Sunday, February 04, 2024 1:08:18 AM

This threshold for the Total Assets, is the prior MANDATORY release Undercapitalized in the FHEFSSA, struck by Calabria/Pelosi's HERA.

That's called Regulatory Risk.

Core Capital is similar to Tier 1 Capital.

As of September 30, 2023, FnF fetched CET1 > 2.5% of Adjusted Total Assets.

It means that the JPS can be redeemed. Then, Tier 1 Capital > 2.5% of ATA (ERCF) again.

Not only the FHFA wanted to get rid of the JPS (AT1 Capital) before Congress chooses one of the 3 options for the Privatized Housing Finance System revamp, that the Treasury came up with in 2011 for the release, but also, if the Separate Account would have been unveiled when the real threshold was met, the JPS couldn't have been redeemed at their par value yet, as the threshold that marks the resumption of dividend payments wouldn't have been met yet (25% of Capital Buffers).

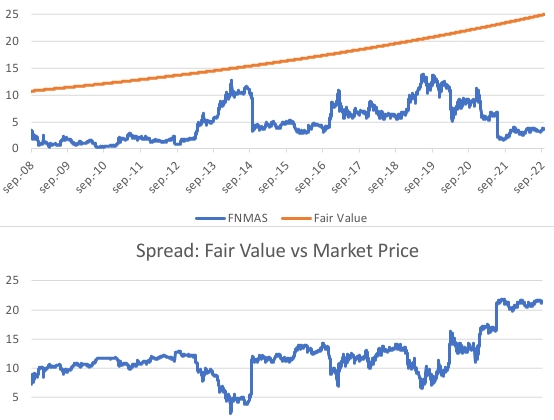

Even when the latter was met (chart), FHFA snubbed it because it didn't want the JPS lingering in the capital structure trading at their par value, and it went all the way to CET1 > 2.5% of ATA to redeem them.

This is the famous expulsion of the unwanted shareholders it already carried out with the FHLB membership in a 2016 Final Rule, that was first proposed in 2010. They were hedge funds unrelated to Housing Finance, that used insurers to have access to the FHLB low cost funding. FHFA called them "captives" and expelled.

This is essential if we are waiting for Congress to announce a Privatized Housing Finance System revamp for the release of FnF.

Now, FHFA wants the JPS to get the missed dividend payments (estimated 1 year in Fannie Mae, 2 years in Freddie Mac), and that's the reason of the Lamberth rebate.

The FHFA also wants its attorney-mercenaries to get paid for stock price manipulation, using part of the Lamberth rebate. Likely, claiming that it's "an outstanding obligation to be honored", like the dividend declared but not paid in Fannie Mae on day one of Conservatorship.

Phony damage and illegal Class Action, the plotters will have to pay the Equity holders $4.8B in Punitive Damages, along with the rest of the gang.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM