Thursday, February 08, 2024 4:37:46 AM

Next 6 months average $1

Next 6 months average $2 ?

Next 6 months average $4 ?

Next 6 months average $7 ?

Next 6 months average $10 ?

Next 6 months average $13 ?

Next 6 months average $17 ?

Next 6 months average $23 ?

Next 6 months average $27 ?

This isn't serious.

Whatever the Fanniegate resolution is, each share class will trade at their true fair value which is such where the stocks discount all available real information, not like today with a Separate Account, and what better than to use the NYSE uplisting to do it through the Reference Price required, and knowing that their CUSIP symbols are restated, like occurred when we began to trade on the OTC market.

The conservator can't claim that it isn't in the business of calculating the stocks' fair values, because this is precisely why Sandra Thompson stated in her Nomination hearing at the Senate that:

FHFA continues to retain advisors.

It doesn't take too long to calculate a fair value with the PER method, with the adjusted annualized Q3 2023 EPS.

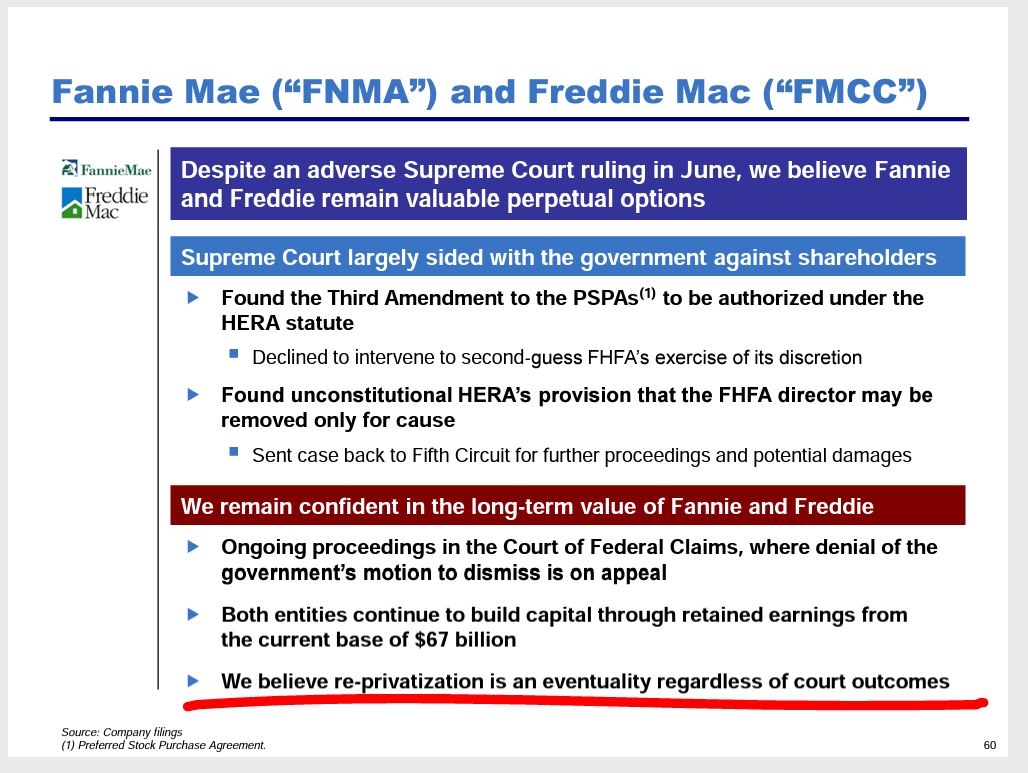

Obviously, there are people that can't be trusted, like the trustee Bill Ackman, with his Pershing slides promoting the plotters' Govt theft story (Fiduciary Duties owed to them), by covering up the key statutory provisions in FnF, and, instead, repeat the slogans:

- "Privatization": sale of SPS and the Warrant.

- Implying that the SCOTUS said FHFA has absolute discretion;

- The lie of "FnF continue to build capital through retained earnings", when those earnings are wiped out with the offset attached to the SPS LP increased for free in the same amount that began on December 2017 (currently the $118B SPS LP and its offset with reduction of Retained Earnings account, are missing in the balance sheets. Financial Statement fraud and collusion with the FnF mngmt, BOD and conservator) and, therefore, FnF build capital stock (SPS) in its current $118B Net Worth, not regulatory capital. Even if the SPS were "off-balance sheet", which they are not, like their MBS trusts, FnF present their financial statements on a consolidated statements and the MBS (obligations) and underlying mortgages (Assets) do show up on their balance sheets.

We have the example with the initial $1B SPS issued for free, debited from the Additional Paid-In Capital account (nowadays exhausted), Core Capital and it does appear on the balance sheet. A breach of the FHFA-C's Rehab power by the way and a capital distribution as well.

- And my favorite: the common stocks are "options" to later portray himself on Twitter as options trader expert, in an attempt to justify that the stocks are trading rock bottom like an option trading at cents of a dollar, when they simply discount (A legal claim on the annual EPS, plus prospects): the Warrant, $0 EPS posted every quarter, Machiavellian conditions in the SPSPA amendments, Financial Statement fraud with SPS missing, con operation in the U.S. courts, etc., and not that they have turned into a different security: "options". He read my take about JPS turned into stocks trading at a discount because they are fixed-income securities (obligations in respect to Capital Stock) now without coupon payment (like the 30-year callable zero cuopon MTNs in FnF). Fair value assessed with an estimated 6% discount rate, discounting the time period to resume the dividend payment (25% of the Capital Buffer. Table 8: Payout ratio) when it recovers the par value (its fair value. Now we are in overtime "in the best interests of FHFA": get rid of these unwanted AT1 Capital instruments, with a CET1 > 2.5% of ATA), and he just claimed the same for the common stocks.

Pershing slide on FnF:

Being a "sophisticated investor" is an aggravating circumstance when assessing the compensation in Punitive Damages that the Equity holders are entitled to.

The plotters (plaintiffs, Pagliara, etc) are liable for one of the three rounds of Punitive Damages ($0.97 per $25 par value JPS)

Besides, Bill Ackman is a well-known recruiter for the Bitcoin scam:

- A token called "technology":

- Tokens called "commodities":

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM