Friday, December 22, 2023 8:21:41 AM

Or are you going to sell below it?

A fixed-income security without a "coupon payment", trades at a discount to "face value", discounting the time period till "maturity".

In our case, till FnF resume the dividend payments calculated as a percentage of the par value. It's when the fair value fetches the par value.

The resumption of the dividend payments is determined by the Table 8: Payout ratio. So, above the Adequately Capitalized threshold that was before (now, minimum 25% of the Capital Buffer)

It was estimated that Fannie Mae surpassed this threshold with the 3Q 2022 Earnings report, under the Separate Account plan. Freddie Mac, one year earlier.

All the securities have fundamentals, otherwise they have a collateral to back it up. Unbacked crypto like bitcoin, doesn't exist.

The Common Stocks represent a legal claim on future profits after the payment of dividends to JPSs, and also on the Retained Earnings account.

Now, FHFA is withholding the release till CET1 > 2.5% of Adjusted Total Assets, in order to redeem the JPS and later FnF meet the Tier 1 Capital >2.5% of Adjusted Total Assets (ERCF), and meanwhile, try the assault on the FnF ownership (Common Stock) by the SPS and JPS with shenanigans in court. They are annoyed with the Charter Act and a Privatized Housing Finance System revamp, but it's their role.

Blame FHFA and the plaintiffs. Up to two years of delay of stock valuation at par value.

Just because FHFA didn't want "captives" as FnF shareholders, unrelated to Housing Finance. The same occurred with the FHLBanks in a 2016 final rule, where some members were expelled. Proposed Rule in 2010.

It looks like the litigation was rigged by the parties from the onset, to try the shenanigans in court, aiming to change the fate.

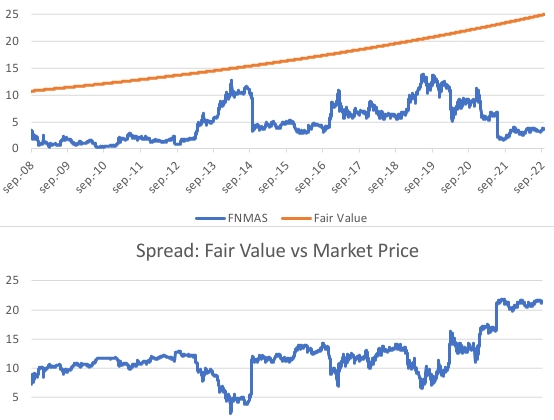

This is the chart of FNMAS with a 6% discount rate.

You sound ridiculous with:

To be quite honest, there's a very good chance I will liquidate a sizable chunk of my position once it gets to 50%+ PAR.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM