Friday, February 02, 2024 4:48:35 AM

Bankruptcy is for debt restructurings.

Conservatorship is meant for the financial rehabilitation of enterprises. This is why the management and BOD is expelled and it's appointed a conservator in their place, who needs the rights and powers from the shareholders as well, to carry out its statutory mission, otherwise they would oppose to every action, ASMs, etc.

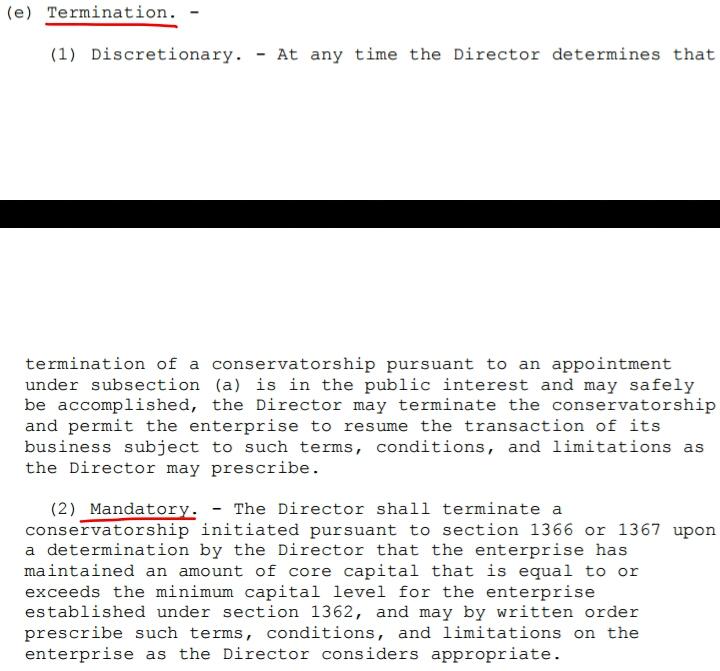

This is why there is a MANDATORY release Undercapitalized (Core Capital > Minimum Leverage Capital requirement). It can't overstep.

Calabria struck this MANDATORY release in the FHEFSSA with HERA.

It doesn't mean that, all of a sudden, now a Conservatorship is a state to induce bankruptcy or Receivership, 15 years into a Machiavellian plan of deception, because the key 2 points in the prior FHEFSSA conservatorship prevail, so don't think about repealing HERA and return to the prior FHEFSSA:

-Capital Restoration Plan.

-Restriction on Capital Distribution.

Today's FHEFSSA conservatorship, as amended by HERA, states the same in the conservator's Rehab Power: "Put FnF in a sound and solvent condition", when "soundness" is related to building regulatory capital,

Regarding the Restriction on Capital Distribution, HERA placed it at the end of the section Capital Classifications of the FHEFSSA, and it applies "IN GENERAL" when FnF are undercapitalized. Let alone in a Conservatorship for Critically Undercapitalized enterprises.

Calabria wanted the companies in Receivership in 2008. This is why he came up with a Final Rule entitled "Resolution Planning" in mid 2021, which is "Receivership scheming". Such a bad taste during a Deceivership.

Our enemy pro se plaintiff Joshua Angel, a JPS holder, continues his bad performance in the U.S. courts, requesting on Wednesday permission to amend his 4th complaint in the DC courts, navycmdr posted on Twitter.

An attorney chosen also for the Madoff case aiming to spin undervalued assets off to his gang. It can't be just a coincidence.

And who, in this board, pretends to defend the shareholders, asking now for debt forgiveness Argentina-style, so he can sneak a 10% dividend in a negotiation, where dividends are called "interests" to skip the Restriction on Capital Distributions, and calling it "contractual rate". It turns out that it's as "contractual" as the NWS dividend. Duh!. A negotiation controversial attorney Bryndon Fisher-style.

This is why kthomp19 brought up on Wednesday the themes of "administrative bankruptcy" by Calabria and the "legacy shareholders" by Pagliara.

We are dealing with an organized group.

The plaintiff Joshua Angel has to call the NWS dividend "NWS", because dividends are restricted and, because we cannot undo what's already been done, it's applied towards the exceptions to this restriction to legalize it, thanks to the FHFA-C's Incidental Power that authorizes this plan of deception. The same with the 10% dividend (Restricted and unavailable earnings for distribution as dividends).

"HERA" instead of the "FHEFSSA", so other provisions are concealed. For instance, that the capital requirements are met with Core Capital, currently adjusted $-194B, not with "Capital Reserve", which is an adjusted $0 by the way.

A negotiation cattle market-style, where no rule has existed before, as we can read in his daily comments on Ihub with his 20+ aliases.

Attempt to conceal the reality of the Separate Account plan, with assessments sent to Treasury under the guise of dividend payments, in accordance with the law, rules and basic finance.

The key: the original low cost financing of the operations by the Treasury (both debt and Equity), as a last resort (image below), in the Charter Act, prevails.

With CET1 > 2.5% of Adjusted Total Assets as of September 30, 2023, now the Charters can be revoked and Calabria's wish comes true.

Complying with the Fee Limitation of the United States in the Charter Act, that Calabria also conveniently forgot.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM