Thursday, December 28, 2023 1:29:01 AM

According to the FNMA balance sheet.

You start your comment based on a Financial Statement fraud. There is $121 billion worth of SPS LP outstanding on the balance sheet, but $74 billion absent from the balance sheet. Totalling $195 billion SPS LP outstanding, including the $5 billion SPS LP scheduled to be increased on December 31st, 2023.

The ones that are missing, are the SPS LP increased for free in the absence of dividend to Treasury, since, first, a $3 billion one-time handout on December 2017, and every quarter since September 2019.

Anyway, talking about stock valuation, the Net Worth of Fannie Mae stands at $74 billion as of September 30, 2023. This is the wealth that belongs to the Equity holders. You can't create "$140b of equity value" of wealth out of the blue, when the valuation stands at $74 billion.

With $195 billion SPS LP outstanding, it means that the full $74 billion Net Worth belongs to the UST and the JPSs would be wiped out in a restructuring.

You are mistaking it for a debt restructuring, where the debt is valued at face value to start a negotiation. Calling the JPS par value "face value" doesn't make it Debt. An obligation indeed (fixed-income security), but recorded in Equity. An hybrid financial instrument.

Your security is Equity, subject to the Net Worth of the company.

The UST and the Moelis Gang fell into their own trap. They thought that they can decapitalize FnF and later swap SPS and JPS for common stocks with their stocks valued at par value. The Common Equity is held in escrow and it needs to be returned.

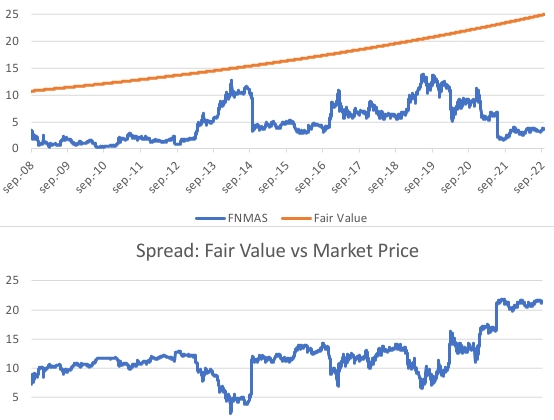

You'd better join the Separate Account plan in accordance with the law, that gives you the full par value for your JPS (fair value). It's achieved when Fannie Mae resumes the dividend payments and, for that, the Common Equity has to be built first, in order to meet the threshold of 25% of the Capital Buffer (Table 8: Payout ratio)

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM