Monday, December 11, 2023 2:38:17 AM

He even makes up what the SCOTUS said with quotation marks. Another sign, now of desperation:

the FHFA being able to do "whatever is in the bests interests of the FHFA and/or the public it serves."

"Whatever". Are you sure?

A shill that repeats the same slogan pointed out by the plotter Glen Bradford before. A sign of coordination:

And also, Bradford's mentor, Bill Ackman, implying that the SCOTUS agreed with the idea that FHFA has absolute discretion, here. This is called "wishful thinking".

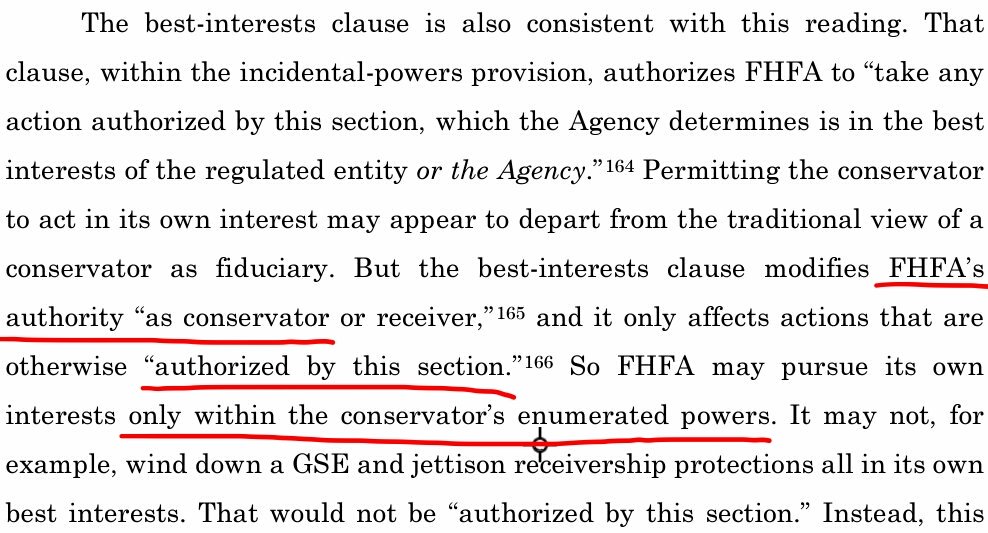

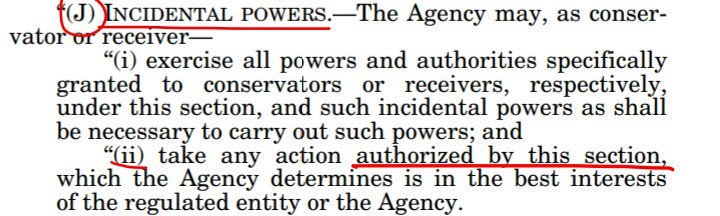

Justice Alito paraphrased his colleague judge Willett in the prior ruling over the same Collins case (5th Cir.), who claimed that any action must be within the enumerated powers (Rehabilitation power: put FnF in a sound and solvent condition; Conserve and preserve the assets.)

, in his interpretation of the conservator's Incidental Power, that states:

Justice Alito paraphrased it because he began his sentence with "rehabilitate FnF", which is what the aforementioned FHFA-C's power is about. Justice Alito didn't say "do whatever". And followed up with interpreting the "in the best interests of the Agency", with: "in a way that is beneficial to the Agency" to mislead the broad population that would immediately think about a "monetary benefit", when it's always "interests". So, activities related to the director's job. It can't be the construction of a luxury vacation resort for the FHFA officials, for instance.

Finally, adding up the after-thought of "and the public it serves" that isn't written in the law, to enable the extortion of resources through the sale of NPL, RPL and REO inventory, using the investment banks as conduit or directly sold to special interest groups. But always related to activities, not taking their capital away once it's generated (Capital = Retained Earnings), which would be barred in the Rehab Power.

It's been determined that the Separate Account plan was enabled by this Incidental Power, as it was "in the best interests of the Agency" and it's "authorized by this section" (Rehab Power). The same rogue officials attempted to replicate the 1989 statutory provision SEPARATE ACCOUNT for the FHLBanks, with assessments. The difference is that before there was a portion for interest payments and other for reduction of the obligation RefCorp (amount "invested in zero coupon Treasuries". Although these rogue officials used it for the fast repayment of interests that Funding Corp had to pay during 40 years, instead of reducing the principal of the obligation. Source. So, the $30 billion principal of the RefCorp obligation remains outstanding) and now, all the assessments were applied towards the reduction of the obligation SPS, then recap outside their balance sheets, as dividends are restricted (Cumulative dividend. The special rates in the original UST backup prevail, with 0.50% spread over Treasuries vs 0.299% in the FHLBanks, according to a GAO report)

Let's not forget that they were interpreting an Incidental Power that, by definition, is related to measures that help it fulfill the main power, which corroborates the view that it's some leeway to carry out other activities (Housing Finance System revamp, ...), but always respecting and supplementing the main power.

It's shocking how someone could think that they can deplete capital in FnF, having clear what financial rehabilitation means:

Today, justice Alito's prerequisite of "rehabilitation of FnF" has not been satisfied: $-216 billion Retained Earnings, etc., unless there is a Separate Account plan.

Those peddling the "release as is" and "the capital requirements are met with the Net Worth", want to cover it up.

"Release as is" is fine, but the Separate Account plan must be unveiled in the first place. $150 billion cash refund from the UST and the FHFA, plus a posting in their Retained Earnings accounts of the Common Equity held in escrow ($236 billion)

FEATURED BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • Jul 2, 2024 7:19 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM