Wednesday, February 28, 2024 2:10:10 AM

The same two plotters with multiple aliases, keep on throwing numbers at the wall and pointing out that it's over a period of time.

The way a Separate Account is unwound, is fixing the stocks' fair value upon listing on the NYSE again, when the CUSIP symbol changes and they need to have a Reference Price on day one, regardless of the prior closing price. The same occurred when we were listed on the OTC market.

An "overnite" fix.

This fair value used as Reference Price must, at least, reflect the prospects of a Housing Finance System revamp we've been bound for and chosen for the release in 2011 (no TCCA fees) and the key: no dilution in the common stocks and JPS redeemed, both thanks to CET1 > 2.5% of the Adjusted Total Assets. Obviously, no CRT operations which are Charter-barred nowadays and the reason why it's been requested a refund of the CRT expenses, net.

So, everything that is known in the past. The reason why it's been suggested that FMCC should trade at PER 12 times, whereas 10x in FNMA, based on volume growth. Let alone that it was Fannie Mae the one that dragged Freddie Mac into conservatorship and now it's the laggard to meet the capital requirements.

For instance, it's been estimated that the dividend resumption, equal to par value JPS valuation, was fetched with the 3Q2022 results of Fannie Mae, one year earlier in Freddie Mac.

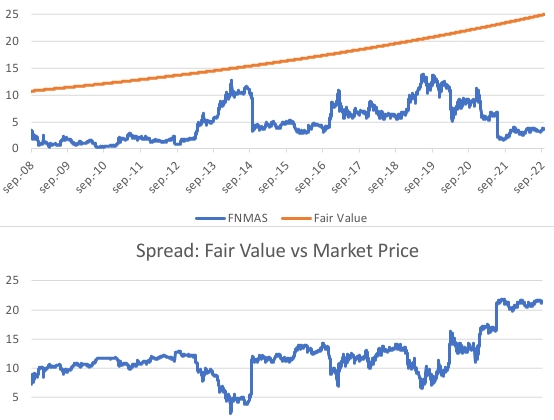

$FNMAS chart, the most liquid series of JPS:

A fair value or Reference Price can't discount other matters, like a forward EPS, the case of FHA's MMIF ceasing to exist, a future spin-off of CSS, etc.

That would be the market the one that puts the exact fair value with all the available information at the time and on the first day of trading on the NYSE.

And an "overnite" payment of Punitive Damages depending on the ultimate scenario, because the common shareholders waive their claim in a Takeover or "as is" scenarios, not in a Takings at the stocks' fair value of Common Equity per stock (BVPS) as of December 31, 2023.

The plotter Bill Ackman has already received a "capital requirement". And yes, "capital" means "cash" in this case. Not Equity, not regulatory capital, not Capital Reserve. Jesus!

The E in EPS=$0 is the same E in Retained Earnings that @BillAckman claims is being retained by FnF.

— Conservatives against Trump (@CarlosVignote) February 27, 2024

The same E to assess the Common Equity.

$0

He is liable for the payment of Punitive Damages for stock price manipulation, peddling the Govt theft story.#Fanniegate @TheJusticeDept https://t.co/AM7YZELbb0 pic.twitter.com/gUofottuZZ

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM