Tuesday, February 20, 2024 3:33:00 AM

FnF don't have such statutory limits.

Actually, it's the opposite with a Fee Limitation of the United States.

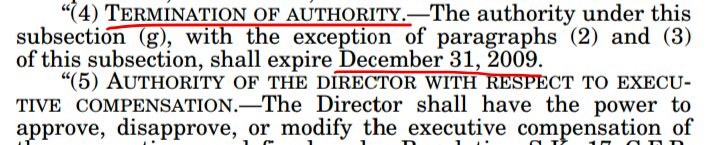

It wasn't changed "as of the passage of HERA" (DOJ attorneys), primarily because the 2nd UST backup of FnF with an infinite rate on SPS, inserted by HERA in the Charter Act, was a TEMPORARY authority with a deadline on December 31, 2009.

Let's not forget the multiple attempts by Mnuchin to portray FnF as "liquidity providers" for the banks, when that's the FHLBanks and the Federal Reserve.

FnF carry out a Public Mission, but related to the Guaranty Mortgage Securitization business, with secondary market operations.

So, a business activity that can be perfectly carried out by fully private companies (Charter, revoked)

A Charter Act with a UST backup of their operations as a last resort (Section: statutory purposes), now pointless with FnF subject to the Basel framework for capital requirement, 15 years into a conservatorship.

MISTAKE OF PA "THE LAW" WASN'T MADE BY CHANCE

— Conservatives against Trump (@CarlosVignote) February 20, 2024

Capital Reserve(FHEFSSA-invalid) mimics the Fed's Capital Surplus,w/ statutory limit changed from time to time by law:$7.5B→$6.825B,May 2018.

PA changed the Applicable CR too,but as part of a Separate Acct.#Fanniegate @TheJusticeDept https://t.co/vZClCSXivH

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM