Thursday, January 11, 2024 3:52:18 AM

And that it was authorized by the SCOTUS, without elaborating more.

because the NWS was legislatively authorized (per SCOTUS)

You and your other 20 aliases on this board.

Dividends are restricted. A capital distribution.

Separate Account plan.

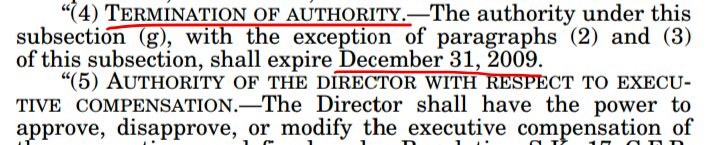

The NWS dividend is authorized, even an infinite dividend on SPS with the second UST backup of FnF in the Charter Act and the felony of "SPS increased" instead of issued, because, for this 2nd UST backup, there is still a deadline on a TEMPORARY authority of UST to purchase obligations on December 31, 2009.

The exception to this deadline #3-FUNDING, is about how the UST funds the purchases with Public Debt, and the rogue UST and FHFA made us think that it's the Funding Commitment. This is why the SPSPA was amended one week before the deadline, December 24, 2009 (2nd PA amendment) "with new formulaic commitments" that simply meant to put on paper what we already knew, that the amount of funding commitment is drained and not a fixed amount every quarter.

The preps to later switch to the NWS dividend, arguing that it's useful to avoid the death spiral that was depleting the Funding Commitment with the 10% dividend. Which is 100% correct.

A felony with these SPS LP "increased" (it's only allowed when the dividend is added to the LP, but not in the case of new funds/obligations, for which is necessary new issuances, as, in this world, all the securities must be dated and attached to a new certificate), jointly with other 7 Securities Law violations, for which we request a compensation for Punitive Damages.

A 2nd UST backup of FnF useful to update the outdated $2.25B original UST backup of FnF at rates similar to Treasuries, established more than 60 years ago when the debt outstanding of Fannie Mae was $800 million.

Lawful for a Separate Account plan that must "rehabilitate FnF" as the prerequisite laid out by the Supreme Court.

At some point, it would be unwound in order to comply with:

- The original UST backup: it's been estimated a weighted-average 1.8% dividend rate on the cumulative dividend of the SPS, applying a 0.5% spread over "Treasury yields as of the end of the month preceding the purchase" (For instance, it was a 0.299% spread over Treasuries in the 1989 bailout of the FHLBanks. GAO report) until they were fully repaid (end of 2013 and 2014, in FMCC/FNMA, resp.). It's netted out with the interests on the $150.9B owed to FnF.

- The exceptions to the Restriction on Capital Distributions: reduce the SPS and, later on, for their recapitalization. That is, necessarily the Common Equity is held in escrow (The same occurs later with the SPS LP increased for free: another capital distribution that, this time, we apply towards the recapitalization. Effect easily seen through the offset (reduction of Retained Earnings) attached to these gifted SPS (Once it's unwound, the Retained Earnings is back up), had these SPS and the offset been posted on-balance sheet, another Securities Law violation (Financial Statement fraud).

- The FHFA-C's Rehab Power: Put FnF in a sound and solvent condition (Recap and reduce the SPS, resp.)

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM