Wednesday, March 13, 2024 3:45:17 AM

A capital buffer is a cushion to prevent a company from breaking out the capital requirement that would trigger Prompt Corrective Actions (Does Restriction on Capital Distributions like dividend payments, gifted SPS and the Lamberth rebate ring a bell?)

A capital buffer isn't a capital requirement for the Capital Classifications, and it's only valuable to determine the Payout ratio, in the case of FnF (Table 8: the dividend is suspended if the capital buffer < 25% of the Prescribed Capital Buffer). So, now the dividend payment is more stringent.

This is the treatment of the management like Kindergarden. The Capital Buffers should be eliminated, making sure that the Prompt Corrective Actions are activated when a company becomes undercapitalized, not the 3-notch jumps in the Capital Classifications we are used to, or an OFF MARKET deal like Mnuchin with $NYCB pretending that it was undercapitalized, when its capital ratios were pristine as of end of december 2023 and thus, there was no need to raise capital. Let alone that it must be done solely through a Rights Issue to avoid these conspiracies by the same people over and over again that want to impose their own rules. That is, any common stock must have Preferential Subscription Rights because that's inherent to a common stock.

This is why Blooomberg wrongly claims that the capital shortfall over Risk-Weighted Assets of $161B in Freddie Mac and $243B in Fannie Mae, measured with the "Adjusted Total Capital".

The official numbers of capital shortfall posted in their ERCF tables as of December 31, 2023, are $110B in Freddie Mac and $164B in Fannie Mae, had they posted the column "Capital Shortfall" because they no longer post it for the fraud of peddling the idea that the capital requirements are met with the Capital Reserve or with the Net Worth. Below, it's posted the ERCF table as of June 30, 2023, to see this column for the last time.

They also ignore that the official numbers have to be adjusted for the offset (reduction of Retained Earnings. Core Capital) attached to the $125B SPS LP increased for free in FnF together by Mnuchin/Trump - Calabria, but first a one-time $3B SPS LP for free with Mnuchin/Trump - Watt on December 2017.

Therefore, the capital shortfall is worse than the one officially posted.

June 30, 2023:

At least, Bloomberg Intelligence or lack thereof, has exposed the scammers that are using the FHEFSSA-invalid capital metric "Capital Reserve" that is only used by the Federal Reserve (Capital Surplus), and also the fact that the conservatorship isn't in compliance with the Supreme Court's prerequisite of "rehabilitation of FnF" with such awful ERCF tables that correspond to Justice Alito's out-of-the-box remark: "in a way not in the interest of FnF" on paper, to legalize the Separate Account plan, aiming the add-on "and the public it serves" for the utilization of FnF for public policy ($15B owed to FnF for the MHA program will have to be condoned; Sale of loans to women- and minority- owned businesses, LGTB associations, etc).

Good! But, at some point, the Separate Account plan will have to be unwound to see the financial rehabilitaion of FnF for real (on their Balance Sheets).

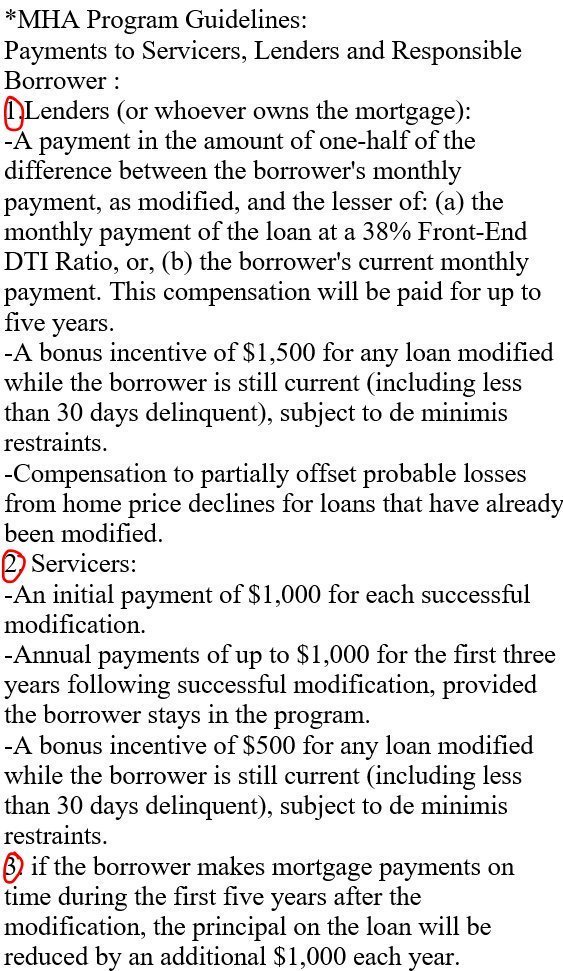

As a reminder, these are the guidelines in the Making Home Affordable program. FnF advanced payments to servicers (banks) and borrowers, later Obama forgot to pay the bill.

Big bank bonuses in the banks those years.

FnF have their own programs and foreclosure prevention actions.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM