Monday, February 26, 2024 6:18:21 AM

Profitability isn't a measure for the soundness in a financial company.

It's the capital metrics in comparison to capital requirements.

Like the 6th Circuit Court of Appeals in the Robinson case (almighty attorney for Berkowitz, David Thompson), about "put FnF (restore) in a sound condition", it claimed that it was achieved with "the return to profitability, even if a large portion of that profit was sent to Treasury's coffers'".

And about the "put FnF (restore) in a solvent condition", which is the ability of a company to pay its obligations, including the SPS, it claimed that it was achieved with the funding commitment, when it's supposed that rehabilitation is when a company is in solvent condition on its own.

The remark: "The companies likely should not return to business as usual", says it all. No one asked the judge about his opinion.

Both restoration plans were achieved through the exceptions to the statutory Restriction on Capital Distributions: reduce the SPS and Recapitalization.

It's not that they don't know what a capital distribution is, because there is a statutory definition.

To become FHFA Dtr, it's required by law a deep understanding of housing finance and the financial markets in general. Which reminds me of Judge Lamberth asserting that the plaintiffs were denied dividends that otherwise were certain to receive.

Everbody wants dividends.

Let alone the jurors that are only required to have driver license.

Pagliara and David Fiderer playing the fool:

More of a threshold, or evergreen, question: If Fannie and Freddie have been so profitable for over a decade, why are they in conservatorship?

— David Fiderer (@Ny1david) February 24, 2024

Although the prior MANDATORY release Undercapitalized was struck by HERA, it's still a reference for the release, primarily because the Treasury Department chose in 2011 a Privatized Housing Finance System revamp for the release, and, secondly, because that's what the FHFA-C's Rehab power is about: "Put FnF in a sound and solvent condition".

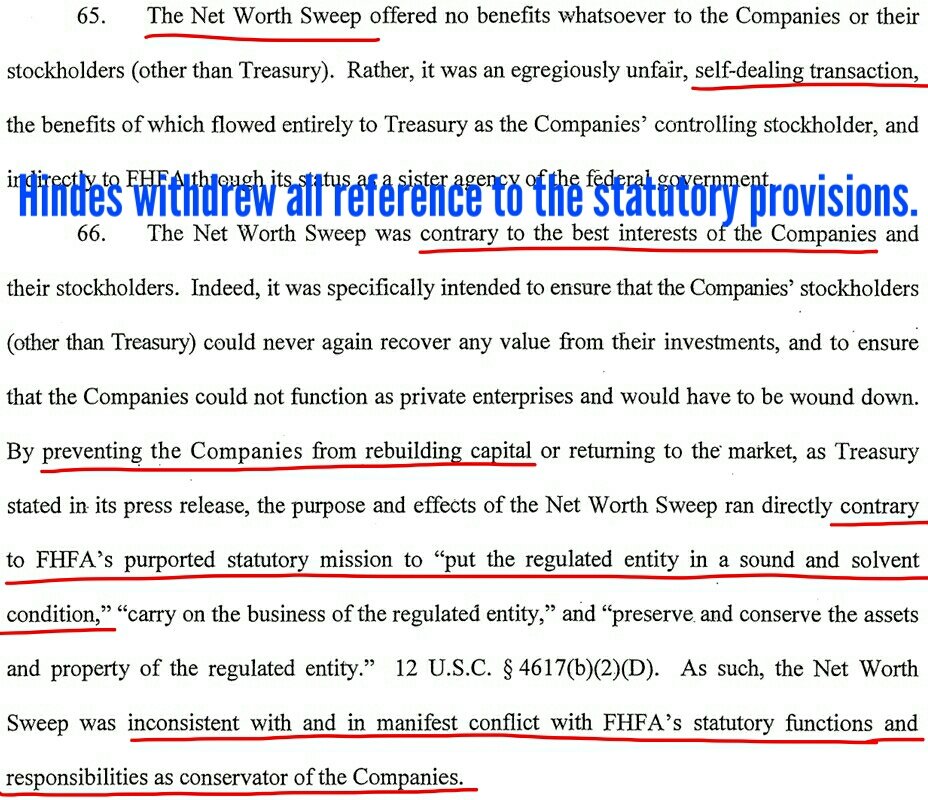

The Rehab Power was called "statutory mission" by Gary Hindes, before removing it in an amended complaint.

This is because it slammed his stance defending the 10% dividend, another capital distribution and the same breach of the Rehab Power as the NWS dividend.

He was told to remove it and that the SCOTUS had just been activated for twisting the Incidental Power instead: "Beneficial to the Agency" remark.

A response to Berkowitz's "We've been robbed!" stance.

BERKO UNAWARE OF CONSERVATORSHIP

— Conservatives against Trump (@CarlosVignote) February 26, 2024

Let alone that the Undercap threshold for FHEFSSA (prior)MANDATORY release ↑from 0.45% to 2.5% of MBS.

"Highly regulated industries" is precisely why FHFA has limited powers:

-Charter-barred CRT

-Capital distribution,restricted

-Rehab.#Fanniegate https://t.co/e4vGGllQlQ

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM