Thursday, December 21, 2023 8:14:35 AM

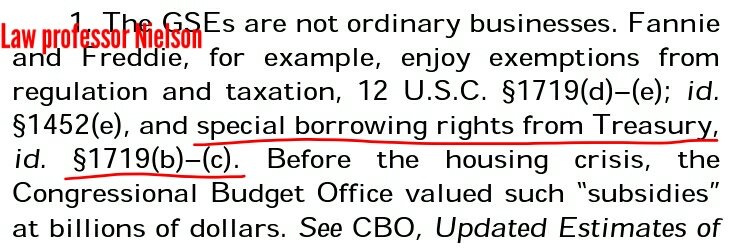

Law professor Nielson, SCOTUS-appointed amicus, who spotted the original UST backup of FnF:

FnF didn't get funds from the TARP fund, but the Charter Act.

UST backup as a last resort, written in the same section where is set forth their Public Mission:

UST backup limited to $2.25B but de facto updated in the 2nd UST backup of FnF in 2008, at an up toa an infinite rate and in an infinite amount, and subsequent amount in the SPSPA fact sheet. Useful for the Separate Account plan through assessments to Treasury under the guise of dividends. The exceptions to the Restriction on Capital Distributions kicked off.

The original rate prevails, estimated in a weighted average 1.8% cumulative dividend rate on SPS. It's netted out with the interests on the $150.9 billion owed to FnF.

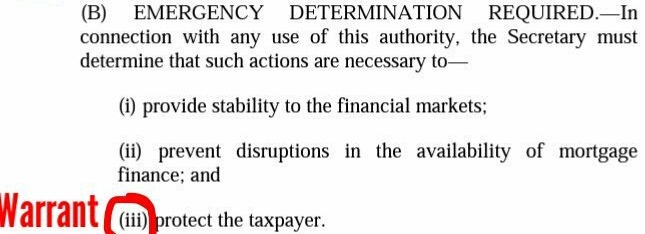

A Warrant, issued for free, authorized only to (iii) protect the taxpayer (collateral). The exercise price of $0.00001ps confirms that it was a collateral.

Although, a collateral is barred in the Fee Limitation clause.

We know that the real reason was the assault attempt on the ownership of FnF by Wall Street and the community banks, in the clause 2.1: Shares assigned to any Person: MS, BLK, etc.

The Warrant is non-transferable (clause 7), but the right to receive the shares can be assigned, mentioned before. It turns out that that right is the Warrant itself, so you are making it transferable and later you claim that it's non-transferable. What it is, is void to begin with. GS's Paulson didn't want to see the Treasury selling 80% of FnF to the bankers at $0.00001ps, and he made the whole thing void.

Blowaccount sounds a lot like Guido, Pagliara's footman, who, in turn, is the Chamber investor for representative Maxine Waters (same slogan recently Guido-MW: "Federal Government conservatorship"), because Guido is the only person in the world that has mentioned that the Warrants have a fair value in the prospectus, mistaking it for what it really states : "Market Fair Value", for a settlement through differences that isn't contemplated in the prospectus. So, a pointless definition of MFV.

Guido has always followed up with a Treasury web site informing of the Treasury warrants and the banks, stating that they were allowed to buy them back.

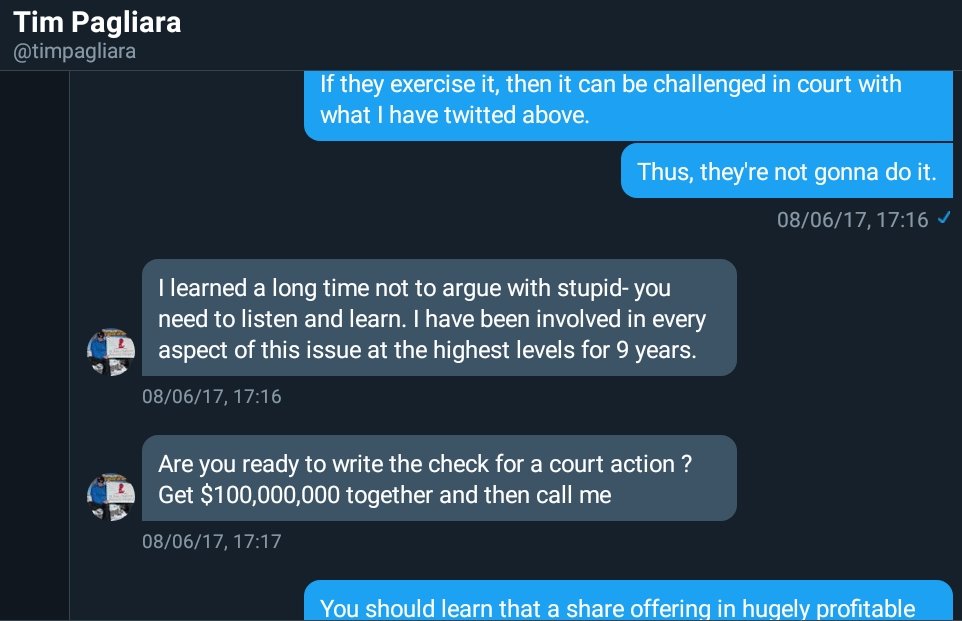

Pagliara, the plotter in chief.

I have been involved in every aspect of this issue at the highest levels for 9 years.

Though, the "purgatory" theme sounds like the plaintiff Joshua Angel with his more than 20 different aliases in this board.

They are all in this together.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM