Tuesday, January 30, 2024 6:19:56 AM

Let alone Glen Bradford that calls the SPS "SPSPA".

The SPS certificate is usually amended a few weeks after a SPSPA amendment or whenever they want, because what the plotters call "4th amendment", is the 4th amendment of the SPS certificate dated April 2021, in light of the January 14, 2021 6th amendment of the SPSPA, called 3rd Letter Agreement, currently in force (the latest with regard to compensations to UST)

The plotters mess around with the names because secretary Yellen was sworn in on January 26, 2021, and thus, unrelated to the January 14, 2021 SPSPA amendment.

This is why they talk about the 4th (SPS Certificate) amendment, of April 2021, that didn't need the OK from Yellen.

Summary:https://www.fhfa.gov/Conservatorship/Pages/Senior-Preferred-Stock-Purchase-Agreements.aspx

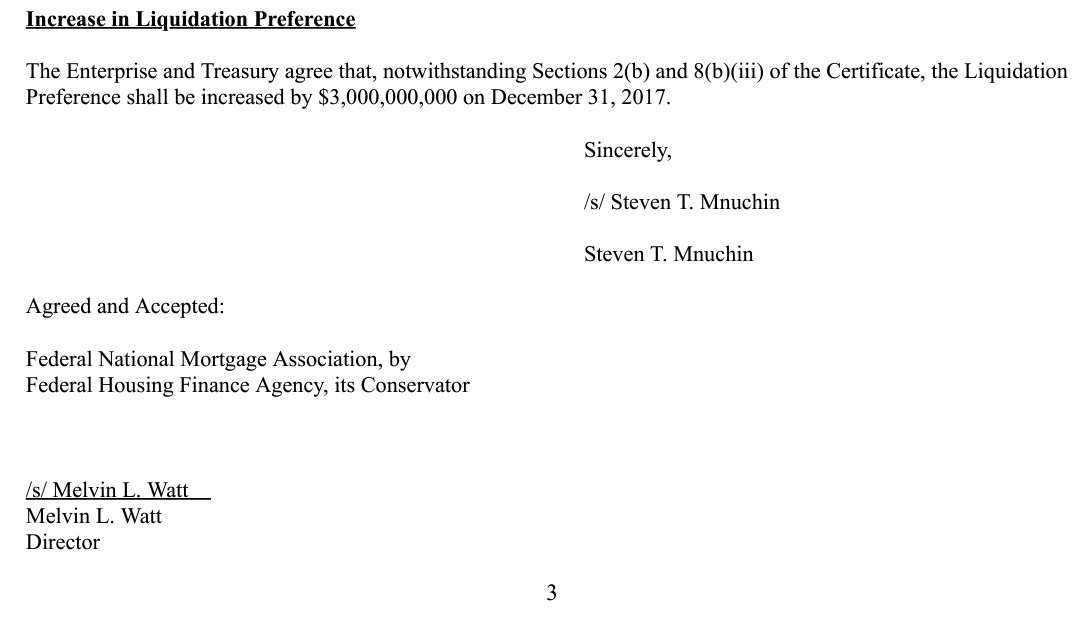

The September 2019 "Letter Agreement" would be the 5th amendment of the SPSPA, because there was one before, on December 2017 by the allies Watt-Mnuchin (concealed to seek constitutional damages for the "for cause" removal restriction), that kick-started the current Financial Statement fraud with a one-time $3B SPS LP increased for free out of the blue, absent from the Balance Sheets, along with its offset (Reduction of the Retained Earnings account)

With the 5th amendment, the SPS LP increased for free doesn't emerge as a result of the cumulative dividend when it isn't paid with cash, stipulated in a SPSPA covenant (the only way a LP can be increased, otherwise new SPS had to be issued for each draw from the UST). The thing is that the dividend was terminated, as a consequence of judge Willett's ruling in the Collins case 3 weeks before (5th Circuit en banc), contending that the conservator exceeded its powers. And it's a brand new compensation to UST, laid out in this brand new covenant:

Not a dividend but another capital distribution in its FHEFSSA definition (1) compensation with stocks, other than a dividend.

Then, the same Restriction on Capital Distributions and the same we do to legalize this action: it's applied towards the exceptions. In this case, for the Recapitalization (CFR 1237.12). That is, necessarily the Common Equity is held in escrow, which also complies with the FHFA-C's Rehab power (soundness). Easily seen with the aforementioned offset, had the SPS LP increased for free and the offset, been posted on the Balance Sheet.

Everything is adjusted (Image). So, nice try and now pay damages.

The moment that Mnuchin made clear in a press release that the dividends were terminated to all effects.

BOTTOM LINE

Trump and Mnuchin participated actively in the continuation of the Separate Account plan, both with Mel Watt and with Calabria.

All of them expect the Congress to undo what's already been done and "treat the stocks".

Or, the return of Trump to finish them off, along with holding up all other scams worldwide:

-Argentina-IMF spree.

-Fraudulent European Central Banks' Payment Systems Target2 and TIPS (External Positions)

-BOE's stamp on loans to foreigners.

-The S.E.C.-sponsored unbacked token scam.

-CRTs in FnF.

-Etc.

Reliant Coffee Debuts at #271 on the Inc. 5000 List of Fastest Growing Companies - Coffee Service Industry Disruptor Brews Up Exponential Growth Sep 5, 2024 11:51 AM

VAYK Confirms Receiving Revenue from First Airbnb Property with 1.4 Million Annual Revenue Goal • VAYK • Sep 4, 2024 9:34 AM

Mawson Finland Limited Expands Known Mineralized Zones at Rajapalot: New Lens Intercepts 21.75 m at 5.25 g/t Gold & 515 ppm Cobalt • MFL • Sep 4, 2024 9:02 AM

Integrated Ventures Acquires 51% Stake In GetTrim.Com (TM), Telemedicine Platform With Focus On Expansion Into Booming GLP-1 Powered Weight Loss Market • INTV • Sep 4, 2024 8:45 AM

Avant Technologies Announces Strategic Review Process Intended to Maximize Shareholder Value • AVAI • Sep 4, 2024 8:00 AM

PickleJar Launches National "Get on the Bus" Campaign, Unveils Thompson Square Tour Bus Wrap • PKLE • Sep 4, 2024 7:17 AM