Tuesday, February 13, 2024 1:55:02 AM

What do you do when you see a payment RESTRICTED?

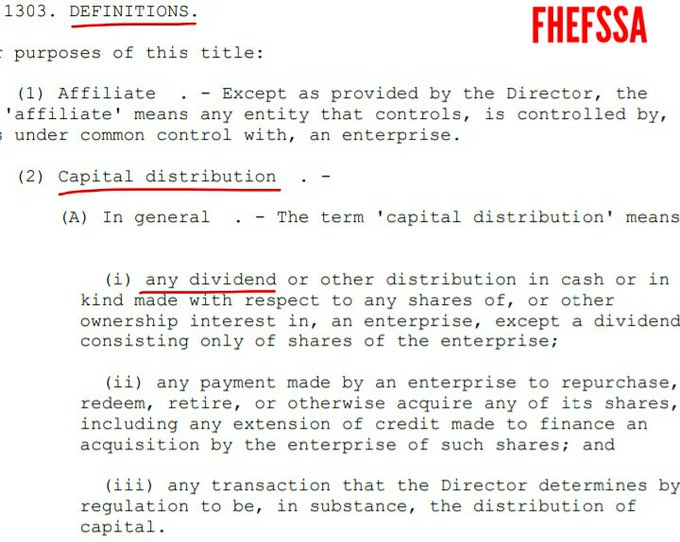

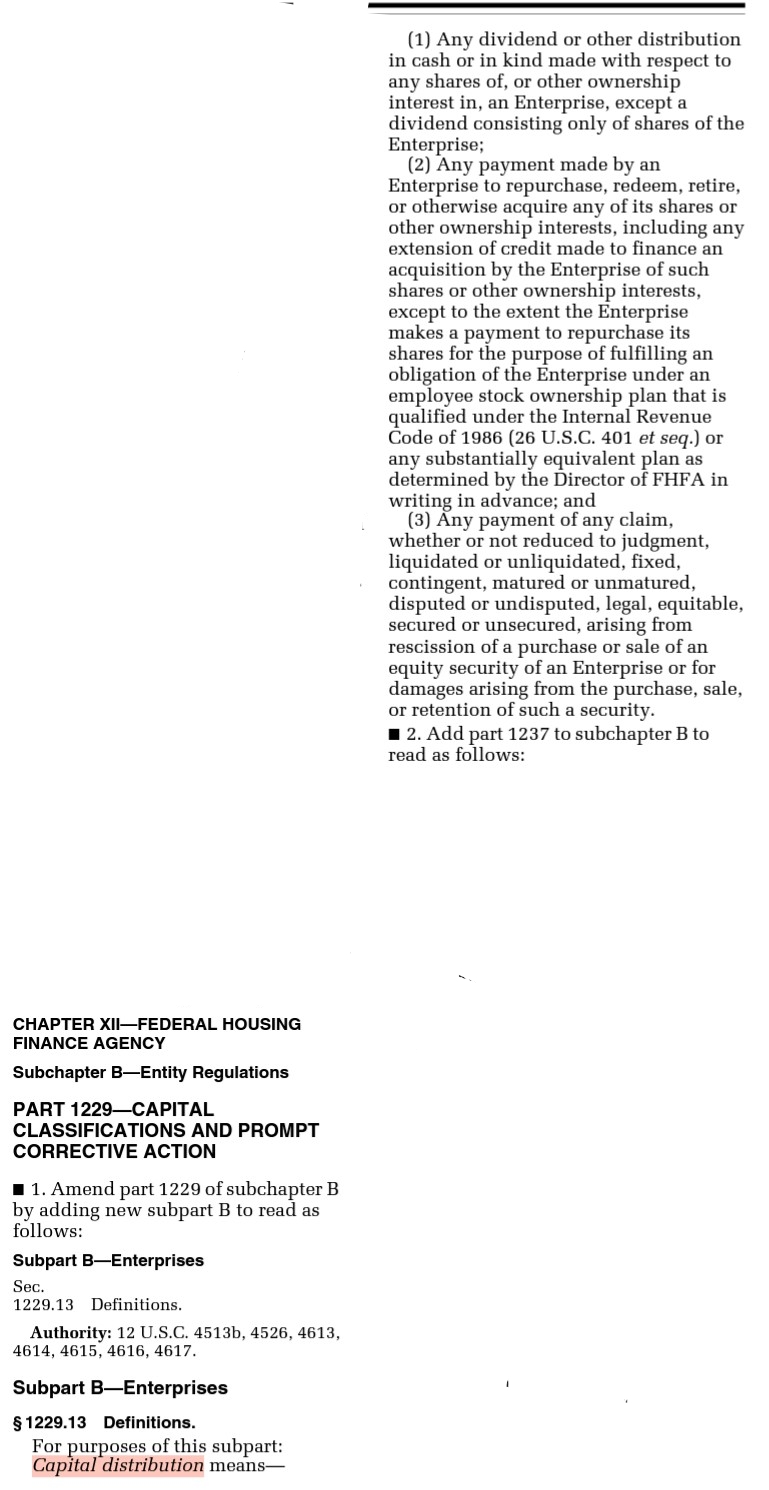

A capital distribution #1.

Restriction on Capital Distributions, inserted by HERA chapter: Prompt Corrective Action, into the FHEFSSA. U.S. Code §4614(e)

The exception (A) was satisfied with the cash raised with the double-entry accounting when the Common Equity increased, for the reduction of SPS in the exception (B), through the assessment sent to Treasury. Watch my signature image below to see how it worked out in Freddie Mac.

Stock buybacks are a capital distribution #2 (Definition posted below). This is why the reduction of the SPS in the law is included as an EXCEPTION, when FnF are undercapitalized.

Also, there weren't Earnings available for distribution as dividend out of an Accumulated Deficit Retained Earnings accounts (Balance Sheet = picture of a company at a determined date)

First, you have to learn that a dividend is a distribution of Earnings, they aren't interest payments. So, you have to have it, before distribute something out. It's not a charge on an account like occurs with the quarterly losses charged on a Retained Earnings account, that can be done even if it has negative balance, but a distribution of Earnings.

It's prohibited. Both dividends (#1 in the definition of Capital distribution), today's gifted SPS LP in the absence of dividend to Treasury (#1) and the Lamberth rebate (#3). Zero, nitch, nada.

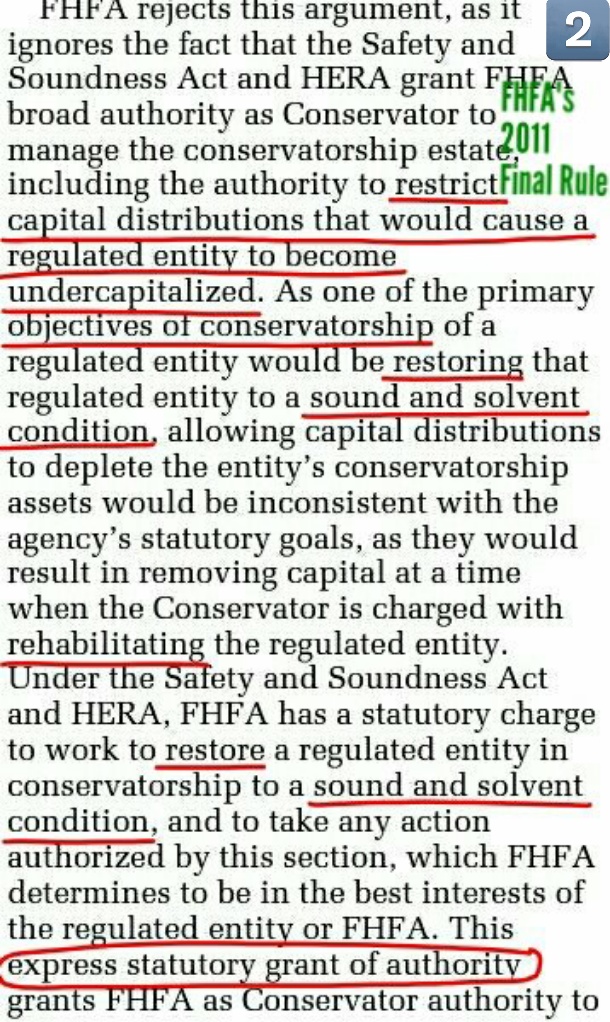

FHFA said so in the preface of the 2011 Final Rule.

The Adequately Capitalized threshold for the resumption of dividend paymetns, was switched in the Table 8 of the Capital Rule: Payout ratio, for 25% of the Capital Buffer. Therefore, we have to wait a little bit more.

It's a capital distribution that depletes capital and thus, a breach of the FHFA-C's Rehab power.

FHFA said so in the 2011 Final Rule (preface) in light of a response to whether the Securities Litigation judgments (Lamberth rebate) can be paid while FnF remain undercapitalized.

It's not upon declared Undercapitalized (Capital Classification) as you have shamelessly repeated several times, but it states undercapitalized in general, and it starts with IN GENERAL.

It can't use its Incidental Power to override it because it states that "any action" must be "authorized by this section" or the 2011 CFR 1237.12 exception (4) is otherwise in the public interest Source), because it ends with (c) that states that it supplements and shall not replace or affect any othe restriction imposed by statute, which is the one in the U.S. Code §4614(e), which states that it's prohibited, obviously for their recapitalization as Prompt Corrective Action. The concepts have a meaning, there isn't a restriction on a whim. It can't be overridden by regulation just because the conservator claims that it's in the public interest.

This exception (4) or its Incidental Power, might have been used by the FHFA to claim by regulation, after prohibiting the payment of Securities Litigation claims with the exceptional explanation posted above, that serves as Carta Magna of the conservatorship dynamics, that (CFR 1237.13):

except to the extent the director determines is in the interests of the conservatorship.

If it's restricted, it's restricted.

The FHFA amended this definition, with the express grant of authority to do it in the #3, to include what now is known as "The Lamberth rebate", and it's considered a trap set by DeMarco, as it exposes all other capital distributions that went through despite being restricted, and the exceptions kicked off to legalize them.

BOTTOM LINE

The were assessments sent to Treasury, in the form of capital distributions, under the guise of dividend payments. Just like the assessments sent to Treasury ("invested in zero coupon Treasuries") to reduce the obligation RefCorp, set forth in the Section entitled SEPARATE ACCOUNT, for the FHLBanks in 1989, starring the same individuals: Sandra Thompson at the FDIC and DeMarco at GAO (in charge of Accounting. It requested the expulsion of PwC to not duplicate resources, though it was for concealing that there weren't paying down the principal of the obligation RefCorp), later he moved to the Treasury Department.

.jpeg)

Quit playing the fool. Today's Retained Earnings accounts stand at $-216B together. That's not rehabilitation. The dividends have prevented replenishing this account necessary to absorb losses and to distribute dividends, let alone to later meet the capital requirements (Core Capital and CET1 Capital)

With the frivolous lawsuits, FnF don't recover even $1 of core capital, primarily because they request a refund of cash when FnF sent Core Capital (dividends).

What the FHFA has done is to use its Incidental Power "in its best interests", to mislead the world and carry out yet again a Separate Account plan in accordance with the law, regulation and basic finance.

You are another one with: Sepr...pr..pr...prrrrrr... Separate whaaa?

Timothy Howard:

Separate Account? I don't know what that is"

With your:

Dividend payments on preferred stock don't ever reduce the liquidation preference. Not for FnF, and not for any other company.

It's time to snub the attorneys that lack knowledge about basic finance even if it's literally written in the law. What we are witnessing is a group of mercenaries hired to mess around, aiming to cover everything up: what a dividend is, what a capital distribution is, what financial rehabilitation is, the Charter dynamics with financing by the Treasury as a last resort (UST backup), etc.

This is why the payment of Punitive Damages is of supreme importance.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM