doesn't show up on the adjusted Balance Sheet. The accumulated amount is what appears in the tweet above.

It shows an obsession with the word "separate". Even "separate" within a Balance Sheet that doesn't exist in this world. Only "restricted cash and custodial account" for some amount already pledged.

"Separate restricted Retained Earnings account" or just "separate Retained Earnings account", is beyond shenanigangs. No one calls it that and it's pointless. They want to impose their own rules.

Let alone that there are no damages whatsoever in the Lamberth court for an "Implied in fact contract breach". The dividend was impeccably suspended.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM