Sunday, January 28, 2024 12:59:44 AM

And he had to ask:

Do you know what date the Warrants expire?

Wait! I will tell you more!

The prospectus includes also the assault on the ownership by Wall Street and the Community banks by Immaculate conception (shares "assigned").

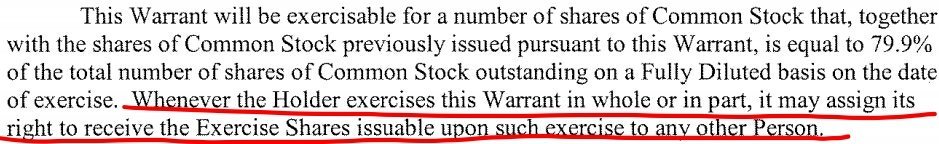

Covenant 2.1:

That "right to receive shares" is the Warrant itself, making it transferable (assignable).

But then, there is the covenat 7 stating that the Warrant is non-transferable.

This confrontation of covenants makes the prospectus void.

Anyway, the Warrant has been determined to be a collateral to make it somewhat lawful ("to (iii) protect the taxpayer"), despite its no-purchase to skip this prerequisite on purchase of securities in the Charter ("Assigned" too. It reminds me the SPS LP "increased". These people aren't serious.), rather than an "entry fee" for a UST backup that already existed in the Charter Act from its inception ("Authority of Treasury to Purchase Obligations. Terms and conditions.") in exchange for their risky Public Mission (section Purposes posted yesterday), and trampling the Fee Limitation of the United States in the Charter as well.

Then, now the only way that the banks can acquire FnF from the Treasury, is after the Treasury announces a Taking of our stocks at their adjusted fair value, adjusted for all the trickery to misrepresent the financial condition of FnF (Charter-barred CRTs, SPS LP increased for free that makes FnF continue to post $0 EPS every quarter, the Warrant to purchase a 79% stake in FnF at $0.00001 per stock, Separate Account in accordance with the law, etc.)

The fair value in a Taking is the BVPS or Common Equity per stock (not the tangible BV because the business goes on)

Othewise the banks have to purchase the stocks directly from us, announcing a takeover of FnF at a different fair value, PER 14 times, which must include the Deferred Income, net, if the accounting standard is changed, as it's been proposed.

$0.00001ps .... "NOT collateral" .... That was funny.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM