Friday, January 26, 2024 2:24:44 AM

One thing is their intention, which I already pointed out yesterday that it was to tumble the common stock price, as mentioned also in the FASB meeting minutes that you posted, so it mimics the initial collapse in the JPSs' fair value with the suspension of the dividend payment and they can peddle the idea that Cs and JPSs are equivalent securities for a conversion JPS to Cs.

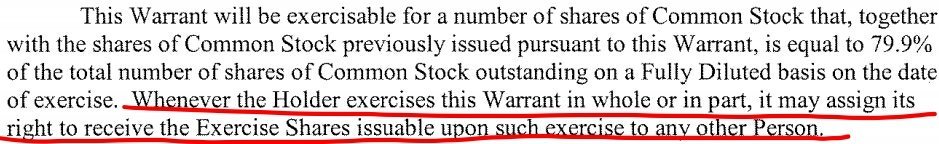

Also, for the intention of assault on the ownership of FnF with the clause 2.1 "Shares assigned to any Person (BX, BKT, MS, JPM, Community banks, etc.)"

This way, the Treasury pays almost $0 for a 79.9% stake in FnF but, by Immaculate conception ("Assigned"), the banks and investment banks become owners of FnF overnight. What government policy is that? Don't expect to read it in the FASB meeting minutes with Sheila Bair (later she became chairman of the BOD of Fannie Mae to continue to provide cover for the UST-FHFA Machiavellian conservatorship).

And a different thing is where in the law is authorized the Warrant for the Treasury, because you seem to forget that everything surrounding FnF is statutory (decided, required and controlled by law), as congressionally-chartered private corporations, and it includes the relationship with the Treasury.

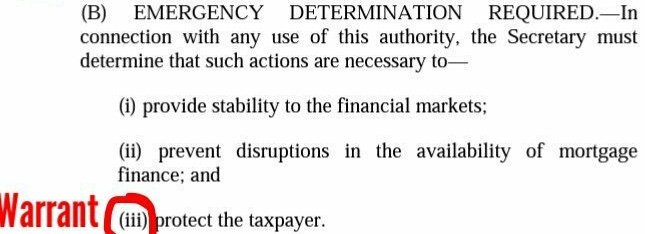

The temporary authority of Treasury in 2008, with regard to the purchase of securities like the SPS and the Warrant, had 3 prerequisites, after the determination of EMERGENCY (conservatorship), and the only one suitable for the Warrant, is (iii) to protect the taxpayer. A security that acts as protection, in this world is called collateral. That is, a guaranty that secures the repayment of a debenture (SPS, obligations in respect of Capital Stock)

Despite that this security was issued for free to evade this prerequisite on purchases. We considered it purchased at $0 cost. Instead, it was written that it was an "entry fee" or "commitment fee", that is, a higher compensation for the SPS, but they are barred in the Charter's Fee Limitation of the United States, both as fees and as a compensation worth 79.9% of a company (isn't it crazy?) for the funding commitment.

As always, we are here to legalize every action.

It isn't the first time that navycmdr and the rest of the plotters attempt to substitute the law in force for emails, statements in articles or press releases, or now, the minutes of a FASB meeting, most of them if not all, staged precisely to that end.

Zero sense of what the Rule of Law is about. This substitution is more of the same strategy of covering up of the law: the Trump Presidential Memorandum, an advisor called "Parrot", etc.

No one can come to the conclusion that it isn't a collateral, with the FASB minutes. As I've demonstrated, it can be both collateral and to tumble the stock price. You were ordered to write "NOT collateral", and you didn't know how.

I don't see in the law: "Authority of Treasury to get a Warrant with the objective to tumble the common stock price."

Keep the emails, the litigants' charts, statements, meeting minutes, etc. for yourself.

Maybe it's because of the numbers again (Sesame Street), like with the statutory definiton of capital distribution:

Number 1: (authorization to buy SPS)

Number 2: (authorization to buy SPS)

Number 3: to protect the taxpayer.

Spoiler alert: the Warrant is number 3.

And with the definition of capital distribution:

The Lamberth rebate is number 3 and dividends and SPS LP increased for free, number 1.

RESTRICTED when FnF are undercapitalized. The exceptions to the restrictions kicked off to legalize the capital distributions that went through:

-Reduce the SPS.

-Recapitalization (CFR 1237.12)

Hence, the Warrant (SPS collateral) should have been cancelled in late 2013 and late 2014, in FnF, resp., when their SPS were fully repaid, but a Separate Account plan has allowed the conservator to keep it "in the best interests of the Agency" (Incidental Power)

The FHFA is only interested in misleading the world in its alliance with the hedge funds and investment banks (Utility Model).

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM

VPR Brands (VPRB) Reports First Quarter 2024 Financial Results • VPRB • May 17, 2024 8:04 AM