Wednesday, December 20, 2023 2:06:05 AM

Justice Alito simply legalized the Separate Account plan, which isn't beneficial to FnF "on paper", as we can see in their awful ERCF tables, but the "rehabilitate FnF" occurs in an "External Position", a global pandemic about off-balance sheet exposures (Europe Payment Systems, the Fed's Deferred Asset conceals the UST's SPS that should have funded the losses, etc)

It's beneficial to the Agency and the public (he claimed), as far as "interests" are concerned, in the sense that it enables the extension of conservatorship for the extortion of their resources on a great scale, with the sale of loans with a debt forgiveness clause attached and REO inventory to special interest groups, like Goldman Sachs gobbling up through a subsidiary all the REO inventory sold by Fannie Mae.

The Separate Account isn't that difficult to see it if you know to read plain English: a capital distribution (deplete capital) is authorized if it improves the regulatory capital (build capital). So, a Separate Account (External Position) wording right there, that

"supplements (follow-on plan) and shall not replace or affect the restriction on capital distribution by statute U.S.Code §4614(e) (a capital distribution that reduces the SPS: First phase of the plan)"

A slap in the face of the plotters that have been covering it up in the lower courts, like Gary Hindes removing the breach of the FHFA-C's Rehab power in an amended complaint (Source)

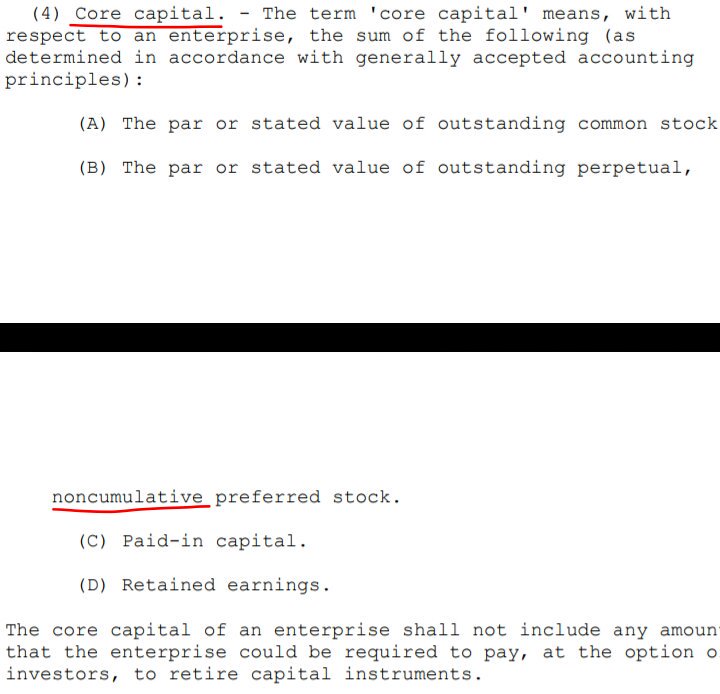

Definition of Core Capital. 12 U.S.Code §4502(7)

12 U.S.Code §4502(23). Total Capital.

12 U.S.Code §4502 (5)(A). Capital distribution. Amended later on (12 CFR 1229.13) to include the payment of Securities Litigation judgment as number 3.

Etc.

The Treasury of Mnuchin recommended the Congress to repeal the statutory definitions regarding capital.

This way, the capital requirements are met with the SPS increased for free every quarter, peddling the idea that the Net Worth is what meets the capital requirements, though these gifted SPS are missing on the Balance Sheets to conceal it, and not with Core Capital or Total Capital.

I don't know why all the U.S. banks don't do the same. According to Berkowitz's attorney, "at the same time, FnF are being recapitalized" (Collins case)

The reality is that this is the 3rd phase of the Separate Account plan: the gifted SPS are a capital distribution, restricted. Then, we apply them towards the exceptions to legalize them: recapitalization. That is, these gifted SPS are holding the Common Equity in escrow through the offset attached (reduction of the Retained Earnings account. Concealed with fraud when these SPS are missing. Watch the image below.), but, at some point, it will be posted on-Balance Sheet once these gifted SPS are cancelled after Sandra Thompson says that it was a joke "in the best interests of the Agency".

The U.S. courts isn't the proper place to learn Finance.

Let alone playing the fool and covering everything up.

All the attorneys, plaintiffs, sponsors and the peddlers of the Government theft story, face a $4.8 billion penalty in punitive damages.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM